How to detect malvertising? This comprehensive guide delves into the intricate world of malicious advertisements, providing actionable steps to identify and mitigate the threats they pose. Malvertising, a deceptive tactic employed by cybercriminals, often disguises itself as legitimate online advertisements. Understanding its various forms, from misleading banners to sophisticated exploit kits, is crucial for safeguarding your digital presence.

This guide will cover everything from recognizing visual cues and analyzing website behavior to leveraging network monitoring tools and educating users. We’ll explore real-world case studies, emerging trends, and preventive strategies to effectively combat this pervasive threat.

Introduction to Malvertising

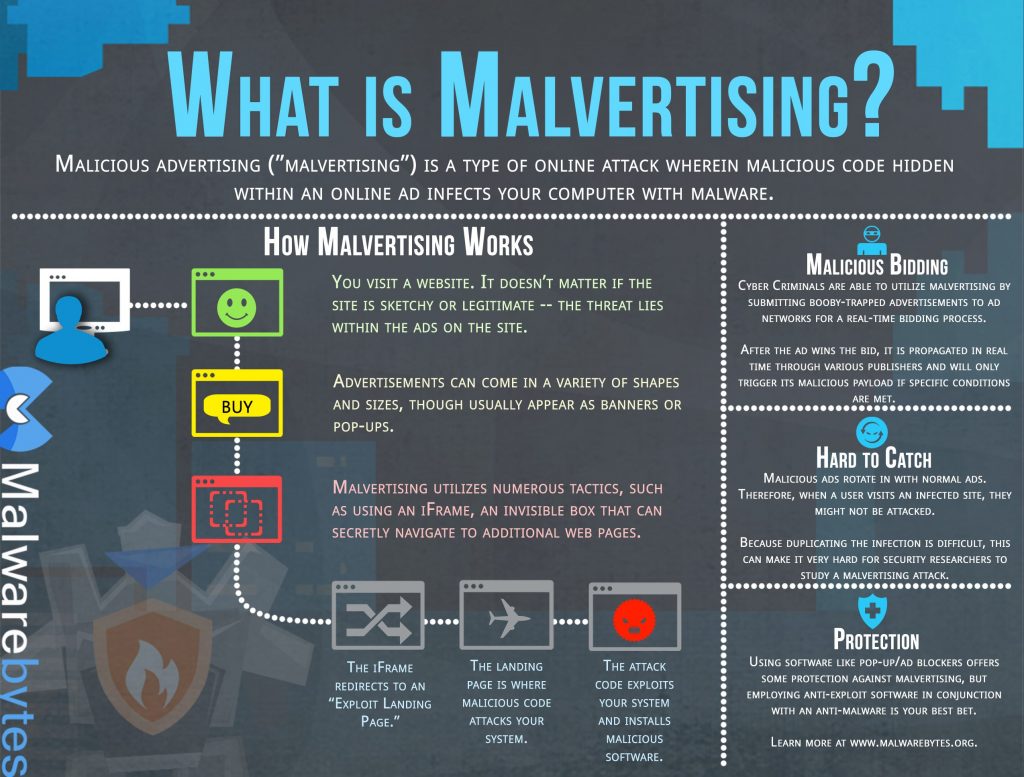

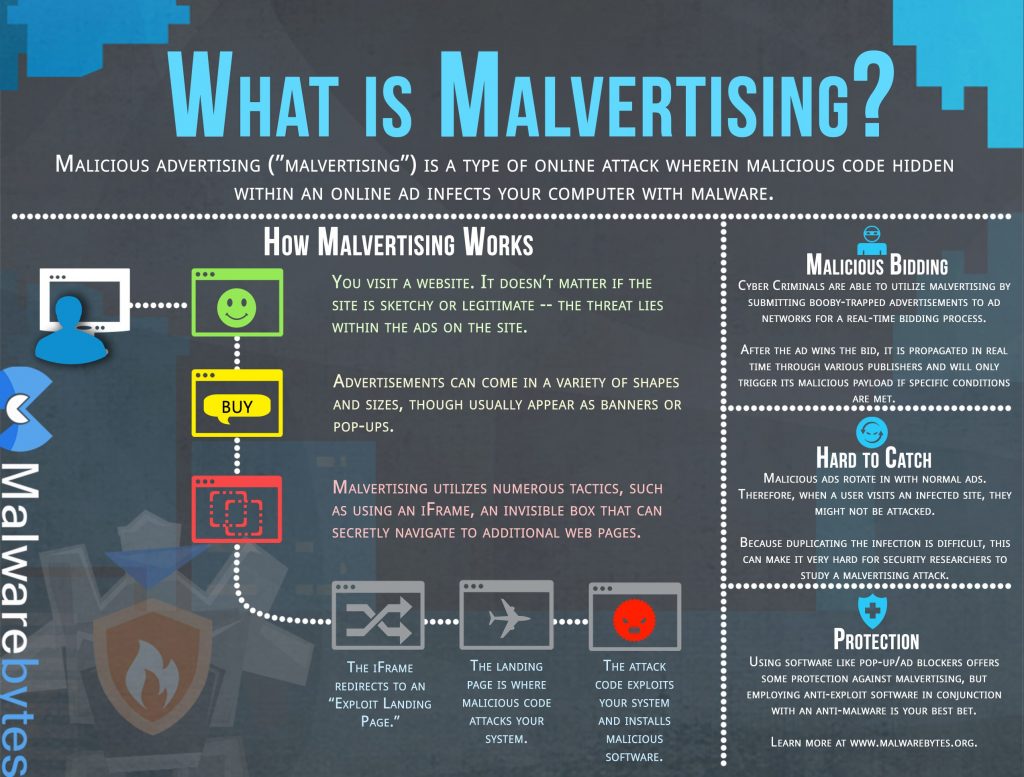

Malvertising is a sophisticated and insidious form of online attack that leverages legitimate advertising platforms to deliver malicious code. It exploits the trust users place in websites and applications, masking malicious intent within seemingly harmless advertisements. This deceptive practice can lead to significant security risks, infecting systems with malware and compromising sensitive data.Malvertising campaigns are meticulously crafted to evade detection and remain undetected for extended periods.

Attackers often use sophisticated techniques to bypass security measures, ensuring their campaigns remain effective and profitable. Understanding the various types and deployment methods of malvertising is crucial for effectively mitigating the associated risks.

Malvertising Techniques

Malvertising campaigns employ a variety of techniques to deliver malware. These techniques often exploit vulnerabilities in web browsers, operating systems, or applications. A comprehensive understanding of these techniques is critical to defending against these attacks.

Spotting malvertising can be tricky, but a good starting point is to look for unusual pop-ups or redirects. Crucially, ensure your web server is configured correctly, like enabling CORS (Cross-Origin Resource Sharing) with Apache or Nginx. Proper configuration, like enable cors apache nginx , can prevent malicious scripts from loading from untrusted domains, thus reducing the risk of malvertising attacks.

This is a vital part of a comprehensive defense strategy against these increasingly sophisticated threats.

- Malicious Ads: These ads directly contain malicious code, such as JavaScript or ActiveX controls. When a user interacts with the ad, the malicious code is downloaded and executed on their system, potentially installing malware. Examples include drive-by downloads where clicking on an ad triggers the download of malware or ads that inject malicious scripts into the webpage.

Spotting malvertising can be tricky, but paying close attention to unusual pop-ups or links is key. This massive NBA trade, with Luka Dončić heading to the Lakers and Anthony Davis to the Mavericks in a blockbuster trade, highlights the importance of being cautious online. If a banner ad looks too good to be true, it probably is.

Double-checking the source and looking for red flags is crucial in avoiding those pesky malicious ads.

- Exploit Kits: Malvertisers frequently incorporate exploit kits into their campaigns. These kits are pre-packaged sets of exploits that target known vulnerabilities in software. When a user visits a compromised website displaying an advertisement, the exploit kit attempts to exploit any vulnerabilities present in their system. If successful, malware is installed, often with the victim being unaware of the attack.

- Redirect Scams: These attacks use seemingly legitimate ads that redirect users to malicious websites. The malicious websites may contain malware, phishing scams, or other forms of malicious content. Users are often unaware of the malicious redirection and the potential consequences of visiting the malicious website.

- Malicious Plugins and Extensions: Malvertisers can also use legitimate plugins and extensions for web browsers to deliver malicious payloads. These plugins and extensions can be disguised as legitimate software and downloaded through legitimate websites. Once installed, the malicious extensions can compromise the browser’s security and install malware on the system.

Motivations Behind Malvertising Attacks

The motivations behind malvertising attacks are diverse and often driven by financial gain. Attackers seek to exploit vulnerabilities in legitimate advertising platforms for various purposes.

- Financial Gain: Malware can be used to steal sensitive information, such as login credentials, credit card details, or banking information. This stolen information can then be sold on the black market, generating significant revenue for the attackers.

- Data Theft: Malvertising campaigns can be used to steal confidential data, such as intellectual property or customer data. This data can then be used for various malicious purposes, including extortion or identity theft.

- Distribution of Malware: Malvertising is a common method for distributing various types of malware, including ransomware, spyware, and Trojans. Attackers can use these malware to gain unauthorized access to systems, disrupt operations, or cause significant damage.

Key Characteristics of Malvertising Types

The following table Artikels the key characteristics of different malvertising techniques.

| Malvertising Type | Key Characteristics |

|---|---|

| Malicious Ads | Directly contain malicious code; often disguised as legitimate advertisements; trigger downloads of malware upon interaction. |

| Exploit Kits | Pre-packaged sets of exploits targeting known vulnerabilities; attempt to exploit vulnerabilities in user systems; install malware upon successful exploitation. |

| Redirect Scams | Redirect users to malicious websites; the malicious websites may contain malware, phishing scams, or other malicious content; users are often unaware of the malicious redirection. |

Identifying Malicious Advertisements

Malvertising, the insidious practice of concealing malicious code within online advertisements, poses a significant threat to internet users. Recognizing the subtle signs of a malicious ad is crucial in safeguarding your devices and personal information. This section dives into the visual and textual clues that can help you identify and avoid these insidious threats.Understanding the tactics employed by malvertisers is essential for proactive protection.

They often leverage common advertising formats, making it vital to develop a keen eye for inconsistencies and suspicious elements.

Visual Cues of Malicious Ads

Malicious advertisements often deviate from the standard visual presentation of legitimate ads. Pay close attention to unexpected elements like overly aggressive graphics, flashing colors, or unusual animations. These elements can be used to draw attention and potentially mask the true nature of the ad. Unusual font styles, sizes, and colors, which don’t align with the surrounding webpage’s design, should also raise suspicion.

A poorly designed, or drastically different design compared to the rest of the page, ad is a potential red flag.

Spotting malvertising can be tricky, but paying close attention to unusual pop-ups or banners is key. Economic anxieties, like those surrounding the current Nasdaq curse and Wall Street troubles, might actually be affecting California’s economy, as reported in this article nasdaq curse wall street troubles might chill californias economy. This economic downturn could potentially make people more susceptible to clicking on suspicious ads, so extra vigilance is needed when browsing the web, especially if something looks too good to be true.

Checking for secure connections (HTTPS) and verifying the site’s legitimacy are also crucial steps in detecting malvertising.

Suspicious Ad Copy

The content of an advertisement can also be a strong indicator of its malicious intent. Look for urgent or overly enticing language promising extraordinary results. Phrases like “limited-time offer,” “free prize,” or “urgent action required” are often used to create a sense of urgency, encouraging hasty clicks. Similarly, vague or nonsensical ad copy, which doesn’t seem to clearly describe the product or service, should be approached with caution.

Be particularly wary of advertisements that contain misspellings or grammatical errors.

Scrutinizing Ad URLs

A critical step in identifying malicious ads is inspecting the URL. A seemingly legitimate URL might mask a malicious destination. Look for unusual characters, long strings of seemingly random characters, or unexpected subdomains. A URL that doesn’t align with the ad’s content or the website’s general design should be flagged as suspicious. A seemingly innocuous URL that redirects to an entirely different page should also be a concern.

Identifying Malicious Domains and IP Addresses

Beyond the URL, understanding the domain and IP address associated with the ad is vital. Use online tools to check the reputation of the domain and IP address. If the domain or IP address has a history of malicious activity or is associated with known malicious campaigns, it’s a significant red flag. Malicious actors often use proxy servers or anonymizing techniques, making it challenging to trace the source.

Therefore, research is paramount in determining the legitimacy of the ad’s origin.

Comparing Legitimate and Malicious Ad Formats

| Feature | Legitimate Ad | Malicious Ad |

|---|---|---|

| Banner Ads | Consistent with website design, clear and concise text, links to a relevant webpage, familiar brand logos. | Unusual colors or graphics, flashing animations, overly aggressive or urgent language, links to suspicious or unfamiliar websites. |

| Pop-ups | Usually targeted, relevant, and clear. | Overly large, intrusive, or disruptive, often appearing abruptly, often leading to malware downloads or phishing attempts. |

| Interstitials | Frequently used for product promotion, contextually relevant to the content. | Large, disruptive, and potentially contain hidden code to download malware. |

Legitimate ads integrate seamlessly with the website’s design and context, while malicious ads often stand out with unusual visual elements, questionable content, and misleading URLs. The table highlights the key differences to help you identify malicious advertisements.

Analyzing Website Behavior

Uncovering malvertising often requires digging deeper than just the advertisement itself. Observing website behavior can reveal suspicious patterns that point to malicious intent. This involves monitoring traffic, scrutinizing code changes, and examining server logs for anomalies. A proactive approach to website security is crucial, which includes regularly updating software to patch vulnerabilities that malicious actors could exploit.Website behavior analysis is a vital component of malvertising detection.

By closely monitoring traffic patterns, code modifications, and server logs, security teams can identify subtle shifts that might indicate an infiltration. A proactive, vigilant approach, complemented by routine software updates, is essential in thwarting malicious activities.

Monitoring Website Traffic for Unusual Patterns

Analyzing website traffic is a crucial step in identifying potential malvertising. Unusual spikes in traffic from specific regions or IP addresses, or traffic patterns inconsistent with typical user behavior, can be warning signs. Fluctuations in traffic sources, such as a sudden surge from countries with a history of malicious activity, deserve immediate attention.A sharp increase in traffic to a particular page or section of a website, unaccompanied by any significant changes in content, could indicate a malicious redirect.

Monitoring for unusual traffic sources and patterns is essential in preventing malicious actors from exploiting websites for their own nefarious purposes. Examples include analyzing referral traffic, checking for traffic from known bot networks, and scrutinizing traffic from unusual IP addresses or geographic locations.

Detecting Changes in Website Functionality or Code

Regularly checking for changes in website functionality or code is vital in malvertising detection. Malicious actors often inject malicious code into websites, leading to unexpected redirects, pop-ups, or the installation of malware. This requires a proactive approach to code security and a clear understanding of the website’s structure.Automated tools and scripts can be employed to identify code modifications.

Using version control systems, like Git, enables comparing code versions to detect discrepancies and identify potential malicious changes. Frequent code audits, performed by security teams, are also important for preventing potential breaches.

Importance of Regularly Updating Software

Software updates are crucial for patching vulnerabilities that malicious actors can exploit. Out-of-date software can leave websites susceptible to attacks, including those involving malvertising. Regular updates are a vital security measure.Keeping all software, including web servers, operating systems, and content management systems (CMS), updated to the latest versions is paramount. By implementing regular patching procedures, organizations can mitigate the risk of vulnerabilities being exploited.

This includes promptly addressing security advisories and implementing recommended updates.

Examining Server Logs for Anomalies

Analyzing server logs is a critical component of malvertising detection. Malicious activities often leave traces in server logs, such as unusual requests, error messages, or access patterns. These logs are a valuable source of information for security teams.Regular review of server logs, including access logs, error logs, and application logs, can reveal suspicious activity. Identifying unusual access patterns, such as requests from unusual IP addresses or unusual patterns of requests, is a key element of this process.

Filtering and searching server logs for specific patterns or s associated with known malicious activities can help in identifying suspicious behavior.

Using Browser Extensions to Detect Malicious Ads

Browser extensions can act as a frontline defense against malvertising. These extensions can scan advertisements and block potentially malicious ones. They provide a crucial layer of protection against malvertising.Using extensions designed to detect and block malicious advertisements can help in identifying and preventing malicious ads. These extensions frequently utilize a combination of blacklists, whitelists, and heuristics to identify suspicious advertisements.

Using reputable browser extensions can effectively augment the protection against malvertising.

Network Monitoring and Security Tools

Network security tools are crucial for detecting and mitigating malvertising threats. These tools provide a proactive approach to identifying malicious advertisements before they can compromise user systems. By monitoring network traffic and analyzing suspicious patterns, these tools allow organizations to strengthen their defenses and protect their users from potentially harmful online experiences. A layered security approach, integrating network monitoring with other security measures, is essential for a robust defense against malvertising.

Network Security Tools for Malvertising Detection

Various network security tools play a vital role in identifying and responding to malvertising campaigns. These tools provide different functionalities, from monitoring network traffic to detecting anomalies and preventing malicious activities. Effective malvertising detection requires a combination of tools and techniques to comprehensively analyze network traffic and identify potentially harmful advertisements.

Network Traffic Monitoring Tools

Network traffic monitoring tools are fundamental for detecting malvertising. These tools capture and analyze network packets, providing insights into the flow of data within the network. Tools like Wireshark, tcpdump, and SolarWinds Network Performance Monitor can capture and decode network traffic, allowing analysts to inspect the content of advertisements and identify suspicious patterns. Setting up these tools involves configuring them to capture network traffic from relevant interfaces and defining specific filters to focus on relevant data.

Intrusion Detection and Prevention Systems (IDS/IPS)

Intrusion Detection Systems (IDS) and Intrusion Prevention Systems (IPS) are vital for detecting and preventing malvertising attacks. IDS systems monitor network traffic for malicious activities, while IPS systems actively block malicious traffic. IDS/IPS implementations require careful configuration to define rules and signatures that match known malvertising patterns. They also need to be regularly updated with the latest threat intelligence to maintain their effectiveness.

Interpreting Network Logs for Malicious Traffic

Network logs are essential for analyzing potential malvertising threats. They contain detailed information about network activity, including the source and destination of traffic, the type of packets, and the content of the communication. Analyzing these logs requires expertise in identifying patterns and anomalies that might indicate malicious activity. Key elements to look for include unusual traffic volume from specific IPs, unusual types of traffic, and unexpected changes in website behavior.

For example, a sudden spike in traffic from a previously unknown IP address to a known advertising network could indicate a malvertising campaign.

Configuration and Setup of Network Security Tools

Configuring and setting up network security tools for malvertising detection involves several key steps. This includes defining the scope of monitoring, selecting appropriate tools, configuring filters to focus on relevant traffic, and establishing alerts for suspicious activities. The specific configuration depends on the chosen tools and the organization’s network infrastructure. Regular updates and maintenance are crucial to keep the tools effective against evolving threats.

Capabilities of Network Security Tools for Detecting Malvertising

| Tool | Capabilities |

|---|---|

| Wireshark | Captures and analyzes network traffic, allowing for deep packet inspection to identify malicious code within advertisements. |

| IDS/IPS | Detects and blocks malicious traffic based on predefined rules and signatures. Can be configured to detect known malvertising patterns and block malicious traffic before it reaches end-users. |

| SolarWinds Network Performance Monitor | Monitors network performance, identifying unusual spikes in traffic that might indicate malvertising campaigns. Can be used to identify anomalies and potential attacks. |

| Snort | An open-source intrusion detection system that can be configured with rules to detect known malvertising techniques. Its flexible rule-based system allows for customization and updates based on emerging threats. |

User Education and Awareness

Protecting yourself from malvertising requires a multi-faceted approach, and user education is a critical component. A well-informed user is the first line of defense against malicious advertisements. Equipping users with the knowledge and skills to recognize and report suspicious ads, coupled with robust security practices, significantly reduces the risk of falling victim to these attacks.Educating users about the dangers of malvertising involves more than just technical details; it requires a clear and concise explanation of the potential consequences.

Users need to understand that clicking on seemingly harmless advertisements can lead to malware infections, data breaches, or financial losses. This understanding fuels the importance of vigilance and cautious behavior online.

Recognizing Suspicious Ads

Users need to develop a critical eye for identifying potentially malicious advertisements. This involves scrutinizing elements like the ad’s appearance, the website hosting it, and the overall context. Trustworthy sources, such as reputable security organizations, can provide a foundation for evaluating the authenticity of advertisements.

- Unusual or unexpected pop-up ads are often a warning sign. They might appear suddenly, demanding immediate attention, or promise extraordinary benefits.

- Ads with poor grammar or spelling errors can suggest they are not from legitimate sources.

- Ads containing unfamiliar or suspicious URLs should be avoided. Use a URL checker to determine the site’s reputation and potential risk.

- Offers that seem too good to be true often are. Exercise caution when encountering advertisements promising high returns with minimal effort.

Strong Passwords and Security Software

Robust passwords and up-to-date security software are essential elements in a layered defense against malvertising. Strong passwords make accounts harder to compromise, while security software acts as a crucial deterrent against malicious code.

- Employing strong, unique passwords for each online account is vital. A password manager can assist in generating and securely storing complex passwords.

- Regularly updating security software, including antivirus and anti-malware programs, is paramount. These tools identify and neutralize malicious threats, preventing infection.

Secure Browsing Practices

Implementing secure browsing practices is a proactive measure to protect against malvertising attacks. These practices include avoiding untrusted websites and utilizing secure connections.

- Avoid clicking on suspicious advertisements or links from unknown sources.

- Using HTTPS ensures that data transmitted between the user’s browser and the website is encrypted. Look for the padlock icon in the address bar.

- Regularly updating web browsers to the latest versions is important, as they often include security patches addressing known vulnerabilities.

Common Red Flags for Malvertising

Identifying potential threats requires vigilance. A well-prepared user can recognize red flags in advertisements.

| Category | Red Flags |

|---|---|

| Appearance | Unusual fonts, colors, or layout; unexpected pop-ups; poorly formatted content |

| Content | Promises of extraordinary returns, overly aggressive language, or unrealistic offers; requests for personal information |

| Website | Unknown or unverified websites; suspicious website structure or design; unsecure connection (HTTP instead of HTTPS) |

Handling Potentially Malicious Ads

Users must know how to handle potentially malicious ads in different browsers. This involves understanding the browser’s reporting mechanisms and taking appropriate action.

- Chrome: Right-click on the ad and select “Report” or “Report a problem.” Chrome provides a reporting mechanism to flag malicious advertisements.

- Firefox: Right-click on the ad and select “Report this content” or “Report a problem.” Firefox offers a similar mechanism for reporting potentially harmful advertisements.

- Edge: Right-click on the ad and select “Report a problem.” Microsoft Edge provides a method for reporting suspicious content, including advertisements.

Prevention and Mitigation Strategies

Malvertising attacks pose a significant threat to website security and user safety. Proactive measures are crucial in preventing these attacks and mitigating their impact. Implementing robust security protocols, vigilant monitoring, and user education are key components of a comprehensive defense strategy.Effective prevention requires a multi-faceted approach that encompasses both technical safeguards and user awareness. This involves not only securing the website infrastructure but also empowering users to recognize and avoid potentially malicious advertisements.

A well-rounded strategy minimizes the risk of successful attacks.

Website Security Measures

Strengthening website security is paramount to preventing malvertising. This includes rigorous validation of all third-party scripts and plugins. Regular security audits are vital to identify vulnerabilities and implement necessary fixes. Implementing a robust firewall, utilizing intrusion detection systems (IDS), and encrypting sensitive data are crucial steps.

Securing and Updating Ad Serving Platforms

Regular updates for ad serving platforms are essential. Outdated platforms are more susceptible to vulnerabilities that malicious actors can exploit. Using reputable ad networks with robust security measures and regularly reviewing their security protocols are vital. Implementing rigorous code reviews and penetration testing can help detect and address vulnerabilities before they are exploited.

Regular Security Audits

Regular security audits are crucial for identifying and addressing potential vulnerabilities. These audits should cover all aspects of the website, including the ad serving infrastructure, the server configuration, and the codebase. Vulnerabilities often go unnoticed until exploited, so proactive audits help identify and address them before they lead to successful attacks.

Ad Blocking Solutions Comparison

Ad blockers play a crucial role in mitigating the risk of malvertising. Their effectiveness varies depending on the specific technology used.

| Ad Blocking Solution | Effectiveness Against Malvertising | Strengths | Weaknesses |

|---|---|---|---|

| uBlock Origin | High | Widely used, customizable, and highly effective at blocking various ad types. | May block legitimate ads, potentially impacting website functionality. |

| AdGuard | High | Comprehensive ad blocking capabilities, excellent malware protection. | Can sometimes cause website loading issues, may require configuration. |

| Ghostery | Medium | Focuses on tracking protection, which can help prevent malicious scripts from being loaded. | Less focused on directly blocking ads compared to dedicated ad blockers. |

| Adblock Plus | High | Popular and effective at blocking various ad types, widely supported. | May have less granular control over blocking compared to uBlock Origin. |

The table above highlights the comparative effectiveness of various ad blocking solutions. Choosing the appropriate solution depends on specific needs and priorities. Considering the strengths and weaknesses of each solution is essential for selecting the best fit for a particular website or user.

Case Studies of Malvertising Attacks

Malvertising, the insidious practice of concealing malicious code within seemingly legitimate online advertisements, has wreaked havoc on countless individuals and organizations. Understanding past campaigns offers valuable insights into the evolving tactics of cybercriminals and helps in developing robust defense mechanisms. Analyzing these case studies allows us to identify patterns, anticipate future threats, and ultimately protect ourselves from these sophisticated attacks.

Real-World Malvertising Campaigns

Numerous malvertising campaigns have targeted unsuspecting users. These campaigns often exploit vulnerabilities in popular software or operating systems to compromise systems and gain unauthorized access. Understanding the methods employed in these attacks provides crucial knowledge for effective prevention.

The Impact on Victims

The impact of malvertising campaigns can range from minor inconveniences to significant financial and reputational damage. Victims may experience data breaches, loss of sensitive information, and costly remediation efforts. In some cases, infected systems become part of botnets, used for further malicious activities. These attacks can lead to financial losses, reputational damage, and even legal liabilities. Victims often face the difficult task of recovering from the attack’s aftermath.

Attacker Methods and Tactics, How to detect malvertising

Cybercriminals employ various methods to deliver malicious advertisements. These range from compromising legitimate advertising platforms to injecting malicious code into seemingly harmless websites. The methods used often rely on social engineering tactics to trick users into clicking on malicious advertisements. Attackers often leverage vulnerabilities in advertising networks or website hosting platforms. They might also use sophisticated techniques to camouflage their malicious code, making detection more challenging.

Company Responses to Malvertising Attacks

Companies targeted by malvertising attacks have responded in various ways. Some have implemented robust security measures to prevent future attacks, while others have focused on damage control and remediation efforts. Often, public relations strategies play a significant role in mitigating the negative consequences of such attacks. Transparency and communication with affected users are crucial in maintaining trust and minimizing reputational damage.

Comparative Analysis of Malvertising Campaigns

| Campaign | Target Audience | Method of Infection | Malicious Payload | Impact | Response by Affected Organizations |

|---|---|---|---|---|---|

| Example Campaign 1 | Users of a popular gaming platform | Malicious advertisements embedded in in-game advertisements | Trojan horse disguised as an update | Significant data breach, financial loss, and reputational damage | Implemented enhanced security protocols, initiated damage control efforts, and provided support to affected users |

| Example Campaign 2 | Users visiting news websites | Malicious code injected into legitimate advertisement slots | Keylogger to steal login credentials | Compromised user accounts, financial fraud, and identity theft | Strengthened website security measures, alerted users about the threat, and offered support for recovery |

| Example Campaign 3 | Users browsing social media | Exploiting vulnerabilities in advertising plugins | Stealing cookies and session data | Unauthorized access to accounts, data breaches, and potential financial losses | Updated plugins, implemented multi-factor authentication, and improved security practices across their platform |

Emerging Trends in Malvertising

Malvertising, the malicious use of online advertising, is constantly evolving, adapting to new technologies and user behaviors. This dynamic nature necessitates a constant vigilance in detecting and mitigating these threats. Understanding the emerging trends allows security professionals to proactively address the vulnerabilities they exploit.The landscape of malvertising is characterized by a shift from simple exploit kits embedded in banner ads to more sophisticated and targeted attacks.

This evolution demands a broader approach to security, encompassing not just the technical aspects of ad blocking and network monitoring but also the human element of user awareness and education.

Rise of Mobile Malvertising

Mobile devices have become increasingly vulnerable to malvertising attacks due to their widespread use and often less secure configurations. Malvertisers are capitalizing on the growing mobile app ecosystem, targeting users through seemingly legitimate apps or game downloads. They are also exploiting vulnerabilities in mobile browsers and operating systems.The rise of mobile malvertising is driven by several factors:

- Increased mobile internet usage: More users are accessing the internet via mobile devices, creating a larger attack surface for malvertisers.

- Mobile app downloads: Malicious apps are often disguised as legitimate applications, leading to unintentional downloads and infections.

- Mobile browser vulnerabilities: Exploiting vulnerabilities in mobile browsers can allow attackers to inject malicious code into websites viewed on mobile devices.

Social Engineering Tactics in Malvertising

Malvertisers increasingly incorporate social engineering techniques to trick users into clicking on malicious advertisements. This involves creating deceptive advertisements that mimic legitimate websites or offers, luring users into downloading malicious files or entering sensitive information. The goal is to bypass security measures and gain access to user accounts or systems.

- Deceptive landing pages: Malvertisers create fake landing pages that look like legitimate websites, tricking users into entering personal information or downloading malicious software.

- Phishing attacks: Malvertising campaigns often employ phishing techniques to collect sensitive information such as usernames, passwords, and credit card details.

- Psychological manipulation: Malvertisers use psychological tactics to influence users’ behavior, making them more likely to click on malicious advertisements.

Malvertising as a Delivery Vector for Other Malware

Malvertising is frequently used as a vector to distribute other malware, such as ransomware, spyware, and Trojans. The malicious advertisements may download and install these programs without the user’s knowledge or consent. This multi-stage attack allows attackers to gain more control over the infected system and deploy more harmful payloads.

- Ransomware deployment: Malvertising can be used to distribute ransomware, encrypting user files and demanding payment for their release.

- Spyware infiltration: Malicious advertisements may download spyware, tracking user activity and collecting sensitive information.

- Trojan horse delivery: Malvertising is used to deploy Trojans, which can grant attackers remote access to the compromised system.

New Techniques for Bypassing Ad Blockers

Malvertisers are constantly developing new techniques to circumvent ad blockers. This involves creating sophisticated advertisements that can evade detection or exploit weaknesses in ad blocking software. The goal is to deliver malicious content despite the user’s attempts to block advertisements.

- Advanced obfuscation: Malvertisers are using more advanced techniques to obfuscate malicious code, making it harder for security software to detect.

- Ad blocking software exploits: Malvertisers seek vulnerabilities in ad-blocking software to deliver malicious code.

- Invisible iframes: Malicious iframes, invisible to the user, can be used to deliver payloads without triggering ad blockers.

Final Wrap-Up: How To Detect Malvertising

In conclusion, detecting malvertising requires a multi-faceted approach combining technical vigilance, user awareness, and proactive security measures. By understanding the various techniques used by attackers, employing the right tools and strategies, and staying informed about emerging trends, you can significantly reduce your vulnerability to this insidious online threat. This comprehensive guide equips you with the knowledge to protect yourself and your online assets from malvertising attacks.