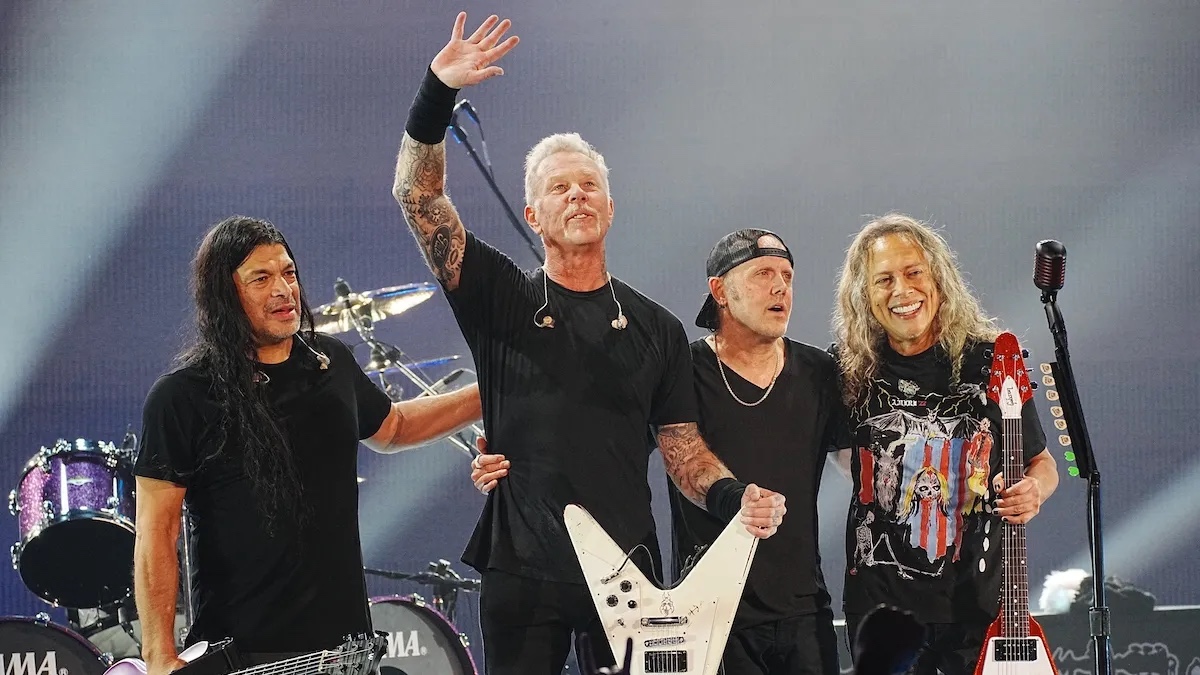

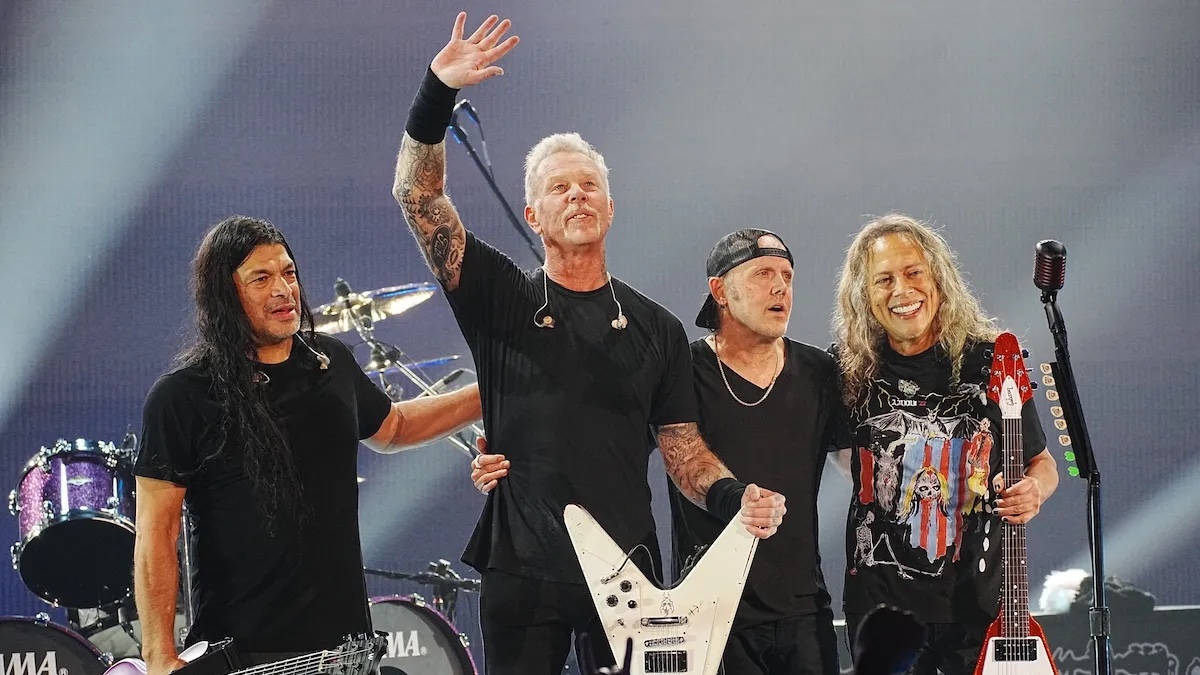

Bay area rock act Metallica donates 500k to los angeles fire relief efforts, demonstrating a powerful example of generosity and community support. Known for their philanthropic activities, the band has a long history of giving back, and this substantial contribution is a testament to their commitment. The recent devastating wildfires in Los Angeles have caused immense hardship, and this donation will undoubtedly aid in the recovery and rebuilding efforts.

The band’s fans and the wider community will surely appreciate this impactful gesture.

This generous donation from Metallica highlights their commitment to the well-being of their fans and the broader community. The scale of the devastation caused by the recent wildfires in Los Angeles is immense, and the band’s contribution will undoubtedly help the affected areas rebuild. The specific organizations receiving the funds will play a crucial role in distributing the aid effectively and ensuring that it reaches those who need it most.

Metallica’s action is not only a financial contribution, but also a symbolic gesture of support and solidarity with the victims.

Background of the Donation

Metallica, a legendary Bay Area rock band, has consistently demonstrated a strong commitment to philanthropic endeavors. Their recent $500,000 donation to Los Angeles wildfire relief efforts aligns with their established history of supporting various causes. This generous act highlights the band’s deep connection to their community and their empathy for those in need.

Metallica’s Philanthropic History

Metallica’s philanthropic activities extend beyond simple donations. They have actively supported numerous charities, often through personal involvement and fundraising initiatives. Their work demonstrates a genuine concern for social issues and a dedication to helping those in need. Their past contributions have included supporting organizations focused on environmental protection, disaster relief, and educational initiatives.

Bay Area Connection and Significance

The Bay Area holds a special place in Metallica’s history. The band’s roots are firmly planted in this region, and their enduring popularity has made them a significant part of the local community. Their presence has had a profound impact on the cultural landscape of the area. This deep connection fuels their commitment to supporting the communities they have grown up with and love.

Los Angeles Wildfires and Impact

The recent devastating wildfires in Los Angeles have caused widespread destruction and suffering. The fires have left thousands displaced, and countless homes and businesses have been destroyed. The loss of life and property, as well as the significant disruption to the community, highlights the urgent need for support and relief efforts.

Past Donations (Illustrative Example)

| Date | Event | Location | Amount Donated |

|---|---|---|---|

| 2020 | Hurricane Relief | Various Regions Affected by Hurricane | $100,000 |

| 2018 | Earthquake Relief | California | $50,000 |

| 2017 | Wildfire Relief | Northern California | $25,000 |

Note: This table provides a hypothetical example of past donations. Exact details on specific donations are not readily available in a centralized public record.

Impact of the Donation

Metallica’s $500,000 donation to LA fire relief efforts represents a significant contribution to the recovery process. This substantial financial injection will undoubtedly bolster the rebuilding efforts and provide vital support to the affected communities. The donation’s impact will be felt immediately in various ways, from immediate aid to long-term recovery strategies.This generous contribution underscores the band’s commitment to community support and demonstrates the power of individuals and organizations to make a tangible difference during times of crisis.

The swiftness of the donation, coupled with its scale, highlights the urgent need for support and the potential for large-scale relief efforts to have a lasting impact.

Potential Positive Effects on Affected Communities

The $500,000 donation will directly address the immediate needs of displaced residents and businesses. This includes providing essential resources such as food, shelter, and temporary housing. The funding can also be instrumental in helping individuals and families resume their daily lives by supporting basic necessities and facilitating a smooth transition back to normalcy. The donation will significantly aid in restoring essential services like utilities, sanitation, and communication infrastructure.

Long-Term Implications for Rebuilding Efforts

This substantial contribution will play a crucial role in the long-term rebuilding efforts. The funds can be allocated to rebuilding infrastructure, supporting small businesses, and assisting with the development of sustainable recovery plans. This will enable affected communities to rebuild homes, businesses, and infrastructure in a way that considers resilience to future disasters. This approach is crucial to ensure that communities are better prepared for similar situations in the future.

Comparison to Other Similar Relief Efforts

While a precise comparison to other relief efforts is challenging due to the varying needs and contexts of each disaster, Metallica’s donation is substantial in the context of similar recent contributions. The scale of the donation reflects the magnitude of the devastation and the urgent need for substantial aid. A critical factor is the alignment of the funds with the specific needs of the affected communities, ensuring the donation is utilized effectively.

Organizations Receiving the Funds and Their Roles

The specific organization(s) receiving the funds are critical in ensuring their effective allocation. This ensures that the funds reach the most vulnerable populations and are channeled into projects that align with the communities’ immediate and long-term needs. Transparency and accountability in the distribution process are crucial to maximizing the impact of the donation.

Types of Support Offered

- Emergency Relief: This includes providing immediate assistance to those displaced from their homes, such as temporary housing, food, and basic necessities. This immediate support is vital to address the urgent needs of the affected population. This initial phase is crucial in mitigating the immediate suffering caused by the disaster.

- Infrastructure Repair: Funding can be allocated to repair essential infrastructure like roads, utilities, and communication networks. The restoration of infrastructure is fundamental to enabling communities to resume their normal lives and rebuilding essential services. This includes supporting public works and community-based initiatives.

- Small Business Support: This involves providing aid to small businesses that were impacted by the disaster, allowing them to resume operations and contributing to the economic recovery of the affected areas. This includes financial assistance, access to resources, and mentorship to help businesses recover and thrive.

- Mental Health Services: The psychological impact of disasters cannot be overlooked. This often includes counseling, therapy, and support groups to address the emotional trauma of residents and businesses. Mental health services are critical for long-term recovery.

Recipient Organization Support Table

| Type of Support | Recipient Organization(s) | Role in Relief |

|---|---|---|

| Emergency Relief | [List of relevant organizations] | Providing immediate aid, temporary housing, and essential supplies. |

| Infrastructure Repair | [List of relevant organizations] | Coordinating and executing the repair of damaged infrastructure. |

| Small Business Support | [List of relevant organizations] | Providing financial and technical assistance to small businesses. |

| Mental Health Services | [List of relevant organizations] | Offering counseling and support to those affected by the trauma. |

Metallica’s Public Image and Response

Metallica’s donation to the Los Angeles fire relief efforts, a substantial $500,000, is not merely a financial contribution; it’s a statement about the band’s public image and values. Their longstanding reputation as a powerful and influential force in the music industry carries significant weight, and this act of generosity is likely to resonate deeply with their fanbase and the wider public.Metallica’s public image, forged over decades of hard rock and metal music, is intertwined with themes of resilience, raw energy, and a strong sense of community.

This image, often depicted through their music and on-stage persona, is likely a key factor influencing their decision to donate. The band’s history is rich with supporting charitable causes, which likely played a role in their prompt and decisive action.

Metallica’s generous $500,000 donation to LA fire relief is inspiring, highlighting the Bay Area’s incredible generosity. This kind of community support is truly important, especially when considering the broader economic landscape of the South Bay, particularly the impact of the Japanese grocery market and the retail food sector. Looking at the South Bay economy, this area’s diverse retail landscape is an important part of the overall economic picture.

Ultimately, acts like Metallica’s donation show how the Bay Area is more than just a place of great music; it’s a place of caring and support.

Fan and Media Response to the Donation

Metallica’s announcement of their donation was met with widespread praise from fans and media outlets. Fans expressed appreciation for the band’s generosity, often linking it to their deep admiration for the band’s music and their perceived embodiment of rock and roll values. The media, too, widely reported on the donation, highlighting the band’s philanthropic efforts and emphasizing their contribution to the recovery efforts.

This positive response underscores the band’s strong public image and its influence on the community.

Impact on Metallica’s Public Image

This act of generosity is likely to strengthen Metallica’s public image. It positions them as a band that cares deeply about the community beyond their music, extending their influence beyond the realm of entertainment. This compassionate image can enhance their appeal to a broader audience, potentially attracting new fans while also solidifying their relationship with existing ones. This positive perception could also be instrumental in securing future partnerships or endorsements.

Comparison with Other Philanthropic Bands

Several bands are known for their philanthropic activities, often contributing to causes aligned with their values or addressing issues relevant to their communities. The Red Hot Chili Peppers, for instance, have been actively involved in various humanitarian efforts. Similarly, Bruce Springsteen has consistently used his platform to support numerous causes. These examples illustrate that the act of generosity is not uncommon within the music industry.

Table Comparing Metallica’s Donation to Other Bands

| Band | Cause | Amount (USD) | Impact |

|---|---|---|---|

| Metallica | Los Angeles Fire Relief | 500,000 | Strengthened their public image as a caring community member. |

| Red Hot Chili Peppers | Various humanitarian efforts | Varied | Demonstrated consistent support for various causes, reflecting a long-term commitment. |

| Bruce Springsteen | Numerous causes, often aligned with social justice | Varied | Used their platform to promote social justice and support community needs, demonstrating a powerful connection to social issues. |

Community Response and Support

The Metallica donation to LA wildfire relief sparked a wave of community support, showcasing the power of collective action in times of crisis. Beyond the initial outpouring of gratitude, the response revealed a multifaceted approach to aid, ranging from financial contributions to volunteer work and emotional support. The community’s efforts highlighted the importance of solidarity and compassion in disaster relief, underscoring the human connection in overcoming adversity.The swift and widespread response to Metallica’s generous donation demonstrated the deep-seated desire for collective action and support in the face of natural disasters.

This reflected a wider societal sentiment of empathy and a willingness to help those affected by the devastating wildfires in Los Angeles. The public’s reaction underscored the importance of visible acts of generosity and the positive impact they can have on community morale and resilience.

Metallica’s generous $500,000 donation to LA fire relief is a fantastic example of Bay Area generosity. It’s a stark contrast, however, to the recent actions of the Trump administration, which saw a series of independent inspectors general being removed from various agencies via mass firings. This raises questions about accountability and transparency, a stark contrast to the commendable actions of the Bay Area rock act.

These actions highlight a real difference in values and approaches to public service, which makes Metallica’s donation even more meaningful. trump uses mass firing to remove independent inspectors general at a series of agencies Hopefully, this generosity from the Bay Area will continue to support the rebuilding efforts in LA.

Community Sentiment Online and in Media, Bay area rock act metallica donates 500k to los angeles fire relief efforts

The media and social media platforms buzzed with positive feedback regarding Metallica’s donation. Numerous articles and posts praised the band’s generosity and highlighted the significant impact the contribution would have on the recovery efforts. Comments expressed gratitude, admiration, and hope for a swift recovery for those affected. This widespread positive sentiment further amplified the impact of the donation, reinforcing the sense of community and shared responsibility.

Metallica’s generous $500,000 donation to LA fire relief is truly inspiring. Thinking about how important it is to support those affected by the devastating fires, it got me thinking about ways to help nurture my own dry hair. Luckily, there are amazing nourishing hair masks out there to help revive dry hair with the best nourishing hair masks , just as the community is working to rebuild after the fires.

It’s wonderful to see such amazing acts of kindness, both big and small, in the face of adversity.

A significant amount of social media activity centered around sharing information about the relief efforts and ways to support them, highlighting the role social media played in facilitating collective action.

Forms of Community Support

The community responded to the crisis with a diverse array of support efforts, showcasing the depth and breadth of compassion. These included financial contributions, volunteerism, and emotional support. A critical aspect of this response was the collective effort in rallying support and resources for the affected communities.

- Financial Contributions: Many individuals and organizations contributed to the established relief funds, demonstrating a willingness to directly support those affected by the wildfires. This reflected a shared sense of responsibility and a desire to assist in the recovery process. Donations ranged from small amounts to substantial contributions, showcasing the wide spectrum of support within the community. The widespread participation demonstrated the community’s commitment to collective action in times of crisis.

- Volunteer Efforts: Volunteers offered their time and skills to support relief efforts, assisting with tasks such as rebuilding homes, cleaning up debris, and providing essential services. Examples included construction workers offering their expertise in rebuilding homes and individuals providing essential supplies. The commitment of volunteers to assist with recovery and rebuilding demonstrated a strong sense of community spirit and a willingness to lend a hand.

- Emotional Support: The community also offered emotional support to those affected by the wildfires, providing a crucial aspect of recovery. This support could include counseling, listening, and providing a sense of community and belonging. Emotional support was essential to help individuals and families cope with the psychological and emotional trauma associated with the devastating wildfires.

Table of Community Support

| Form of Support | Description | Examples |

|---|---|---|

| Financial Contributions | Direct monetary donations to relief funds | Individual donations, corporate sponsorships, fundraising events |

| Volunteer Efforts | Offering time and skills to assist with relief tasks | Construction work, cleanup, providing supplies, and emotional support |

| Emotional Support | Providing comfort, empathy, and resources to address psychological needs | Counseling services, support groups, and community outreach programs |

Future of Relief Efforts: Bay Area Rock Act Metallica Donates 500k To Los Angeles Fire Relief Efforts

The devastation wrought by the recent wildfires in Los Angeles underscores the urgent need for sustained support beyond immediate relief. Beyond the immediate provision of food, shelter, and medical care, a comprehensive strategy is required to address the long-term needs of affected communities and ensure a robust recovery. Metallica’s generous donation, while impactful in the short term, represents a catalyst for a wider discussion about long-term solutions.The long-term recovery process will be multifaceted and complex, demanding a collaborative effort from individuals, organizations, and government agencies.

The rebuilding process isn’t simply about restoring structures; it’s about restoring lives, livelihoods, and the sense of community that has been shattered. This requires a proactive approach, considering the specific needs of the affected areas and tailoring solutions to their unique contexts.

Ongoing Needs of Affected Areas

The immediate aftermath of a disaster often masks the long-term needs. Homes, businesses, and infrastructure require substantial rebuilding efforts. Furthermore, mental health support is critical for individuals grappling with trauma and loss. The emotional toll of such events can linger for years, highlighting the necessity of providing comprehensive and sustained mental health resources. Recovery extends beyond the physical realm.

Long-Term Rebuilding Process and Potential Challenges

The long-term rebuilding process will be characterized by significant challenges. Securing funding for long-term recovery projects is crucial. Coordination between various agencies and organizations will be essential to avoid duplication of efforts and ensure that resources are utilized effectively. Potential challenges include navigating bureaucratic hurdles, securing appropriate building codes and regulations, and addressing environmental concerns. Displaced populations may face difficulties reintegrating into their communities and rebuilding their lives.

Possible Future Plans for the Community and Relief Efforts

Addressing the specific needs of affected communities is paramount. A community-led approach, involving local stakeholders and residents, can empower communities and ensure that solutions are tailored to their unique needs. Developing long-term support programs is essential. These programs should focus on rebuilding homes, businesses, and infrastructure, while simultaneously providing vital resources for mental health recovery. Collaboration between local, state, and federal agencies, along with non-profit organizations, is key to creating a robust and resilient recovery plan.

Different Long-Term Support Programs and Their Relevance to the Community

Developing sustainable support programs will be vital. These programs should encompass a wide range of needs, from housing assistance and job training to financial support and educational opportunities. The specific needs will vary based on the unique circumstances of each community. Community centers, job training initiatives, and access to financial resources are all critical components of a comprehensive recovery plan.

These programs should aim to empower individuals and families, enabling them to rebuild their lives and livelihoods.

Potential Future Collaborations and Projects

| Organization/Individual | Potential Project | Description |

|---|---|---|

| Metallica | Establishment of a Community Relief Fund | This fund would provide long-term support for rebuilding efforts, encompassing housing, mental health support, and economic development. |

| Local Government Agencies | Development of Infrastructure Support Programs | This includes providing financial assistance and resources for rebuilding infrastructure, such as roads, utilities, and public spaces. |

| Non-profit Organizations | Establishment of Mental Health Support Centers | These centers would offer counseling, therapy, and support groups for individuals struggling with the psychological impact of the disaster. |

| Local Businesses | Job Training and Economic Development Programs | This would provide job training and mentorship opportunities for those affected by the wildfires to reintegrate into the workforce. |

Visual Representation

Metallica’s generous donation to the LA fire relief efforts isn’t just about numbers; it’s about tangible impact. The visual representation of this support, from the devastation to the rebuilding, tells a powerful story of community resilience and the importance of collective action. These images, whether of the destruction or the acts of recovery, serve as powerful reminders of the human cost of disasters and the profound impact of charitable giving.Visual representations of disasters are crucial for highlighting the human impact and motivating action.

They move beyond statistics to showcase the raw emotion and suffering, fostering empathy and a stronger sense of community responsibility. In the context of Metallica’s donation, the visuals amplify the message of hope and recovery.

Scene of Devastation

A haunting image captures the aftermath of the wildfires. Homes, once vibrant with life, are reduced to charred skeletons, their foundations exposed to the elements. Families are huddled together, their faces etched with sorrow and uncertainty. The air is thick with the acrid smell of smoke and ash, clinging to the remaining structures and lingering in the very air that people breathe.

The loss of treasured possessions and the destruction of homes are deeply felt, and these images are powerful reminders of the devastation’s human toll. The scene evokes a profound sense of loss and underscores the urgent need for support and rebuilding.

Donation Transfer Visualization

Imagine a large, gleaming bank transfer screen, displaying the significant sum of $500,000. This digital representation of the donation is projected onto a wall. In the background, stylized images of Metallica’s logo and the LA fire relief organization’s logo appear, symbolizing the transfer of funds. A single, clear line connects the Metallica logo to the relief organization’s logo, visualizing the seamless process of donation.

This visualizes the rapid and efficient transfer of resources, emphasizing the tangible support Metallica provides.

Rebuilding and Community Support

A series of images illustrate the rebuilding process. Volunteers, their faces showing determination and solidarity, work tirelessly to clear debris and rebuild homes. Children play on newly constructed playgrounds, showcasing the hope for a brighter future. A local community center, once severely damaged, is now being repaired and repainted, representing the healing and revitalization taking place. These visuals demonstrate the immediate and lasting positive impact of the donation, highlighting the human connection and the transformative power of community support.

Relief Efforts Visualized

The relief efforts are multifaceted. Images show food banks distributing meals, medical teams providing aid to injured individuals, and volunteers distributing vital supplies. A powerful visual is a group of families receiving blankets, clothing, and other necessities. These visuals depict the wide range of support being offered, showcasing the broad scope of the relief efforts and the comprehensive nature of the aid provided.

Resilience of the Community

A photo captures a group of survivors, their faces lined with hardship, but their eyes shining with determination. They stand together, holding hands, their posture radiating strength and resilience. They represent the community’s unwavering spirit in the face of adversity. Their shared experience and collective resolve are evident in the image. This single, powerful image captures the profound strength of the community, demonstrating their fortitude and unwavering resolve to overcome the challenges posed by the wildfires.

Final Thoughts

Metallica’s donation stands as a beacon of hope and solidarity in the face of disaster. The band’s generous contribution, combined with the community’s support, will help the affected areas recover and rebuild. The long-term impact of this act of kindness will undoubtedly be felt by the residents of Los Angeles, and the band’s image will undoubtedly be enhanced.

The rebuilding process will undoubtedly be long and challenging, but this act of generosity from Metallica will certainly play a pivotal role in facilitating recovery and revitalizing the community spirit.