State farm seeks 22 rate hike for california homeowners to cover los angeles wildfire losses – State Farm seeks a 22% rate hike for California homeowners to cover losses from the devastating Los Angeles wildfires. This significant increase in insurance premiums raises crucial questions about the financial burden on homeowners, the scope of wildfire damage, and the future of insurance in California. How will this impact existing policies? What preventative measures can be taken?

This article dives deep into the complexities of this situation, examining the historical context, financial implications, and potential solutions.

The proposed hike, the largest in recent memory, highlights the escalating costs associated with wildfire damage in California. Insurance companies are struggling to absorb the massive financial strain caused by the wildfires, and this proposed rate increase reflects that reality. The article will examine the factors contributing to this surge, and explore alternative strategies for homeowners and the insurance industry to manage this growing crisis.

Background of the Rate Hike

State Farm’s proposed 22% rate hike for California homeowners is a significant development in the state’s insurance market, particularly given the recent surge in wildfire activity. This increase, while substantial, reflects a broader trend of rising premiums across the industry, driven by escalating claims costs and the evolving risk landscape. Understanding this proposed hike requires a look at historical trends, the regulatory process, and the factors influencing these adjustments.California’s insurance market is complex, with a regulatory framework that aims to balance affordability and adequate coverage.

Insurance companies, like State Farm, must demonstrate that their proposed rate increases are justified by rising claim costs, the changing risk profile, and market conditions. This justification process is crucial for maintaining consumer trust and ensuring the stability of the insurance industry.

Historical Context of State Farm Rate Adjustments in California

State Farm, a major player in the California insurance market, has a history of adjusting rates based on various factors. Past adjustments have been influenced by factors like catastrophic events, changes in building codes, and shifts in the overall risk environment. Analyzing these past adjustments helps understand the current proposal within a broader context. Historical data on State Farm’s rate changes in California would provide further insight into the reasoning behind the current proposal.

Typical Process for Insurance Rate Changes in California

Insurance companies in California are required to follow a specific process for adjusting rates. This process typically involves submitting proposed rate changes to the California Department of Insurance (CDI). The CDI then reviews the proposed adjustments, considering factors such as the insurer’s financial stability, the cost of claims, and the adequacy of coverage. This regulatory oversight ensures that rate increases are justified and do not unduly burden policyholders.

Transparency and accountability are crucial aspects of this process, and public scrutiny plays a significant role in ensuring fair treatment of consumers.

State Farm’s proposed 22% rate hike for California homeowners, to recoup losses from the LA wildfires, is definitely a hot topic. But it’s interesting to consider how the state is handling the nearly half-a-billion dollars freed up after the Los Vaqueros reservoir expansion project’s collapse. This potential redirection of funds might offer a different perspective on how to address the state’s financial challenges, and potentially impact how the insurance industry manages the costs associated with future disasters like the wildfires.

Ultimately, though, State Farm’s rate hike still needs to be carefully examined to ensure it’s fair and reasonable.

Role of Wildfire Events in Affecting Insurance Premiums

Wildfires are a significant driver of insurance rate increases in California. The increasing frequency and intensity of these events have led to a substantial rise in claims, significantly impacting the profitability of insurance companies. The cost of rebuilding after wildfires, often involving complex restoration and damage assessments, contributes substantially to the financial burden on insurers. Climate change and increased urbanization in fire-prone areas have amplified the risk associated with these events, leading to a noticeable rise in insurance premiums.

Factors Influencing the Magnitude of Rate Hikes

Several factors contribute to the magnitude of rate increases, beyond just wildfire losses. These factors include the severity of past claims, the frequency of claims, and the specific types of risks associated with individual policies. The overall economic climate, inflation, and the cost of reinsurance also play a role in shaping rate adjustments. Insurers consider a multitude of variables when determining the appropriate increase.

Comparison of State Farm’s Proposed Hike with Other Insurers

Comparing State Farm’s proposed rate hike with those of other insurers provides a broader perspective on the current market trends. A comparative analysis of the proposed rate hikes across different insurance companies would provide a clear picture of the current situation. A table illustrating the proposed hikes from various insurers, along with the reasons for the increases, is provided below.

| Insurer | Proposed Rate Hike Percentage | Reason for Hike |

|---|---|---|

| State Farm | 22% | Los Angeles Wildfires and increased claim costs |

| Aetna | 18% | Increased claims from recent storms and wildfires |

| Farmers Insurance | 20% | Wildfire losses and escalating repair costs |

| Allstate | 19% | Rising claims costs due to severe weather events |

Impact on Homeowners

California homeowners are facing a significant financial challenge as State Farm seeks a 22% rate hike for homeowners insurance. This increase, driven by the substantial losses from recent wildfires, will directly impact their budgets and potentially reshape the housing market. Understanding the implications is crucial for navigating this changing landscape.The 22% rate hike is a substantial increase, potentially straining household budgets and impacting the overall affordability of homeownership in California.

The impact will vary based on factors like the size and location of the home, as well as the specific coverage included in the policy.

Financial Implications for Homeowners

The rate hike will translate into higher monthly premiums, impacting homeowners’ budgets. Many homeowners rely on their insurance policies to protect their significant investment in their homes. This increase directly affects their financial well-being and could lead to financial strain for some households. Consider a homeowner with a $500,000 home, a $1,000 annual premium. The increase could lead to a $220 additional annual premium, impacting monthly budgets and potentially impacting other financial obligations.

Consequences for Homeowners with Existing Policies

Homeowners with existing policies will experience a direct increase in their premiums. This increase will be factored into their next renewal, and will likely lead to a significant adjustment in their monthly expenses. The change will necessitate a reassessment of their financial situation and potential alternatives to mitigate the impact. For example, a homeowner with a policy already near the maximum allowed premium could be faced with a decision to downgrade coverage or find alternative solutions.

Impact on Home Values and Affordability

The rate hike could potentially impact home values, as higher insurance premiums may deter potential buyers. This could lead to a reduction in demand and potentially lower home values in affected areas. Affordability could be severely impacted for first-time homebuyers and those with limited financial resources, potentially leading to a decrease in home purchases and a cooling effect on the housing market.

Potential Alternatives for Homeowners

Homeowners facing increased premiums have several options to mitigate the impact. Bundling insurance policies with other services, such as auto or renters insurance, could offer discounts. Exploring alternative insurance providers with potentially lower premiums can also be a viable option. Another strategy could involve exploring options like increasing deductibles to lower premiums. This is a decision that homeowners need to make in conjunction with their own financial situation and risk tolerance.

| Homeowner Profile | Potential Premium Increase | Suggested Actions |

|---|---|---|

| Young Family with a modest home | $150-$250 per year | Shop around for alternative insurance providers, consider increasing deductibles, or explore options for bundling insurance policies. |

| Retired Couple with a large, older home | $300-$400 per year | Review current coverage needs and explore alternative insurance providers, explore options for bundling insurance policies. Investigate if a different policy with lower premiums is available. |

| First-time Homebuyer in a high-risk area | $500+ per year | Explore options for bundled policies, seek insurance advice from qualified professionals, explore coverage options that are more suitable for their risk tolerance. |

Los Angeles Wildfire Losses

The recent spate of wildfires across Southern California, particularly in the Los Angeles area, has had a devastating impact on the region’s infrastructure and economy. These infernos have highlighted the vulnerability of communities to extreme weather events and the significant financial strain on insurance companies. Understanding the scale of these losses is crucial to grasping the necessity of the rate hike.

Scope and Severity of the Wildfires

The Los Angeles wildfires, encompassing various incidents and hot spots, demonstrated the destructive power of rapid fire spread in dry, windy conditions. These fires, fueled by exceptionally dry vegetation and strong winds, rapidly consumed vast tracts of land, destroying homes, businesses, and vital infrastructure. The scale of devastation varied across affected areas, with some communities experiencing more intense damage than others.

State Farm’s 22% rate hike for California homeowners, to cover losses from the LA wildfires, is seriously frustrating. It’s like, they’re just trying to make a quick buck. Maybe we should all get together and unleash our collective fury on those cheesy reality romance TV shows, like this. Then, maybe, just maybe, insurance companies will think twice before ripping us off.

Still, though, a 22% hike is ridiculous, and we all deserve better.

The combined effect of these fires on the insurance industry is significant and requires a comprehensive assessment of the damages.

Financial Burden on Insurance Companies

The financial burden on insurance companies stemming from wildfire damage is substantial. Insurers are obligated to compensate policyholders for losses, and the scale of the recent wildfires has significantly increased the overall claims payouts. The immense cost of rebuilding infrastructure, repairing homes, and compensating for lost businesses has presented a considerable financial challenge to the insurance sector. In the wake of these devastating events, insurers are compelled to factor in these escalating losses when setting premium rates.

A crucial aspect of this is the methodology used to assess the damage.

Methodology for Assessing Wildfire Damage

Insurance companies employ a multi-faceted approach to assessing wildfire damage for claims. This methodology often involves a combination of aerial surveys, on-site inspections by trained appraisers, and detailed documentation of the extent of damage. Experienced professionals analyze the damage to structures, infrastructure, and contents. Furthermore, the cost of mitigation efforts and the need for long-term repairs are considered.

Types of Damages and Associated Costs

Wildfires inflict various types of damage, each with its associated cost. These damages can be categorized into several key areas:

- Structural Damage: This encompasses the damage to buildings, including the complete destruction of homes and businesses. Damage ranges from scorched exteriors to total collapse. Rebuilding or repairing damaged structures requires significant resources and expertise, factoring in the materials needed, labor costs, and potential engineering considerations.

- Infrastructure Damage: Power lines, water mains, and communication networks often suffer extensive damage during wildfires. Repairing or replacing these essential components requires significant financial investment, especially when the damage is widespread and affects large sections of the community.

- Content Damage: Wildfires also destroy personal belongings and business inventories. The replacement cost of these contents can be substantial, especially for items with high sentimental value or specialized equipment.

- Environmental Damage: Wildfires have devastating consequences for the environment. Rehabilitating affected ecosystems often requires extensive planning and resources, involving soil restoration, replanting efforts, and mitigation of the environmental impact. This aspect of the damage is often under-represented in direct cost assessments.

Damage Cost Table

| Category of Damage | Examples | Average Cost (USD) |

|---|---|---|

| Structural Damage | Complete house destruction, significant roof damage, interior fire damage | $150,000 – $500,000+ |

| Infrastructure Damage | Power line repairs, water main replacement, road repairs | $10,000 – $1,000,000+ |

| Content Damage | Household furnishings, vehicles, business inventory | $5,000 – $100,000+ |

| Environmental Damage | Reforestation, soil remediation, ecological restoration | Variable, dependent on extent and complexity of the damage |

Public Perception and Response: State Farm Seeks 22 Rate Hike For California Homeowners To Cover Los Angeles Wildfire Losses

State Farm’s proposed 22% rate hike for California homeowners is sure to spark a strong public reaction. Homeowners, already grappling with rising costs in general, will likely view this increase with concern and skepticism. Understanding the potential for public outcry and developing a robust communication strategy is crucial for State Farm to navigate this challenging situation.

Potential Public Reactions

Public reactions to the rate hike are likely to be mixed and potentially negative. Many homeowners will be understandably upset by the increase, especially given the current economic climate. Concerns about affordability and the fairness of the increase will likely dominate public discourse. Past examples of similar rate hikes have shown a pattern of public frustration, often leading to protests, media scrutiny, and even legislative action.

The level of public outcry will depend on the transparency of State Farm’s explanation for the hike and their commitment to addressing homeowner concerns.

Public Concerns Regarding Insurance Affordability

Homeowners face significant financial pressure from escalating insurance costs. A 22% increase can be a substantial burden, particularly for those already stretched thin financially. This concern is compounded by the rising cost of living and other financial pressures. Many homeowners may struggle to afford the increased premiums, potentially leading to policy cancellations or a decrease in coverage.

This underscores the importance of State Farm demonstrating empathy and understanding towards the financial challenges facing homeowners.

Potential for Government Intervention or Regulation

The potential for government intervention or regulation in response to the proposed rate hike is a significant factor. In instances where insurance rate increases are deemed excessive or unfair, state regulators often step in to review and potentially limit the increase. Public pressure and negative publicity can influence the regulatory environment. Past cases demonstrate how public sentiment can influence legislative action, leading to stricter regulations or limitations on rate increases.

Examples of Public Discourse on Similar Rate Hikes

Previous instances of significant insurance rate hikes have frequently resulted in heated public debate. The discussion often centers on the fairness of the increases, the adequacy of coverage, and the transparency of the insurance company’s rationale. Social media platforms have become significant venues for expressing public concerns and coordinating responses. Online petitions and grassroots campaigns have been employed in past instances of similar rate hikes.

Importance of Transparent Communication from State Farm

Transparent communication is paramount for State Farm to mitigate negative public reaction. Clear and concise explanations of the factors driving the rate hike, such as the financial losses from the Los Angeles wildfires, are crucial. This includes detailing how the increase will directly benefit policyholders and the community. Actively engaging with stakeholders, including homeowners’ associations and community leaders, is essential for building trust and understanding.

Communication Strategy Table

| Potential Public Concern | Potential Response | Suggested Communication Strategies |

|---|---|---|

| Affordability of increased premiums | Financial hardship for many homeowners | Offer payment plans, explore options for reduced premiums, and highlight the importance of insurance coverage. |

| Lack of transparency in justification for the hike | Skepticism and mistrust | Clearly articulate the factors driving the rate increase, including the financial impact of the wildfires. Provide data-driven analysis. |

| Perception of unfairness or excessive increase | Public outrage and protests | Emphasize the need for insurance to cover wildfire damage. Acknowledge public concerns and demonstrate a commitment to addressing affordability issues. |

| Fear of losing coverage | Policy cancellations and reduced coverage | Highlight the importance of maintaining coverage and explain how the insurance protects homeowners from significant losses. |

Industry Analysis

California’s insurance market is a complex tapestry woven from the unique challenges of its geography and climate. The state’s susceptibility to wildfires, coupled with a large and diverse population, creates a dynamic environment for insurance companies. Understanding this environment is crucial to comprehending the rationale behind rate hikes, especially in the face of significant losses like the recent devastating wildfires.

California Insurance Market Overview

California’s insurance market is the largest in the United States, characterized by a high density of residents and a significant concentration of commercial and residential properties. This density, combined with the state’s unique climate and geographic features, presents significant challenges for insurers. The high concentration of assets in the state makes it a critical market for insurers, influencing their overall financial health and strategies.

State Farm’s request for a 22% rate hike for California homeowners to cover losses from the LA wildfires is a stark reminder of the devastating impact of these blazes. Tragically, 24 people have lost their lives in the fires as fire crews desperately try to contain the flames before the return of stronger winds this week, as reported in this article.

This underscores the immense financial strain on insurance companies, and the rate hike seems unfortunately unavoidable in the wake of such widespread destruction.

State Farm’s Market Share and Competitors

State Farm holds a substantial market share in California, and like other major players, its financial performance is closely tied to the state’s overall insurance landscape. Competitors such as Farmers Insurance, Geico, and Liberty Mutual also operate extensively in California, and their performance mirrors the challenges and opportunities presented by the wildfire risk. A comparison of market share reveals a competitive landscape, where State Farm’s position is significant but not absolute.

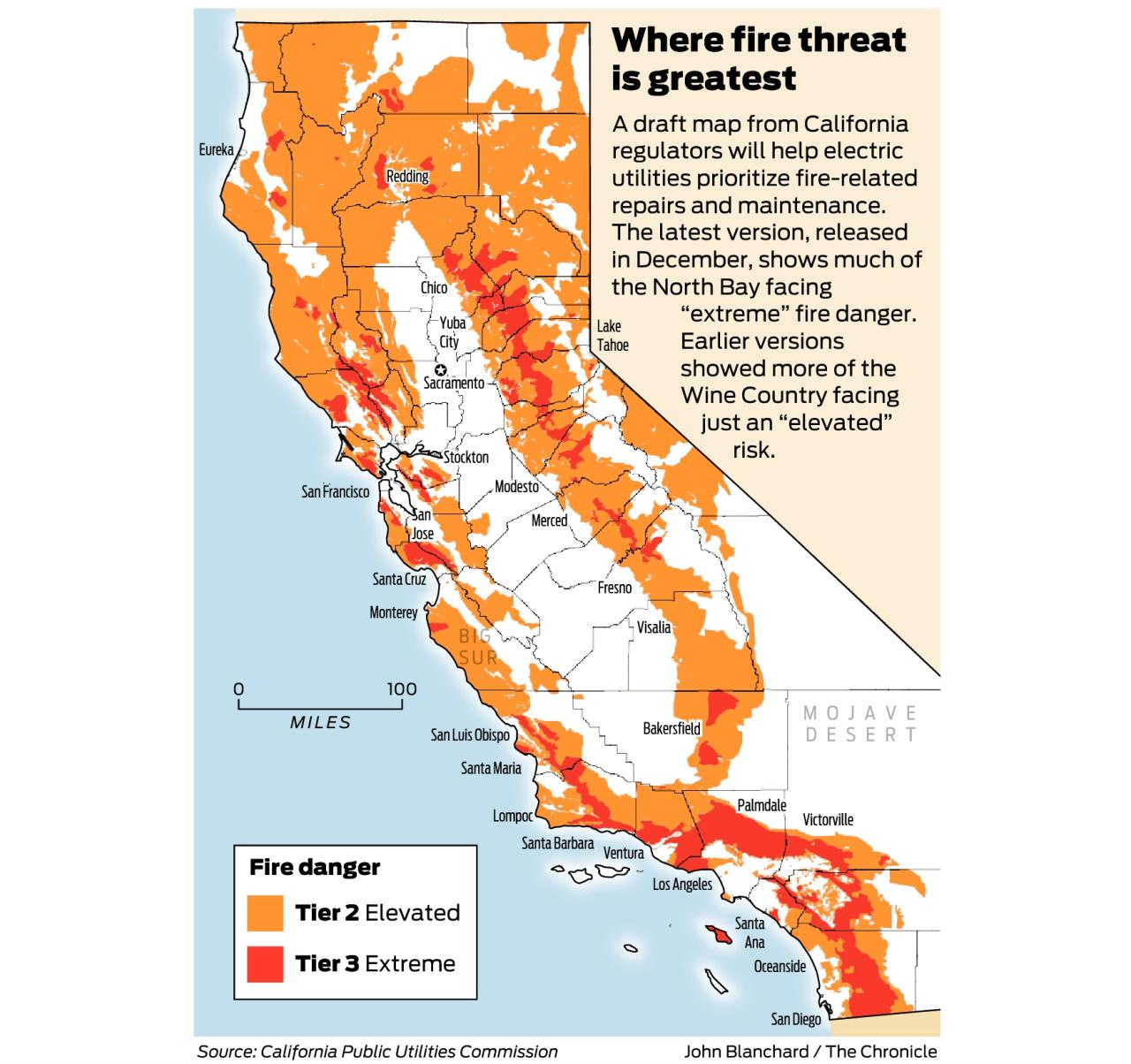

Wildfire Risk Trends

Wildfire risk in California is a growing concern, influenced by factors such as climate change, vegetation management, and population growth. Increased frequency and intensity of wildfires pose a considerable challenge to insurers, driving up claims and impacting their profitability. Historical data and projections from climate models highlight a worrying trend of increasing wildfire risk, influencing both the frequency and intensity of such events.

Financial Performance of Insurance Companies

Insurance companies in California are facing increasing financial pressure as wildfire losses mount. The cost of claims from wildfires is substantial, often exceeding the financial reserves of insurers, and influencing their investment strategies and long-term financial plans. The impacts of these losses are seen in premium increases, reduced profitability, and adjustments to underwriting strategies. These losses can also significantly impact their ability to provide coverage to policyholders, as seen in the case of several insurers experiencing increased financial strain after large-scale wildfire events.

Market Share of Top Insurers in California

| Insurer | Market Share (%) |

|---|---|

| State Farm | ~20 |

| Farmers Insurance | ~15 |

| Geico | ~10 |

| Liberty Mutual | ~8 |

| Allstate | ~7 |

| Other | ~40 |

Note: Market share percentages are approximate and can vary slightly depending on the source and reporting period.

Insurance Claim Processes

Navigating the aftermath of a wildfire is challenging enough without the added stress of a complex insurance claim process. Understanding the steps involved in filing and resolving a claim can help homeowners feel more in control and prepared. This section details the process, from initial reporting to final settlement.The insurance claim process for wildfire-related damage is multifaceted, involving multiple steps and potential points of contention.

Each step is crucial for a smooth resolution, and understanding these steps is vital for homeowners to maximize their chances of a fair and timely settlement.

Wildfire Damage Assessment

Insurance companies use a standardized process to evaluate the extent of damage. This involves a thorough inspection of the property by trained adjusters. They document the damage, taking detailed photographs, videos, and measurements. The adjuster will also interview the homeowner, gathering information about the fire’s impact on the structure and belongings. This comprehensive documentation is crucial for determining the appropriate level of compensation.

Typical Claim Timeframes

The timeframe for processing a wildfire claim can vary significantly, depending on the complexity of the damage and the availability of adjusters. While some claims may be settled within a few weeks, others may take several months or even longer, particularly in areas with widespread devastation. Factors such as the extent of the damage, the number of claims being processed, and the availability of rebuilding materials all play a significant role.

For example, if a region experiences multiple large wildfires simultaneously, the claim processing time might be extended as insurance companies prioritize the most urgent claims.

Steps Involved in Evaluating Damage

- Initial Report: The homeowner reports the damage to their insurance company, providing initial details and pictures of the damage. This is the first step in initiating the claim process.

- Adjuster Inspection: An adjuster from the insurance company will visit the property to assess the damage. They will document the extent of damage to the structure and contents. This step is crucial in determining the validity and extent of the claim.

- Damage Documentation: Detailed documentation of the damage is critical. This includes photos, videos, and a written report from the adjuster, along with any supporting evidence the homeowner provides. Examples of supporting evidence could include receipts for pre-fire possessions or home improvement records.

- Claim Evaluation: The insurance company evaluates the damage and determines the amount of coverage available. They consider the policy’s terms and conditions and the extent of the damage. This step may involve independent appraisals to ensure fairness and accuracy in the estimation.

- Settlement Negotiation: If the homeowner and insurance company agree on the amount of compensation, the settlement is finalized. If there’s a discrepancy, negotiation is required to reach a mutually acceptable resolution. The insurance company’s adjuster will typically propose a settlement amount based on their assessment.

Claims Disputes and Resolutions, State farm seeks 22 rate hike for california homeowners to cover los angeles wildfire losses

Disputes are sometimes unavoidable during the claims process. Disagreements may arise from differing interpretations of damage extent or coverage limitations. In such cases, mediation or arbitration may be necessary to resolve the dispute. A neutral third party can help facilitate communication and reach a mutually agreeable settlement. For example, a homeowner might dispute an assessment of the structural damage, arguing for a higher valuation.

The insurance company might offer a lower settlement, citing the limitations of the policy or the absence of supporting documentation. Through mediation or arbitration, both parties can present their cases, and an impartial decision can be reached.

Filing a Wildfire Insurance Claim: A Step-by-Step Process

Filing a wildfire insurance claim requires careful documentation and adherence to the insurance company’s procedures.

- Contact your insurance company immediately: Notify your insurance provider as soon as possible after the fire. Provide them with the necessary details and any supporting evidence.

- Gather supporting documentation: Collect all relevant documents, including policy details, photos of the damage, and any receipts for pre-fire possessions or home improvements. The more documentation you have, the more likely a fair assessment will be.

- Cooperate with the adjuster: Allow the adjuster to inspect the property and provide all necessary information. Be transparent and honest about the extent of the damage. Answer questions thoroughly and completely.

- Review the adjuster’s report: Carefully review the adjuster’s report and ensure all damage is accurately documented. If you disagree with any aspect of the report, promptly address it with the insurance company.

- Negotiate a settlement (if necessary): If you disagree with the proposed settlement, discuss your concerns with the insurance company and attempt to reach a mutually agreeable resolution. If needed, involve mediation or arbitration to settle the dispute.

- Finalization of claim: Once both parties agree on a settlement, finalize the claim according to the insurance company’s procedures. This typically involves signing documents and receiving payment.

Alternative Risk Management Strategies

Wildfires are a devastating threat, particularly in areas like California. Beyond relying on insurance, proactive measures can significantly reduce the risk of damage and loss. Implementing these strategies not only protects property but also safeguards communities from the catastrophic effects of these events. This involves a multi-faceted approach that considers individual actions and community-wide initiatives.

Preventative Measures for Wildfires

Effective wildfire prevention is a crucial component of risk management. Strategies range from individual property maintenance to large-scale community initiatives. These measures aim to reduce the likelihood of ignition and the spread of fire. For instance, well-maintained landscaping and defensible space around homes play a significant role in mitigating wildfire risks.

Importance of Building Codes and Fire Safety Regulations

Building codes and fire safety regulations are critical for mitigating wildfire risks. These regulations often specify materials used in construction, setback requirements, and landscaping practices. They act as a safety net, minimizing the potential impact of a wildfire on structures. Complying with these regulations strengthens the resilience of communities in the face of wildfires. Stricter building codes that mandate fire-resistant materials and adequate defensible space around structures can substantially reduce the risk of wildfire damage.

Reducing Homeowner Risk of Wildfire Damage

Homeowners can take proactive steps to minimize their risk of wildfire damage. These steps often focus on creating a “defensible space” around their homes. This involves maintaining a certain distance between vegetation and structures, clearing flammable materials, and regularly maintaining landscaping. Implementing these precautions significantly reduces the chance of a fire spreading to homes. For instance, regular lawn maintenance, trimming trees, and clearing brush from the immediate vicinity of homes can make a substantial difference in fire prevention.

Alternative Insurance Products or Programs

While traditional homeowners insurance is crucial, alternative insurance products and programs can offer additional protection or address specific needs. These options might include wildfire-specific insurance policies, which often provide enhanced coverage for wildfire damage. Additionally, some communities may have programs that offer subsidies or assistance for wildfire-resistant upgrades to homes. For instance, a homeowner might consider a supplemental policy focused on wildfire damage, in addition to their standard homeowners insurance, to address the higher risk in a wildfire-prone area.

Actionable Steps to Prevent Wildfires

- Regularly maintain landscaping: Keep vegetation trimmed and clear away dry leaves, grass, and brush around your home. This helps prevent fire ignition and slows the spread of flames.

- Create a defensible space: Clear a zone of vegetation around your home, ensuring a safe distance between flammable materials and your structure. This “defensible space” is crucial for slowing the spread of a fire.

- Install fire-resistant materials: Consider using fire-resistant roofing materials and other building materials when constructing or renovating your home. This can reduce the vulnerability of your property to fire.

- Develop community fire plans: Participate in community-level wildfire prevention initiatives. Working together can enhance safety measures and increase community resilience.

- Practice fire safety: Be mindful of fire hazards in your area and take precautions to prevent accidental fires. For instance, avoid burning debris during high-risk weather conditions.

- Stay informed about local fire regulations: Familiarize yourself with local building codes and fire safety regulations, as these often include crucial guidelines to mitigate wildfire risks.

Final Wrap-Up

In conclusion, State Farm’s proposed 22% rate hike for California homeowners underscores the urgent need for a comprehensive approach to wildfire mitigation and insurance reform. The financial strain on homeowners is undeniable, and the need for proactive measures to prevent future catastrophes is critical. This article has explored the multifaceted nature of this crisis, from the historical context of insurance rate adjustments to the potential public response.

Ultimately, the conversation surrounding this issue demands a balanced approach that considers both the needs of insurance companies and the financial well-being of California homeowners.