What is global payroll? It’s the intricate process of managing compensation for employees working across international borders. This involves navigating complex tax laws, currency fluctuations, and compliance requirements specific to each country. From establishing accurate payroll systems to ensuring timely payments, global payroll is a crucial aspect of managing a multinational workforce. Understanding the nuances of this process is essential for businesses looking to expand internationally.

This comprehensive guide dives deep into the world of global payroll, examining its various facets, challenges, and solutions. We’ll explore the key components, the intricacies of international compliance, and the role of technology in streamlining this often complex process. Get ready to unlock the secrets of global payroll management and navigate the international compensation landscape with confidence.

Definition and Scope

Global payroll is a complex process that manages the compensation and benefits of employees working across multiple countries and jurisdictions. It requires a deep understanding of international tax laws, labor regulations, and currency exchange rates. This process ensures accurate and compliant payment of wages, deductions, and benefits, all while adhering to the unique requirements of each country where employees are located.

Definition of Global Payroll

Global payroll encompasses the entire process of calculating, processing, and distributing employee compensation across multiple countries. This includes salaries, bonuses, benefits, deductions, and tax withholdings. It extends beyond the typical domestic payroll function by navigating varying legal and regulatory environments, currency conversions, and reporting standards.

Key Components of Global Payroll

The process of global payroll involves numerous critical components. These components include employee data management, tax compliance, benefit administration, and payment processing. Accurate and comprehensive employee records are fundamental for ensuring compliance with all relevant regulations. This often involves maintaining separate records for each country where employees work, reflecting their specific tax and legal obligations.

Difference Between Global and Domestic Payroll

Domestic payroll focuses on employees within a single country, handling the specific tax laws and regulations of that location. Global payroll, in contrast, necessitates navigating diverse legal frameworks across multiple countries, handling potentially complex tax situations, and accommodating different payment methods and currencies. The scope and complexity of compliance requirements are significantly higher in global payroll.

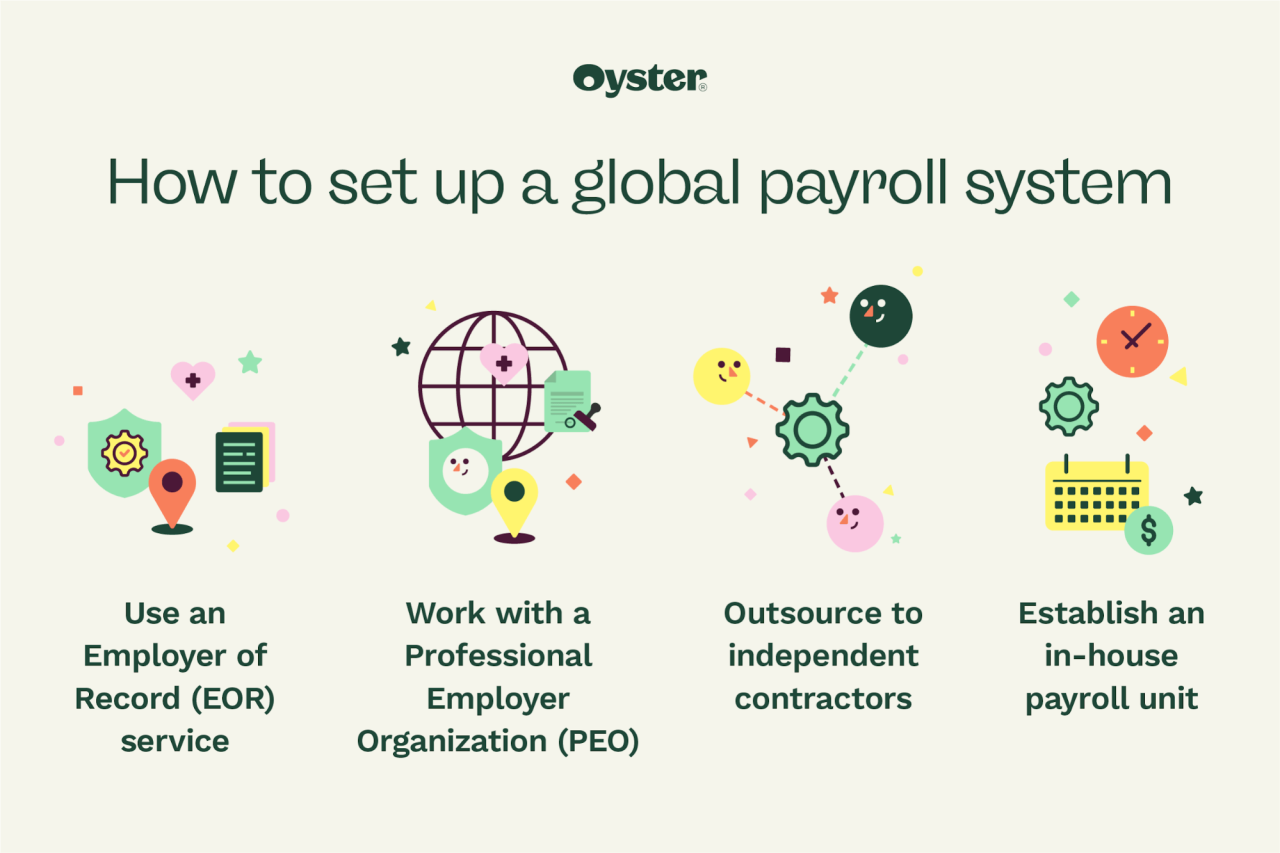

Types of Global Payroll Systems

Various global payroll systems cater to different needs and complexities. Some are centralized systems managing all payroll data across multiple countries, while others are decentralized systems enabling each country to handle its payroll independently. There are also hybrid systems that combine elements of both centralization and decentralization. The choice of system depends on factors like the size of the global workforce, the geographic spread of employees, and the level of control required by the organization.

Complexities of Global Payroll in Different Countries

Payroll complexities vary significantly by country due to diverse tax systems, labor laws, and reporting requirements. In some countries, withholding taxes are high, requiring precise calculations to ensure accurate deductions. Other countries have specific reporting mandates that necessitate detailed records and reports. The complexity also stems from currency fluctuations and international regulations that impact exchange rates and cross-border transactions.

Global Payroll Compliance Considerations by Region

| Region | Tax Laws | Reporting Requirements | Currency |

|---|---|---|---|

| North America (US, Canada) | US Federal and State Taxes, Canadian Federal and Provincial Taxes; various payroll tax regulations | US IRS reporting, Canadian CRA reporting; specific reporting obligations for each state/province | USD, CAD |

| Europe (EU) | Country-specific tax laws; EU directives on payroll reporting | EU VAT reporting, national reporting requirements; data privacy laws (GDPR) | EUR, GBP, etc. |

| Asia Pacific (Japan, China, India) | National tax regulations, withholding tax rules, and payroll tax regulations vary significantly by country | Country-specific reporting requirements, local labor regulations, and compliance | JPY, CNY, INR, etc. |

| Latin America (Brazil, Mexico) | National tax regulations, withholding tax rules, and payroll tax regulations vary by country | Country-specific reporting requirements, local labor regulations, and compliance | BRL, MXN, etc. |

This table highlights the critical elements of compliance in various regions. Each region possesses distinct tax laws, reporting requirements, and currencies that must be carefully considered. This necessitates a nuanced approach to global payroll administration, ensuring adherence to local legal mandates.

Challenges and Considerations

Navigating the complexities of global payroll demands a meticulous approach. From diverse legal frameworks to fluctuating exchange rates, numerous hurdles can hinder smooth operations. This section delves into the crucial challenges and considerations that companies must address when implementing a global payroll system.

Global payroll, in a nutshell, is managing employee compensation across international borders. It’s a complex process, involving various currencies, tax regulations, and labor laws. This complexity is highlighted by recent events like the potential trade disputes between the US and Canada/Mexico, exemplified by the trump tariff threat canada mexico situation. Navigating these political tensions while accurately handling global payroll demands a sophisticated approach to ensure compliance and smooth operations for companies with international staff.

Common Challenges in Global Payroll Management

Global payroll management presents a unique set of challenges. Different countries have varying tax laws, regulations, and compliance requirements. This necessitates a deep understanding of local payroll practices in each region where employees are located. Further complicating matters are cultural nuances that may influence employee preferences for receiving payments and other payroll-related communications.

Importance of Accurate Data Entry

Accurate data entry is paramount in global payroll. Inaccurate data can lead to incorrect tax calculations, penalties, and potentially legal issues. Errors in employee details, such as addresses or bank account information, can result in delayed or failed payments, causing significant disruption to employees and potentially damaging the company’s reputation. Data validation and quality control processes are essential to maintain accuracy and avoid costly mistakes.

Global payroll, essentially, is managing employee compensation across multiple countries. It’s a complex process, especially when you consider things like different tax laws and currency fluctuations. A recent example of the financial realities in play is the sale of a four bedroom home in San Ramon for $1,800,000. This impressive San Ramon sale highlights the importance of understanding local market values and how they can be a significant factor in global compensation strategies.

Ultimately, global payroll is all about ensuring smooth and compliant payrolls for your employees, no matter where they are located.

This includes cross-checking data against employee records and using robust verification mechanisms.

Implications of Inaccurate or Delayed Payroll Payments

Inaccurate or delayed payroll payments can have significant repercussions. Financial penalties and legal issues are potential outcomes. Furthermore, employee morale and productivity can suffer. Delayed payments can create financial hardship for employees, impacting their trust in the organization. Maintaining prompt and accurate payments is crucial for fostering positive employee relations and avoiding operational disruptions.

Significance of Cross-Border Compliance

Cross-border compliance is critical for global payroll. Companies must navigate a complex web of regulations and laws in each country where their employees work. This requires a thorough understanding of each jurisdiction’s specific payroll requirements, including tax laws, social security contributions, and labor laws. Failing to comply with local regulations can lead to hefty fines and reputational damage.

Dedicated compliance experts or payroll service providers specializing in global payroll can assist in navigating these intricacies.

Role of Currency Exchange Rates in Global Payroll

Fluctuating currency exchange rates pose a considerable challenge in global payroll. Companies must account for these changes to ensure accurate calculations and timely payments in the local currency of each employee. Using a robust payroll system that automatically adjusts for currency fluctuations is crucial. Real-time exchange rate data feeds are vital for minimizing potential losses due to currency fluctuations.

Companies should consider hedging strategies to mitigate risks associated with currency volatility, especially for large payroll amounts.

Payment Methods for Global Payroll

Choosing appropriate payment methods is essential for global payroll. Different methods offer varying degrees of cost, speed, and security. Companies must carefully evaluate these factors to ensure they are aligned with their specific needs and employee preferences.

| Method | Cost | Speed | Security |

|---|---|---|---|

| Bank Transfer | Generally lower | Variable, often slower | High, if secure channels are used |

| Payroll Cards | Higher initial setup cost | Faster, often real-time | High, with robust security measures |

| Direct Deposit | Low | Usually fast | High, if the banking infrastructure is secure |

| Cash | Low, in some contexts | Very slow | Low, vulnerable to loss or theft |

Technology and Automation: What Is Global Payroll

Global payroll, especially for multinational corporations, is a complex and time-consuming process. Manual handling of data from different countries with varying tax regulations and compliance requirements can lead to errors and delays. This is where technology and automation play a crucial role in streamlining the process, improving accuracy, and enhancing efficiency.Modern technology provides powerful tools to manage the intricate details of global payroll, from calculating salaries to handling international tax obligations.

Automation can significantly reduce the risk of human error and the associated costs, ultimately contributing to a more effective and compliant global payroll system.

Role of Technology in Streamlining Global Payroll Processes

Technology significantly streamlines global payroll processes by automating various tasks. This reduces the risk of errors associated with manual data entry and calculation, while also improving efficiency through faster processing times. Real-time data access and reporting capabilities enable better oversight and control over the global payroll function.

Use of Payroll Software for Global Payroll

Payroll software is essential for managing global payroll. These systems can handle multiple currencies, tax regulations, and legal requirements in different countries. They can also track employee information, generate payslips, and manage deductions, thereby facilitating a more controlled and organized process. Advanced payroll software solutions provide features for managing global benefits and compliance requirements.

Examples of Different Payroll Software Solutions for Global Payroll

Several software solutions cater to the needs of global payroll management. Examples include ADP, Paylocity, and BambooHR. These solutions typically offer features like multi-currency support, international tax calculations, and compliance reporting for various countries. They can also integrate with other HR systems for a holistic approach to employee management.

How Automation Can Reduce Errors and Improve Efficiency in Global Payroll

Automation significantly reduces errors by eliminating manual data entry and calculations. This results in higher accuracy in payroll processing. Automated processes also improve efficiency by accelerating the payroll cycle, enabling faster payments and improved employee satisfaction. Automated compliance checks ensure adherence to local regulations in each country.

Discussion of the Role of AI in Global Payroll

Artificial intelligence (AI) is increasingly being incorporated into global payroll systems. AI-powered tools can analyze vast amounts of data to identify potential compliance issues or errors, helping organizations proactively address and avoid costly penalties. AI can also assist in predicting potential payroll-related risks, such as tax changes, helping organizations stay ahead of future compliance challenges.

Table of Advantages and Disadvantages of Payroll Automation Tools

| Tool | Advantages | Disadvantages | Cost |

|---|---|---|---|

| ADP | Comprehensive features, robust compliance tools, extensive global coverage. | Steep learning curve, high initial setup cost, limited customization options. | High |

| Paylocity | User-friendly interface, scalable solutions, good support network. | Limited global reach compared to ADP, may not fully meet all specialized needs. | Medium |

| BambooHR | Integrates with other HR systems, focuses on employee experience, simpler setup. | Limited payroll features compared to dedicated payroll solutions, may not be sufficient for complex global setups. | Low to Medium |

| Custom Payroll Software | Tailored to specific business needs, highly customizable, maximum control over processes. | Requires significant upfront investment in development and maintenance, potential for errors if not well-managed. | High |

Compliance and Legal Aspects

Navigating the global payroll landscape requires a deep understanding of the legal and regulatory frameworks in each country where employees are located. Compliance is paramount, as non-compliance can lead to significant penalties and reputational damage. This section delves into the crucial aspects of international tax regulations, applicable taxes, necessary legal documents, and the critical role of local payroll expertise.

Legal and Regulatory Requirements

Global payroll necessitates adherence to a complex web of legal and regulatory requirements. These vary significantly between countries, encompassing labor laws, tax regulations, social security contributions, and data privacy laws. Failure to comply with these specific local requirements can lead to legal issues, fines, and reputational harm. Understanding the specific regulations in each country is vital for maintaining a compliant global payroll process.

International Tax Regulations

International tax regulations play a pivotal role in global payroll. They dictate how taxes are calculated and collected from employees working in different countries. The complexities arise from the varying tax systems and treaties between nations. Companies must ensure compliance with international tax laws to avoid legal issues and potential penalties. A detailed understanding of these regulations is essential for accurate tax calculations and reporting.

Global payroll, essentially, is managing employee compensation across multiple countries. It’s a complex system, but a crucial one for multinational companies. This week’s incredible sports story, the miracle finish Moreau Catholic pulls off an unbelievable victory over Cardinal Newman for the NCS D II title , reminds me of the meticulous planning needed to keep things running smoothly.

In the end, though, global payroll is all about ensuring fair and accurate payments, no matter where your team is located.

Types of Taxes Applicable to Global Employees

Various taxes apply to global employees, often combining national and local taxes. These include income tax, social security contributions, and value-added tax (VAT). Understanding the different types of taxes and their respective rates and requirements in each country is crucial for accurate payroll calculations. Specific withholding tax rates, dependent on the employee’s income and location, must be meticulously considered.

Examples of Legal Documents Required for Global Payroll

Several legal documents are crucial for global payroll compliance. These may include employment contracts, tax identification numbers, benefit enrollment forms, and local regulatory permits. Each country might have specific document requirements, and the accuracy and completeness of these documents are vital for avoiding errors and penalties. For example, a company operating in France needs to ensure compliance with French labor laws and provide appropriate documentation for French employees.

Importance of Local Payroll Expertise

Local payroll expertise is indispensable in global payroll. Payroll professionals with in-depth knowledge of local laws and regulations are crucial for ensuring compliance. They can provide guidance on complex tax regulations, specific legal requirements, and the necessary paperwork. Having a local payroll expert helps companies navigate the nuances of each country’s payroll system and avoid costly mistakes.

Their knowledge is critical in ensuring accurate and timely payments to employees, avoiding legal challenges, and maintaining a positive employer reputation.

Comparative Analysis of Tax Regulations

| Country | Tax Rate | Deductions | Filing Deadlines |

|---|---|---|---|

| United States | Progressive, varies by income bracket | Federal, state, and local income taxes, Social Security, Medicare | Typically quarterly or annually |

| United Kingdom | Progressive, varies by income bracket | Income tax, National Insurance contributions | Typically monthly or quarterly |

| Germany | Progressive, varies by income bracket | Income tax, social security contributions | Typically monthly or quarterly |

| Canada | Progressive, varies by province and income bracket | Federal and provincial income taxes, CPP/EI | Typically quarterly or annually |

Note: Tax rates and deadlines are subject to change. This table provides a general overview and should not be considered exhaustive. Consulting with local tax professionals is highly recommended.

Best Practices and Strategies

Global payroll, while crucial for any multinational corporation, presents unique challenges. Effective management requires a robust framework that encompasses best practices for accurate, timely payments, and transparent communication. This approach ensures compliance, reduces errors, and fosters a positive employee experience across international borders.Successfully navigating global payroll involves a proactive and well-structured approach. It’s more than just processing payments; it’s about understanding the nuances of various legal and cultural landscapes and implementing strategies to ensure accuracy and compliance.

This section details key best practices and strategies for managing global payroll effectively.

Key Best Practices for Managing Global Payroll

Implementing best practices is paramount for successful global payroll management. These practices encompass everything from meticulous record-keeping to proactive communication. Adherence to these practices significantly reduces the risk of errors, ensures compliance, and ultimately, enhances the employee experience.

- Establish a Centralized Global Payroll System: A centralized system streamlines data entry, processing, and reporting, minimizing human error and maximizing efficiency. This system should be equipped to handle various currencies, tax regulations, and local payroll requirements. A centralized system facilitates compliance checks across different jurisdictions.

- Develop Comprehensive Payroll Policies and Procedures: Clear and concise policies, including procedures for handling payroll queries, address various situations effectively, and ensure consistency. These policies should Artikel roles and responsibilities, outlining processes for processing payroll in each location. Detailed documentation of these procedures is essential for audit trails and training purposes.

- Utilize Advanced Technology for Payroll Processing: Automating repetitive tasks, leveraging cloud-based solutions, and utilizing payroll software with advanced features can significantly reduce manual intervention and human error. This also improves efficiency and allows for real-time data access.

- Implement Robust Internal Controls: Establishing clear segregation of duties and implementing regular audits, ensuring proper authorization for payroll transactions, and employing fraud detection measures can effectively safeguard against errors and fraud. Internal controls are essential to maintaining integrity and security within the payroll process.

Strategies for Ensuring Accurate and Timely Global Payroll Payments

Accuracy and timeliness are crucial for global payroll. Implementing strategies that address both will ensure employee satisfaction and minimize compliance risks. These strategies will need to be tailored to specific local laws and regulations.

- Thorough Verification of Employee Data: Regularly verifying employee data, including address, bank details, and tax information, is vital. Regular updates are critical to maintaining accuracy. Automated systems can aid in these checks, especially with large global workforces.

- Proactive Compliance with Local Laws and Regulations: Payroll professionals must stay informed about and adapt to changing local payroll laws and regulations. This requires ongoing research and compliance training to ensure compliance across all regions.

- Establish Clear Payment Schedules: Consistent payment schedules for employees, taking into account local holidays and payment cycles, ensure timely payments. This approach reduces confusion and improves the employee experience.

Importance of Employee Communication and Transparency in Global Payroll

Open communication and transparency regarding global payroll procedures are critical for employee satisfaction and trust. Transparent communication regarding payroll processes builds a strong foundation of trust and confidence.

- Regular Communication Channels: Establish multiple communication channels, such as email, intranet portals, or dedicated FAQs, for employees to access information on global payroll. This will include information on payment methods, tax deductions, and any changes to policies.

- Provide Clear and Concise Information: All payroll-related information should be presented in a clear, concise, and accessible format. This includes using local languages and avoiding complex jargon where possible.

- Transparency in Payroll Deductions: Clearly explain all deductions, including taxes and benefits, with transparent explanations of the calculations involved. This enhances employee understanding and reduces confusion.

Examples of Effective Communication Strategies for Global Payroll, What is global payroll

Effective communication strategies can include providing multilingual resources, creating a dedicated payroll FAQ section, and scheduling regular Q&A sessions.

- Multilingual Resources: Providing payroll information in multiple languages ensures that employees in different regions understand the process.

- Dedicated Payroll FAQs: A dedicated FAQ section on the company intranet or website can address common questions regarding global payroll.

- Regular Q&A Sessions: Scheduling regular Q&A sessions with payroll personnel can address employee concerns and clarify any doubts in real time.

Importance of Training and Development for Global Payroll Personnel

Training and development are essential for global payroll personnel. Regular training programs will enhance their understanding of international payroll regulations, and this will equip them to handle complex situations effectively.

- Regular Training on International Payroll Regulations: Ongoing training programs on international payroll regulations and best practices are vital for personnel to adapt to changes in laws and regulations. Regular updates on local and international payroll rules are essential.

- Cross-Cultural Sensitivity Training: Training on cultural sensitivities is essential to understand and address different communication styles and expectations. This includes cultural differences in approaches to payments and payroll.

- Technical Training on Payroll Software: Regular training on the specific payroll software used will maximize efficiency and minimize errors.

Best Practices for Reducing Errors in Global Payroll

Implementing these best practices can significantly reduce errors in global payroll. Careful attention to detail and the use of technology will greatly reduce the chance of human error.

| Practice | Description | Benefits | Implementation |

|---|---|---|---|

| Establish clear procedures for data entry | Define specific steps for entering employee data and ensure accuracy. | Reduces manual errors, improves data consistency. | Develop a detailed procedure manual and provide training to all personnel involved. |

| Regular data validation checks | Implement automated checks for data accuracy and completeness. | Identifies errors early, reduces processing delays. | Utilize payroll software with validation tools and implement routine data audits. |

| Implement robust audit trails | Maintain records of all payroll transactions and changes. | Facilitates error detection and resolution, supports compliance audits. | Develop a system for documenting all payroll actions and transactions. |

| Cross-functional verification of data | Have multiple departments verify data before processing. | Reduces errors due to data inconsistencies and omissions. | Establish a review process involving HR, finance, and legal teams. |

Global Payroll and HR Management

Global payroll isn’t just about calculating salaries; it’s a crucial aspect of managing a diverse workforce spread across the globe. Effective global payroll hinges on a strong partnership with HR, as HR policies and strategies directly impact the payroll process. This synergy ensures compliance with local regulations and maintains a fair and equitable compensation system for employees worldwide.

Relationship Between Global Payroll and HR Management

Global payroll and HR management are intrinsically linked. HR sets the framework for employee compensation, benefits, and policies, which directly influence the calculations and processes involved in global payroll. HR departments define job classifications, salary bands, and benefits packages, while payroll teams handle the administrative tasks of calculating and distributing wages and benefits according to these established parameters.

A strong collaboration ensures that payroll accurately reflects HR policies and that employees receive the correct compensation.

Role of HR in Global Payroll Processes

HR plays a critical role in ensuring smooth global payroll operations. They are responsible for defining the company’s global compensation strategies, ensuring compliance with international and local regulations, and establishing clear procedures for employee data management. HR professionals work closely with payroll teams to ensure that all policies and regulations are properly integrated into the payroll process. This involves providing payroll with accurate and updated employee data, defining benefit structures, and supporting employees with queries related to payroll.

Examples of HR Policies Influencing Global Payroll

HR policies significantly impact global payroll. For instance, a company’s policy on parental leave directly influences the calculation of payroll during those periods. Similarly, company policies on overtime pay or holiday pay have a direct impact on the payroll calculations. The implementation of performance-based incentives or variable pay structures also affects how payroll is structured and distributed, often requiring customized calculations.

Responsibilities of HR and Payroll Departments in Global Payroll

Effective global payroll requires a clear division of responsibilities between HR and payroll departments. This collaborative approach ensures accurate calculations and compliant distributions of compensation.

| Department | Role | Responsibilities | Interdependencies |

|---|---|---|---|

| HR | Policy Development | Defining job classifications, salary bands, benefits packages, and company policies related to compensation. Ensuring compliance with local and international labor laws. Maintaining accurate employee records. | Provides data and guidelines to payroll, ensuring accurate and compliant compensation calculations. Handles employee queries and feedback related to compensation and benefits. |

| Payroll | Compensation Calculation | Calculating salaries, bonuses, taxes, and other deductions based on HR policies and employee data. Processing payroll payments and ensuring timely distribution. Managing compliance with local and international tax regulations. | Relies on HR for accurate employee data, policy updates, and benefit information. Provides feedback on compliance issues and policy effectiveness. |

Case Studies and Examples

Global payroll, while essential, presents unique challenges when implemented across diverse international locations. Successfully navigating these complexities often hinges on tailored strategies, robust technology, and a deep understanding of local regulations. Real-world case studies provide invaluable insights into the successes and failures of global payroll implementations, offering valuable lessons for businesses venturing into the international market.Detailed examination of these case studies reveals crucial aspects of successful global payroll implementations, including the specific challenges encountered, the adopted solutions, and the crucial role of industry-specific adaptations.

Understanding how different industries handle global payroll, from technology to healthcare, offers valuable blueprints for businesses seeking to optimize their own processes.

Real-World Examples of Successful Global Payroll Implementations

Numerous businesses have successfully implemented global payroll systems, demonstrating the potential for streamlined operations and enhanced employee experience. These implementations often involve careful planning, diligent research into local regulations, and the adoption of robust technology solutions.

Challenges Faced and Solutions Adopted

Global payroll implementations frequently face unique challenges. Currency fluctuations, differing tax regulations, and varying labor laws across countries often create complexities. Businesses address these challenges through careful planning, proactive risk management, and the use of sophisticated payroll software capable of handling multiple currencies and legal frameworks.

Global Payroll Implementations in Specific Industries

The technology sector, for instance, often necessitates handling diverse workforces across multiple locations, demanding a robust and adaptable payroll system. In healthcare, the complexities of regulated benefits and payroll deductions for diverse employee populations necessitate a highly compliant system. Retail, with its fluctuating seasonal workforce and often international supply chains, presents specific challenges regarding payroll administration and compliance.

Global Payroll in Different Sectors

The technology sector often demands agility and scalability in payroll processes, as companies rapidly expand their global footprint. Healthcare institutions face intricate regulations surrounding benefits and deductions, requiring highly specialized payroll solutions. Retail businesses frequently deal with seasonal fluctuations in employment, impacting payroll scheduling and calculations.

Importance of Adapting Global Payroll to Specific Industry Needs

Payroll processes must be tailored to the unique requirements of each industry. For instance, the technology industry often involves remote employees in various countries, requiring a flexible and geographically dispersed payroll system. Healthcare organizations must adhere to strict regulations concerning employee benefits and deductions. Retail companies may need to manage seasonal fluctuations in their workforce, requiring a system that adapts to these changes.

Global Payroll Processes Across Different Industries

| Industry | Payroll Process | Key Challenges | Solutions |

|---|---|---|---|

| Technology | Handling remote employees across multiple countries, managing global benefits, and ensuring compliance with diverse tax regulations. | Managing multiple currencies, differing tax laws, and complex compensation structures. | Utilizing sophisticated payroll software, employing localization experts to navigate regulatory differences, and providing comprehensive employee support. |

| Healthcare | Complying with complex regulations regarding benefits and deductions, ensuring data security, and managing intricate employee compensation structures. | Navigating diverse healthcare regulations, ensuring HIPAA compliance, and maintaining accurate records of employee benefits. | Employing specialized payroll software tailored for healthcare, collaborating with legal experts, and implementing robust security measures. |

| Retail | Managing fluctuating seasonal workforce, ensuring accurate calculations for varying hours worked, and processing payments for temporary staff. | Handling seasonal fluctuations in employment, ensuring accurate payroll calculations for hourly employees, and managing a variety of compensation types. | Implementing flexible payroll systems capable of adjusting to seasonal needs, employing robust timekeeping solutions, and providing clear communication regarding compensation structures. |

| Finance | Managing complex compensation structures, complying with stringent regulatory requirements, and ensuring accurate reporting. | Ensuring compliance with stringent financial regulations, accurately reporting compensation, and handling various types of financial transactions. | Utilizing specialized payroll software designed for financial institutions, working closely with financial legal experts, and implementing comprehensive audit controls. |

Closure

In conclusion, global payroll is a multifaceted process demanding careful consideration of legal and financial factors. Accurate data entry, meticulous compliance, and robust technology are crucial for success. Understanding the unique needs of each country, and adopting best practices for communication and transparency are key elements for smoothly managing a global workforce. This guide has provided a foundational understanding of global payroll, equipping you with the knowledge to navigate the complexities and achieve optimal results.