Best Linux media server software empowers users to effortlessly manage and share their multimedia content. This comprehensive guide explores the diverse landscape of Linux media servers, from foundational concepts to advanced features. We’ll uncover the key functionalities, popular options, installation procedures, and essential considerations for performance, security, and user experience.

From organizing vast libraries of photos and videos to streaming them seamlessly to multiple devices, a robust Linux media server software solution is crucial. This article delves into the core aspects of choosing and implementing the ideal server for your needs, highlighting both the strengths and weaknesses of various options.

Introduction to Linux Media Servers

Linux media servers are powerful platforms for managing and delivering various media types, from music and videos to podcasts and audiobooks. They excel at providing centralized access to content across multiple devices within a network, enhancing user experience and streamlining media consumption. This centralized approach simplifies media management, enabling efficient storage, organization, and playback.These servers leverage specialized software to handle the complexities of media files, enabling seamless playback and organization across diverse devices.

This software is the backbone of a functional media server, providing the critical functionalities needed to manage and deliver content. From encoding and transcoding to metadata tagging and streaming, the software dictates how the server interacts with the media and the network. This interaction is crucial for a robust and user-friendly media experience.

Key Functionalities of Media Server Software

Media server software must provide several essential functionalities to fulfill its purpose. Efficient file organization and indexing are crucial to swiftly locating and accessing media content. Metadata tagging allows for structured information about each file, improving search capabilities and organization. Robust transcoding ensures compatibility across different devices and playback systems. Finally, secure access control mechanisms are critical to maintain privacy and prevent unauthorized access to media files.

Finding the best Linux media server software can be tricky, but a great option is Plex. It’s super versatile and lets you stream your media seamlessly. Speaking of seamless streaming, did you know about the popular Savannah Bananas franchise in Buffalo, NY? Savannah Bananas Buffalo NY is a hot ticket for baseball fans! Regardless of your team loyalties, exploring this local sports scene is definitely worth checking out.

Ultimately, the right media server software should enhance your entertainment experience, just like a great local sports team!

These functionalities contribute to a smooth and efficient media experience.

Comparison of Media Server Software Categories

This table provides a basic overview of different categories of media server software, highlighting their primary purposes and typical use cases.

| Category | Description | Examples |

|---|---|---|

| General-purpose | These servers are designed for a wide range of media types and offer a versatile set of features. They are suitable for users who want a comprehensive solution for managing various media formats. | Plex Media Server, Jellyfin |

| Dedicated Media | These servers are optimized for specific types of media, such as video or audio. They typically offer advanced features tailored to that particular media type, often with a greater focus on performance or specific encoding requirements. | Kodi (for a wider range of media types, but often used as a dedicated media player). |

| Specialized | These servers are designed for niche or specific media needs. This could include archival solutions for large collections, specialized formats, or streaming services tailored for specific platforms. | Custom-built solutions for archival or very specific streaming needs, like streaming to a custom kiosk. |

Key Features of Media Server Software

Linux media servers provide a powerful and flexible way to manage and share multimedia content. Choosing the right software depends heavily on the specific needs of the user, whether it’s for personal use, a small business, or a larger organization. Crucial features include robust handling of various media formats, efficient streaming capabilities, and user-friendly management interfaces. The best software will also prioritize compatibility and scalability for future growth.Effective media server software must accommodate the increasing diversity of media formats and their complexities.

This includes supporting a wide range of video and audio codecs, resolutions, and container formats. This ensures the system can handle everything from standard definition videos to high-resolution 4K content. Furthermore, the software should allow for seamless integration with other systems and devices.

Essential Media Management Features

A robust media server should allow for efficient management of diverse media formats. This includes features like metadata tagging, which allows for organization and searching of media files. The ability to easily add, delete, and organize media is crucial for maintaining a well-structured library. A well-designed user interface plays a significant role in this process.

Transcoding Capabilities

Transcoding is a critical feature for media servers, especially when dealing with diverse devices and playback needs. This process converts media files into formats compatible with various devices and networks. For instance, a server might transcode a high-definition video into a lower resolution format for playback on a mobile device. Transcoding can also be useful for adapting audio formats.

A powerful transcoding engine ensures smooth playback across a wide range of devices and networks. A well-designed system should support multiple output formats, and potentially allow users to adjust output settings (e.g., bitrate, resolution).

Streaming and Playback

Efficient streaming is essential for delivering media content quickly and reliably. A dedicated streaming module ensures smooth playback, minimizing buffering and lag. This is especially important for live streams or when sharing large files. High-quality streaming necessitates careful consideration of bandwidth limitations and network conditions. The software should ideally support various streaming protocols, enabling flexibility in how the media is delivered.

Good playback support is also critical. The server must be capable of handling multiple simultaneous streams without performance degradation. The ability to prioritize playback sessions based on user requirements and network conditions can also improve the user experience.

Comparison of Media Management Approaches

Different media server software employ various approaches to media management. Some use centralized databases to store and organize media files, offering advantages in terms of organization and searching. Others use a more distributed approach, potentially improving scalability but potentially complicating management. The choice depends on the specific needs of the user, taking into account factors like the size of the media library and the number of users.

Finding the best Linux media server software can be tricky, but I’ve been digging into different options lately. While I’m researching, it’s interesting to see how sports news can intertwine with tech topics. For example, did you hear the report that the SF Giants signed former Newark pitching star Joey Lucchesi to a minor league deal? report sf giants signing former newark pitching star joey lucchesi to minor league deal Regardless, I’m still leaning towards Plex as a top contender for a robust and user-friendly media server solution for Linux.

Supported Media Formats

| Format | Codec | Resolution |

|---|---|---|

| MP4 | H.264, H.265 | SD, HD, 4K |

| MKV | Various (e.g., VP9, H.264) | SD, HD, 4K |

| AVI | DivX, XviD | SD, HD |

| FLV | FLV | SD, HD |

This table provides a basic overview of common media formats. Note that the actual codecs and resolutions supported may vary based on the specific software and its configuration.

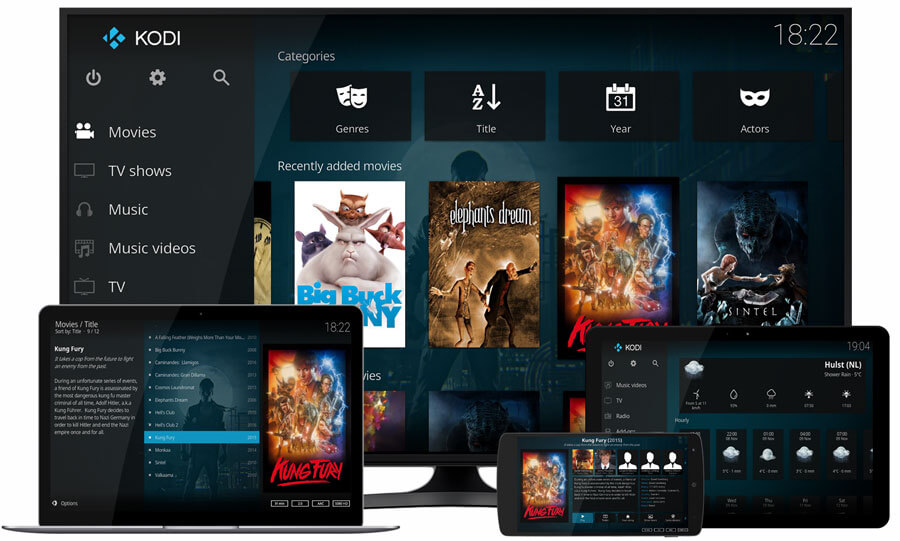

Popular Linux Media Server Software Options

Choosing the right Linux media server software can significantly impact your home entertainment experience. Different options cater to varying needs, from simple file sharing to complex transcoding and streaming. Understanding the strengths and weaknesses of each is crucial for making an informed decision.

Popular Linux Media Server Software

A variety of Linux-based media server solutions exist, each with its own set of features and capabilities. Selecting the appropriate software depends on your specific requirements, including the complexity of your media library, desired streaming options, and the technical expertise you possess.

| Software | Features | Pros | Cons |

|---|---|---|---|

| Plex | Robust media server, transcoding, streaming, extensive customization options, user-friendly interface, large community support. | Wide range of features, excellent user experience, compatibility with various devices and platforms, extensive features for transcoding and managing media, active community for support and troubleshooting. | Can be resource-intensive for older or less powerful hardware, licensing fees may apply for specific features, the learning curve for advanced features can be steep. |

| Jellyfin | Open-source, highly customizable, extensive transcoding capabilities, flexible features for managing media libraries, robust community support. | Cost-effective as open-source, highly customizable, robust transcoding capabilities for diverse media formats, excellent support from a large community, adaptable to a wide range of use cases. | Can be more complex to set up and configure compared to Plex, documentation might require more effort to understand, potentially lower level of user-friendliness for beginners. |

| Emby | Feature-rich media server, transcoding, streaming, advanced user management, and access control. | Excellent transcoding and streaming capabilities, strong user management features, intuitive interface, diverse features like adaptive streaming and custom themes. | Can be expensive for professional licenses, more resources may be required to operate efficiently, potential compatibility issues with certain hardware configurations. |

| Minidlna | Open-source, simple setup, basic features for streaming and playing media. | Lightweight and easy to install, minimal resource usage, excellent for basic media streaming needs. | Limited features compared to other options, fewer transcoding options, might not be suitable for complex setups or large media libraries. |

Installation and Configuration

Getting your Linux media server up and running involves several key steps. Proper installation and configuration are crucial for a smooth and efficient media delivery experience. This section details the process for common setups, focusing on different software options and their specific needs. From basic setup to advanced configurations, we’ll guide you through optimizing your server for peak performance.Installing and configuring media server software often involves several steps tailored to the specific software package.

This includes downloading the software, installing the necessary dependencies, and configuring settings for network access, storage, and playback protocols. Thorough understanding of these steps ensures a stable and high-performing media server.

Installing Media Server Software

Installing media server software typically involves downloading the package, unpacking it, and then running an installer script. The specific steps vary depending on the chosen distribution and package manager (apt, yum, etc.). Following the package’s instructions is essential for a successful installation. For instance, some packages might require specific dependencies to be installed first, while others may need user input for configuration options.

Configuring Network Access

Proper network configuration is vital for accessing your media server remotely. This usually involves setting up port forwarding on your router and adjusting the server’s configuration files. For example, specifying the network interface and port numbers allows clients to connect to the server over the network. Correctly configuring port forwarding on your router ensures that incoming requests reach the server.

Configuring Storage

Media server software often needs to access storage devices to serve media files. Configuring storage involves specifying the paths to the media libraries, which may include external hard drives or cloud storage. Different software packages might have different ways to manage storage. Understanding the structure of your storage and mapping it to the server is crucial for smooth file retrieval.

Configuring Playback Protocols

Different protocols support various devices and network environments. For instance, configuring protocols like HTTP or RTSP allows streaming to devices with compatible clients. This often involves adjusting settings within the server’s configuration file to specify the supported protocols and their corresponding ports. Choosing the right protocol ensures compatibility and performance for the devices accessing the media server.

Configuration Options for Optimal Performance

Several configuration options can optimize your media server’s performance. These include adjusting buffer sizes, optimizing caching, and fine-tuning playback quality. Adjusting these options might be necessary for streaming to different devices. Careful configuration helps ensure smooth playback without interruptions.

Streaming Configuration Table

This table Artikels the configurations needed for streaming to various devices.

| Device Type | Configuration | Steps |

|---|---|---|

| Smart TV | Enable HTTP, specify port, configure UPnP or DLNA | 1. Enable HTTP on the server. 2. Specify a port for HTTP. 3. Configure UPnP or DLNA for automatic discovery. |

| Mobile Device (Android) | Enable HTTP, specify port, configure UPnP or DLNA | 1. Enable HTTP on the server. 2. Specify a port for HTTP. 3. Configure UPnP or DLNA for automatic discovery. |

| Computer (with VLC or other clients) | Enable HTTP or RTSP, specify ports | 1. Enable HTTP or RTSP on the server. 2. Specify ports for the chosen protocol. |

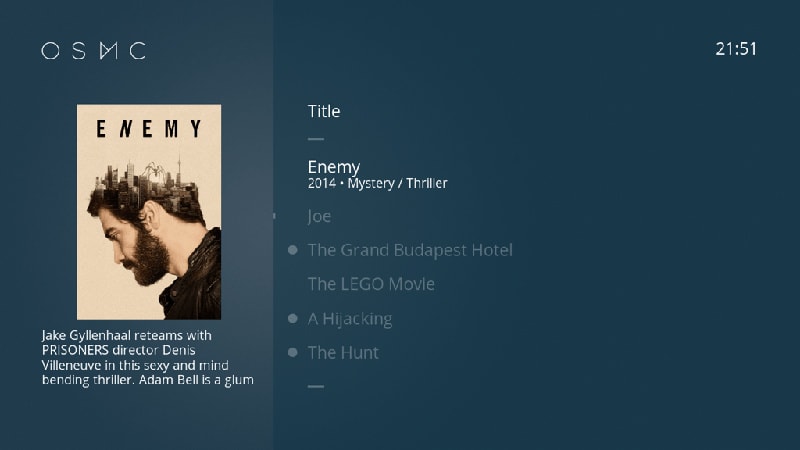

Media Management and Organization

Effective media management is crucial for a smooth user experience on a Linux media server. Well-organized content ensures quick access to desired files, avoiding frustration for users searching through a disorganized library. Robust organization also helps prevent accidental deletion or file corruption, preserving your media collection for years to come.A well-designed media server doesn’t just store files; it provides a structured way to find them.

This involves using efficient metadata tagging, a logical folder structure, and search capabilities that go beyond simple filename matching. A thoughtfully organized media library reflects the value of the content and improves the overall user experience.

Metadata Tagging

Metadata tagging is a powerful method for adding descriptive information to media files. This data is separate from the file itself but linked to it, allowing the server to understand and categorize the content. Metadata includes details like title, artist, album, genre, director, actors, and year of release. These tags enable more refined searches and improved organization.

Common metadata formats like ID3 tags for audio files and IPTC tags for images are widely supported by media server software.

Folder Structure

A well-defined folder structure mirrors the metadata tagging strategy. A logical hierarchy of folders based on genre, artist, or other criteria makes it easy to locate specific media. For example, a folder structure might organize music by artist, then album, and finally by track. Visualizing the structure with a tree diagram or a hierarchical view in the media server’s interface helps users navigate easily.

Search and Retrieval Methods

Effective search and retrieval mechanisms are vital for a user-friendly media server. Beyond simple searches, the software should offer advanced options like searching by metadata fields (e.g., artist, album, genre). Implementing fuzzy search capabilities or the ability to search within specific folders can significantly enhance user experience and streamline the process of finding specific content.

Comparison of Media Management Tools

| Tool | Description | Advantages | Disadvantages |

|---|---|---|---|

| Plex | Plex’s media server software utilizes a comprehensive approach to organization, integrating metadata tagging, smart search features, and a user-friendly interface. | Excellent metadata support, sophisticated search, and a strong user interface. | Can be resource-intensive, potentially requiring significant processing power and network bandwidth. |

| Jellyfin | Jellyfin’s server software offers a highly customizable folder structure, allowing for granular control over organization and metadata. | Highly flexible and customizable, strong metadata support. | Requires more technical expertise for setup and configuration. |

| Emby | Emby’s media server software uses a structured approach to organization, combining metadata with user-friendly folder structure for an efficient search experience. | Strong user interface, good for both users and administrators, metadata support. | Can be more complex to configure compared to other options. |

Streaming and Playback Capabilities

Streaming media is a crucial aspect of any media server, enabling seamless playback across various devices. A robust media server should support a wide range of streaming protocols and formats, ensuring compatibility with modern clients and providing a smooth user experience. This section explores the streaming capabilities of Linux media server software, examining the protocols, formats, client support, and remote control options.

Supported Streaming Protocols and Formats

Linux media servers commonly support multiple streaming protocols, each with its own advantages and disadvantages. These protocols facilitate the delivery of media content to different clients, enabling a rich multimedia experience. Commonly supported protocols include HTTP, RTSP, and potentially others such as WebRTC for real-time streaming. The server software might also handle various media formats, including MP4, MKV, AVI, and more.

This versatility ensures compatibility with a wide array of content.

Delivery to Different Clients

Media servers need to deliver content to a diverse range of clients, from simple web browsers to dedicated media players on various operating systems. Linux media servers often excel at providing this flexibility. Many allow streaming to devices like smartphones, tablets, and smart TVs, using their respective client applications. Specific clients may require unique configurations to ensure proper functionality.

Furthermore, the server might provide options for casting to other devices, including streaming to a dedicated media player.

Remote Playback Control

Remote control of playback is an essential feature. Users should be able to pause, play, rewind, fast-forward, and adjust volume from a remote location. This capability is usually achieved through a web interface or dedicated client software. This remote control often integrates with the media management system, allowing users to navigate and select media items from their library.

This integrated approach enhances user experience and efficiency.

Comparison of Streaming Protocols

| Protocol | Description | Pros | Cons |

|---|---|---|---|

| HTTP | Hypertext Transfer Protocol, commonly used for web browsing. | Widely supported by clients, simple implementation, suitable for static content. | Generally not real-time, less efficient for large files, not ideal for live streaming. |

| RTSP (Real Time Streaming Protocol) | Designed for streaming media content in real-time. | Real-time streaming, support for various codecs, often used for live streams. | More complex to implement, potential for higher bandwidth usage, client-side configuration might be needed. |

| WebRTC | Web Real-Time Communication, enables real-time communication over a web browser. | Direct peer-to-peer connection, low latency, often used for video conferencing. | Requires support on both client and server sides, complexity may be a factor for general use. |

This table provides a concise comparison of common streaming protocols. The choice of protocol depends on the specific needs of the streaming application, balancing factors such as bandwidth, latency, and complexity.

Performance Considerations

Optimizing your Linux media server for smooth playback and minimal buffering is crucial for a satisfying user experience. Performance hinges on a delicate balance of server hardware, software configuration, and network infrastructure. This section delves into the key factors affecting performance and how to fine-tune your setup for optimal media delivery.Server performance is influenced by factors like CPU power, RAM capacity, and hard drive speed.

A well-configured server with appropriate hardware resources can handle streaming demands effectively, while inadequate resources can lead to frustrating playback issues.

Factors Influencing Server Performance

Several factors significantly impact the performance of your media server. CPU speed and processing power directly affect the server’s ability to transcode and stream media in real-time. RAM availability dictates how many media files the server can keep in memory for faster access, and the speed and capacity of the hard drives storing the media library are essential for efficient file retrieval.

Network bandwidth plays a crucial role, as higher bandwidth allows for faster streaming speeds.

Optimizing Server Resources

Proper configuration of server resources is vital for optimal media delivery. Allocating sufficient CPU resources to transcoding tasks and ensuring ample RAM to handle simultaneous streams will prevent performance bottlenecks. Utilizing a fast, solid-state drive (SSD) for the operating system and frequently accessed media files can significantly improve response times. Employing efficient caching mechanisms can further enhance performance by storing frequently accessed media files in memory for rapid retrieval.

Troubleshooting Common Performance Issues

Identifying and resolving performance issues is essential for maintaining a high-quality streaming experience. If playback is jerky or frequently buffers, consider checking for bottlenecks in the CPU usage, RAM consumption, and network bandwidth. Examine the server’s resource utilization using monitoring tools. If CPU usage is consistently high, consider optimizing media files for efficient encoding. If RAM usage is reaching capacity, consider adjusting streaming settings to reduce concurrent playback or add more RAM.

Check network connection stability, as intermittent connectivity problems can lead to playback issues.

Hardware Recommendations for Optimal Performance

The following table provides general hardware recommendations for achieving optimal performance. These recommendations are not absolute and may vary based on individual needs and media file characteristics.

| Component | Recommendation | Reason |

|---|---|---|

| CPU | Quad-core or higher processor with high clock speed | Handles transcoding and streaming tasks more efficiently |

| RAM | 16GB or more | Supports more simultaneous streams and media files in memory |

| Storage | SSD for operating system and frequently accessed media; HDD for large media libraries | Provides faster access to data, improving streaming speeds |

| Network Interface Card (NIC) | Gigabit Ethernet or faster | Ensures sufficient bandwidth for high-quality streaming |

Security and Privacy

Protecting your media and your server is paramount when running a Linux media server. Robust security measures are crucial to prevent unauthorized access, data breaches, and potential misuse of your content. This section dives into the security features offered by various Linux media server software and how to safeguard your setup.

Security Measures in Media Server Software

Various security measures are employed to protect Linux media servers. These include robust authentication protocols, encryption for data transmission, and granular access controls. Implementing these measures can significantly reduce the risk of unauthorized access and ensure the privacy of your media library.

Protecting the Server and Media Content

Protecting your server and media content involves a multi-faceted approach. Firstly, secure the server itself by employing strong passwords, using firewalls, and keeping the operating system and software up-to-date. Secondly, encrypt the media files to add an extra layer of protection against unauthorized access. Thirdly, implement robust access control mechanisms to limit access to specific users and groups.

Choosing the best Linux media server software can be tricky, but Plex is a strong contender. While the NHL trade deadline drama surrounding the San Jose Sharks, Dallas Stars, and players like Cody Ceci and Mikael Granlund is definitely grabbing headlines, this recent news doesn’t overshadow the need for solid media server software. Ultimately, the best choice depends on your specific needs and technical comfort level.

Access Control Methods

Access control methods are essential for restricting access to your media server. This allows you to fine-tune who can access what content. Common methods include user accounts, group memberships, and IP address restrictions. These features allow administrators to limit access to specific users, folders, and media files, ensuring that only authorized individuals can view or download content.

Comparing Security Features, Best linux media server software

The following table provides a comparative overview of security features offered by various Linux media server software options. Note that specific configurations and settings may affect the actual implementation of these features.

| Feature | Software 1 | Software 2 | Software 3 |

|---|---|---|---|

| User Authentication (local/remote) | Yes (multiple methods) | Yes (basic authentication) | Yes (supports various protocols) |

| File Permissions (granular) | Yes (extensive control) | Yes (standard Linux permissions) | Yes (customizable permissions) |

| IP Address Restrictions | Yes (flexible options) | Yes (basic restrictions) | Yes (advanced filtering options) |

| Encryption (data transmission) | Yes (TLS/SSL) | Yes (optional, may require external setup) | Yes (integrated encryption protocols) |

| Auditing/Logging | Yes (detailed logs) | Yes (basic access logs) | Yes (extensive auditing capabilities) |

Advanced Features (Optional)

Beyond basic media streaming, many Linux media server solutions offer powerful advanced features like transcoding, live streaming, and media transcoding. These capabilities allow for greater flexibility, accommodating diverse playback needs and devices. This section delves into these advanced options, exploring their benefits and potential drawbacks.

Transcoding

Transcoding allows a media server to convert a video or audio file into a different format, resolution, or codec. This is crucial for ensuring compatibility across various devices and playback software. For instance, a 1080p video might need to be transcoded to 720p for a device with limited bandwidth. This feature ensures that the content is playable on a wider range of devices, eliminating compatibility issues.

- Improved Compatibility: Transcoding bridges the gap between different hardware and software. A server can automatically adjust video and audio to suit the capabilities of the device receiving the stream, enhancing user experience.

- Content Optimization: Transcoding can optimize content for specific network conditions. For example, a video can be transcoded to a lower bitrate for a slow internet connection without significant quality loss.

- Device Independence: Transcoding enables media playback on a wider range of devices, including older devices or those with limited hardware capabilities. This ensures that users with various devices can access and enjoy the content.

Live Streaming

Live streaming capabilities enable real-time broadcasting of media content. This functionality is essential for live performances, conferences, or events. The media server acts as a central hub, capturing and transmitting the live stream to multiple viewers simultaneously. This is particularly useful for video conferencing or broadcasting of events to a wider audience.

- Real-time Broadcasting: Live streaming allows for immediate sharing of content, such as conferences, concerts, or news updates. This creates a dynamic and engaging experience.

- Scalability: A robust live streaming server can handle multiple concurrent viewers and maintain consistent quality. This is critical for large-scale events.

- Remote Access: Live streaming allows viewers to access the content from various locations, enabling global participation in events.

Media Transcoding

Media transcoding is a more specialized feature. It involves converting media files to different formats, such as changing a video from MP4 to AVI or altering the audio codec. This is often required for specific software or platforms, such as archival or migration to new systems.

- Archival Flexibility: Transcoding enables converting media to formats suitable for long-term storage or preservation. This ensures the content remains accessible despite evolving technology.

- Platform Compatibility: Converting media formats ensures that the content is compatible with various platforms or software, maintaining accessibility across different systems.

- Enhanced Usage: Transcoding allows converting media to specialized formats for particular applications or workflows. This could be necessary for archiving or specific software requirements.

Advanced Feature Comparison

| Feature | Pros | Cons |

|---|---|---|

| Transcoding | Improved compatibility, content optimization, device independence | Potential for quality loss, processing overhead, additional software/hardware requirements |

| Live Streaming | Real-time broadcasting, scalability, remote access | Requires dedicated hardware, high bandwidth, and complex configurations, potential for latency issues |

| Media Transcoding | Archival flexibility, platform compatibility, enhanced usage | Complexity in format conversions, potential for data loss, often requires specialized software |

Summary: Best Linux Media Server Software

In conclusion, selecting the best Linux media server software hinges on understanding your specific needs and priorities. Whether you prioritize ease of use, extensive features, or powerful performance, this exploration has equipped you with the knowledge to make an informed decision. Remember to carefully weigh the pros and cons of each option, considering factors like compatibility, stability, and scalability to ensure your media server remains a reliable and enjoyable hub for your multimedia experience.