What to watch nosferatu is creepy in the best way possible – What to watch? Nosferatu is creepy in the best way possible. This classic horror film, a silent masterpiece, continues to captivate audiences with its unsettling atmosphere and unique approach to the vampire genre. From its eerie visuals to its haunting narrative, Nosferatu’s lasting impact on horror cinema is undeniable. This exploration delves into the specific elements that make this film so effectively creepy.

The film’s visual language, often employing shadows and unsettling close-ups, creates a palpable sense of dread. The narrative, though simple, masterfully builds suspense, leaving viewers on the edge of their seats. The film’s innovative approach to horror, for its time, influenced later filmmakers and remains relevant today.

Nosferatu’s Distinctive Horror

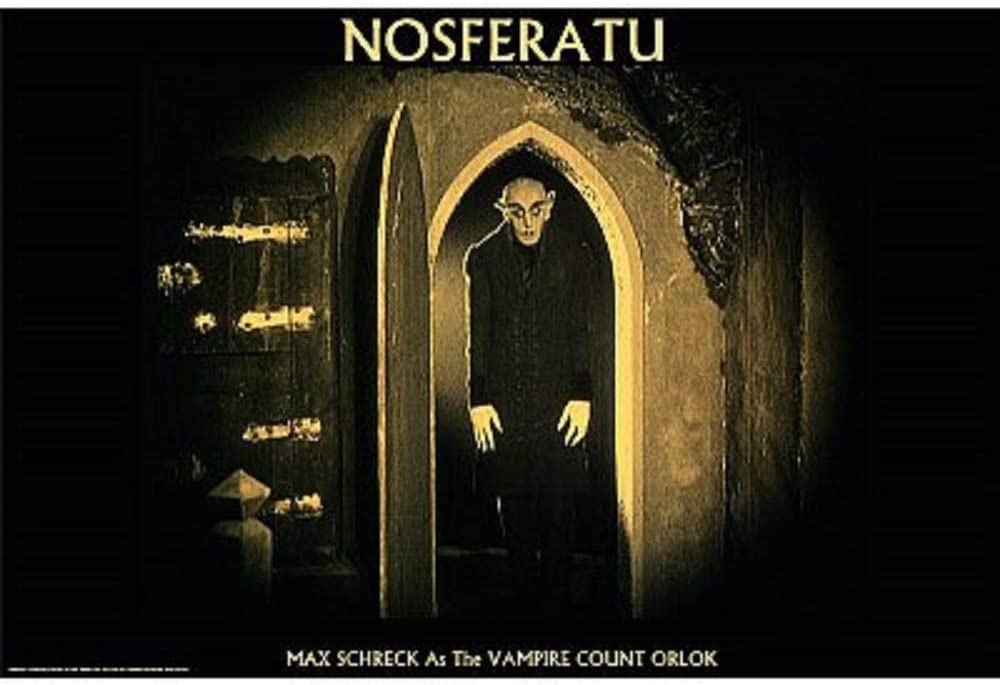

Nosferatu, a 1922 German expressionist film, stands as a cornerstone of horror cinema, not just for its chilling portrayal of Count Orlok, but for its innovative use of visual storytelling and thematic exploration. The film’s unsettling atmosphere, achieved through a unique blend of symbolism, visual language, and narrative pacing, continues to resonate with audiences today. It transcends its historical context, offering a timeless exploration of fear and the unknown.Nosferatu’s horror lies not just in the explicit violence, but in the insidious dread it creates through subtle and pervasive means.

It taps into primal fears of the unseen and the unknown, using visual metaphors and symbolism to convey the creeping dread of the vampire’s approach. The film’s influence on subsequent horror films is undeniable, demonstrating a profound understanding of how to evoke terror through atmosphere and imagery rather than graphic displays.

Unique Characteristics of Nosferatu’s Horror

Nosferatu’s horror transcends the typical conventions of its time. It leverages visual storytelling to build a sense of unease and impending doom, often employing long takes and unsettling camera angles to heighten the suspense. The film’s unsettling visuals and sound design are integral to the horror experience. The contrast between the idyllic countryside and the growing threat of the vampire, played out through close-ups and long shots, creates a palpable sense of foreboding.

Specific Scenes Exemplifying the Unsettling Atmosphere

Several scenes in Nosferatu masterfully build and maintain the film’s unsettling atmosphere. The opening sequence, with its eerie fog and the unsettling arrival of the ship carrying the Count, immediately establishes a tone of foreboding. The scene where the Count first appears in the village, his grotesque form illuminated by flickering candlelight, is particularly impactful. The slow, deliberate pace of the vampire’s movements and the lingering close-ups of his features amplify the sense of menace.

The unsettling transformation of the villagers’ reactions from initial curiosity to outright fear is conveyed through subtle yet powerful shifts in their expressions and body language.

Elements Contributing to Nosferatu’s Enduring Creepiness

The film’s enduring creepiness stems from its meticulous use of symbolism. The darkness, the fog, and the oppressive atmosphere all contribute to a sense of confinement and dread. The visual imagery, frequently utilizing shadows, distorted perspectives, and stark contrasts, enhances the feeling of unease. The film’s innovative use of visual language, employing long takes, close-ups, and unsettling camera angles, creates a palpable sense of foreboding and suspense.

The film also draws on anxieties about disease and the unknown, anxieties that remain relevant today.

Visual Language and Evoked Dread

Nosferatu’s visual language is a crucial element in its horror effect. The film utilizes long takes, close-ups, and stark contrasts to build tension and create a pervasive sense of unease. The use of shadows and distorted perspectives amplifies the feeling of dread, contributing to a sense of the supernatural encroaching upon the mundane. The film’s camera movements, often slow and deliberate, mirror the creeping, insidious nature of the vampire’s approach.

The use of fog and shadows creates a sense of mystery and the unknown.

Comparison to Other Early Horror Films

| Feature | Nosferatu | Other Early Horror Films |

|---|---|---|

| Visual Style | Expressionistic, utilizing shadows, distorted perspectives, and stark contrasts | Often more straightforward, relying on gore and supernatural elements. |

| Atmosphere | Subtle, pervasive dread through visual language and symbolism | Sometimes relying on loud noises or rapid cuts. |

| Narrative Approach | Slow-paced, building tension gradually | Often featuring more immediate scares and plot twists. |

| Themes | Exploration of fear of the unknown, disease, and the encroachment of the supernatural | Sometimes more focused on individual fears, such as monsters or ghosts. |

Difference from Contemporary Horror

Nosferatu’s horror is profoundly different from contemporary horror films. While contemporary horror often relies on jump scares, gore, and special effects, Nosferatu’s horror is rooted in atmosphere and symbolism. It taps into primal fears of the unknown and the supernatural through subtle and pervasive means, creating a more insidious and lasting sense of dread. It uses visual metaphors to convey the threat, rather than relying on explicit violence.

Contemporary horror often prioritizes spectacle, while Nosferatu emphasizes the subtle yet profound impact of atmosphere.

Nosferatu is seriously creepy, in a fantastic way. It’s definitely worth a watch. Speaking of things that are a bit spooky, did you hear about the sale of a three-bedroom home in San Jose for a cool 1.5 million? sale closed in san jose 1 5 million for a three bedroom home 5 Crazy, right?

But back to the movie – Nosferatu is a must-see for anyone who appreciates a good scare. It’s definitely one of the classics for a reason.

Analyzing the Creepiness

Nosferatu, a silent film masterpiece, transcends its era to become a chilling testament to the power of atmosphere and psychological dread. While the visual style is undeniably significant, it’s the interplay of narrative techniques, sound design, and symbolism that truly builds a pervasive sense of unease, leaving a lasting impact on the viewer. The film’s enduring creepiness stems from its meticulous construction of a world where the unknown lurks just beyond the veil of the familiar.The film’s effectiveness in generating unease lies in its subtle yet pervasive techniques.

Instead of relying on overt violence, Nosferatu crafts a creeping sense of dread through meticulous pacing, evocative imagery, and unsettling soundscapes. This approach allows the film’s terror to fester within the viewer, creating a more potent and lasting impact.

Visual and Narrative Techniques

Nosferatu employs a variety of visual and narrative techniques to cultivate suspense. Long takes and close-ups, often focusing on unsettling details, heighten the sense of claustrophobia and impending doom. The film’s use of shadows and silhouetted figures contributes significantly to the sense of mystery and foreboding. The narrative’s slow build-up, punctuated by moments of escalating tension, further amplifies the anticipation of the approaching horror.

This is further enhanced by the film’s frequent use of subjective camera angles, allowing the audience to experience the characters’ mounting anxieties and fears.

Psychological Aspects of Horror

The psychological horror in Nosferatu is deeply rooted in the fear of the unknown and the anxieties surrounding the intrusion of the monstrous into the ordinary. The film portrays a society consumed by a pervasive fear, as evidenced by the reactions of the villagers to the vampire’s presence. This fear is further amplified by the vampire’s ability to corrupt and consume not only bodies but also the very fabric of society, representing the destructive potential of the unknown.

The film masterfully portrays the anxieties of isolation and vulnerability, making the viewer question their own safety and the fragility of the world around them.

Sound and Music

Sound design in Nosferatu plays a crucial role in establishing the film’s eerie atmosphere. The film’s use of unsettling sounds, such as the creaking of doors, rustling of leaves, and ominous whispers, creates an atmosphere of foreboding. The absence of music, in many scenes, further emphasizes the palpable sense of dread, allowing the unsettling sounds to resonate more profoundly.

The occasional use of specific, dissonant musical cues, particularly during pivotal moments, serves to reinforce the narrative’s unsettling tone. These sound design elements, employed with a keen sense of precision, deepen the impact of the visual narrative.

Symbolism and Imagery

| Symbol/Imagery | Interpretation | Example |

|---|---|---|

| Bats | Associated with darkness, evil, and the supernatural. | Frequent appearance of bats, often near or associated with Nosferatu. |

| Darkness | Represents the unknown, fear, and the lurking presence of the vampire. | The use of shadows and darkness throughout the film to create a sense of mystery and dread. |

| Decaying/Unnatural Growth | Signifies corruption and the vampire’s destructive influence. | Visual representation of the vampire’s impact on the surrounding environment. |

| Isolation/Desolation | Represents the helplessness of the characters and the encroaching darkness. | The deserted villages and isolated locations create a sense of isolation and helplessness. |

Memorable Creepy Moments

- The initial appearance of the Count: The shadowy figure, the unsettling introduction, and the anticipation of the impending threat create a potent first impression of dread.

- The arrival of the coffin: The suspenseful delivery of the coffin and the anticipation of the vampire’s emergence. The anticipation is almost palpable.

- The scene in the laboratory: The unsettling details of the laboratory and the preparations for the vampire’s arrival create a sense of unease. The scene further emphasizes the growing fear.

- The transformation of the villagers: The transformation of the villagers into victims of the vampire’s influence showcases the destructive power of the supernatural.

The Film’s Lasting Impact

Nosferatu, a silent film from 1922, isn’t just a piece of cinematic history; it’s a foundational text for the horror genre. Its innovative approach to storytelling, its visual techniques, and its portrayal of the vampire mythos laid the groundwork for countless films that followed. The film’s lasting influence is undeniable, shaping the way we perceive and experience horror to this day.Nosferatu’s impact isn’t limited to a specific generation of horror fans.

Its themes and techniques resonate across decades and continue to inspire filmmakers and viewers alike. The film’s unique blend of psychological dread and palpable atmosphere created a blueprint for future horror narratives, profoundly impacting the evolution of the vampire genre and horror cinema in general. This impact is not only theoretical; it’s clearly evident in modern productions.

Influence on the Vampire Genre

Nosferatu’s depiction of the vampire transcends the typical monster tropes of the time. It emphasized a sense of creeping dread and insidious danger rather than simply relying on monstrous physicality. The film’s portrayal of Count Orlok as a physically imposing but ultimately vulnerable figure, contrasted with his subtle and terrifying methods of attack, revolutionized the way vampires were presented on screen.

This approach laid the groundwork for future vampire portrayals, shifting from the brute force of earlier conceptions to a more insidious and psychologically unsettling threat.

Nosferatu’s Visual Techniques

The film’s use of visual storytelling and atmospheric effects was revolutionary for its time. Nosferatu employed shadows, close-ups, and striking imagery to create a sense of dread and foreboding. These techniques were not only innovative but also profoundly influential on subsequent horror films. The use of claustrophobic settings, eerie lighting, and unsettling imagery to build tension and suspense became a hallmark of horror cinema.

Contemporary Influences

Nosferatu’s legacy continues to inspire contemporary filmmakers. The film’s exploration of themes like isolation, paranoia, and the unknown continues to resonate with modern audiences. Modern horror films frequently draw upon the same techniques and visual strategies established by Nosferatu. For instance, the use of oppressive atmosphere and unsettling imagery to create a sense of unease, as seen in the recent “The Lighthouse,” is reminiscent of Nosferatu’s approach.

Impact on Horror Cinema

| Aspect | Nosferatu’s Contribution |

|---|---|

| Visual Storytelling | Pioneered the use of shadows, close-ups, and atmospheric effects to build tension and suspense. |

| Vampire Mythology | Developed a more nuanced and psychologically unsettling portrayal of the vampire, shifting from a monster to a symbol of insidious danger. |

| Horror Atmosphere | Established a new standard for creating a palpable sense of dread and foreboding through the use of visual techniques. |

| Genre Innovation | Shaped the development of the vampire genre and horror cinema by influencing the techniques and themes that followed. |

Lasting Impression

Nosferatu’s lasting impact is evident in the profound impression it leaves on viewers. The film’s enduring power stems from its ability to evoke a sense of primal fear and existential dread. The film’s atmospheric intensity and the palpable sense of danger create a haunting experience that stays with viewers long after the credits roll. The film’s legacy isn’t just about the vampire; it’s about the enduring power of fear, dread, and the unknown in storytelling.

It’s a chilling reminder that the true power of horror lies not only in gore, but also in atmosphere and subtle fear.

Nosferatu’s Visual and Narrative Techniques

Nosferatu, a silent film from 1922, transcends its era to instill a pervasive sense of dread. This chilling effect isn’t solely reliant on the narrative; it’s deeply interwoven with the film’s visual language, its masterful use of cinematography, and a narrative structure that meticulously builds suspense. The film’s aesthetic choices, both subtle and striking, amplify the inherent creepiness of the vampire story, leaving a lasting impression on viewers.The visual and narrative techniques employed in Nosferatu contribute significantly to its enduring creepiness.

By skillfully manipulating light, shadow, and setting, F.W. Murnau and his team created a visual tapestry that permeated the very fabric of the film’s atmosphere, effectively amplifying the vampire’s menace. The film’s unique blend of visual and narrative elements effectively conveyed the sinister nature of the vampire, making the experience far more visceral than simply watching a story unfold.

Nosferatu’s Cinematographic Techniques

Nosferatu’s cinematography, a critical element in creating its unsettling atmosphere, is notable for its use of long takes and establishing shots that immerse the viewer in the oppressive world of the film. These techniques create a sense of claustrophobia and unease. Close-ups of the Count’s gaunt face, the grotesque transformations of the victims, and the terrifyingly slow movements of the creature’s ship all contribute to a sense of impending doom.

For a truly unsettling cinematic experience, check out Nosferatu. It’s creepy in a way that’s genuinely captivating, and perfect for a spooky night in. While you’re pondering the unsettling imagery, you might also be curious about Dansby Swanson’s wife’s ethnicity. Learning more about Dansby Swanson’s wife’s ethnicity is a fascinating side note, but Nosferatu’s masterful atmosphere will keep you hooked.

Ultimately, it’s a film that you absolutely have to see if you’re a fan of genuinely disturbing cinema.

Editing and Pace

The film’s editing, while not employing the rapid cuts of modern horror, is still quite effective in building tension. The pacing of the film is crucial; slow, deliberate scenes heighten the sense of dread, while quick cuts, especially during moments of attack, contribute to the visceral nature of the fear. The editing style creates a feeling of anticipation and unease, keeping the audience on edge.

Nosferatu is seriously creepy, in a fantastically unsettling way. It’s the kind of film that makes you jump at shadows. Speaking of unsettling, I’ve been seeing a lot of buzz about the situation with Eric Thomas’s husband and the whole “won’t move out” thing, which you can read more about here. It’s a bit of a strange story, but it definitely makes you think about the complexities of relationships.

Either way, if you’re looking for a chilling, classic watch, Nosferatu is a must-see.

Long, lingering shots of the castle, the desolate countryside, and the decaying interiors create an atmosphere of foreboding.

Lighting and Shadow

The use of lighting and shadow in Nosferatu is masterful. Dim lighting and the strategic use of shadows amplify the sense of mystery and fear. The shadows often obscure details, further fueling the suspense and uncertainty, while the occasional harsh light on the Count’s face or a victim’s panicked expression enhances the horror. The interplay of light and shadow creates an eerie and unsettling atmosphere, highlighting the menace of the vampire.

Examples include the long shadows stretching across the grounds of the castle, or the darkness engulfing the streets of the town as the vampire approaches.

Narrative Structure

Nosferatu’s narrative structure plays a crucial role in establishing the creepy atmosphere. The slow, deliberate unfolding of the events, building tension with each step of the vampire’s arrival and the escalating panic of the townspeople, allows the film to fully immerse the viewer in the growing dread. The gradual introduction of the vampire, building suspense, and the portrayal of his devastating impact create an atmosphere of helplessness and fear.

The sense of impending doom is palpable, creating an experience that lingers long after the credits roll.

Setting and Atmosphere

The setting of Nosferatu is profoundly important in establishing the film’s creepy atmosphere. The decaying castle, the desolate countryside, and the fog-laden towns all contribute to a sense of isolation and foreboding. These locations serve as metaphors for the encroaching darkness and the pervasive threat that the vampire embodies. The visual imagery of these settings mirrors the psychological and emotional tension of the film, creating an unforgettable experience for the viewer.

The bleak, desolate landscape reflects the despair and hopelessness that permeate the narrative, making the horror feel even more real and inescapable.

Exploring the “Best Way Possible”: What To Watch Nosferatu Is Creepy In The Best Way Possible

Nosferatu’s chilling impact transcends the typical tropes of horror films. It achieves a profound sense of dread, not through jump scares or gore, but through a meticulous crafting of atmosphere and a masterful use of suggestion. The film’s strength lies in its ability to evoke a visceral sense of unease, a constant feeling of impending doom that lingers long after the credits roll.

This unique approach to horror is precisely what makes it “creepy in the best way possible.”The film’s success hinges on its calculated avoidance of explicit violence. Instead, Nosferatu relies on subtle cues, unsettling imagery, and a pervasive sense of dread to create a powerful and lasting impression on the viewer. This approach is far more effective than relying on gratuitous shocks, as it taps into deeper psychological anxieties and allows the viewer to actively participate in the creation of the film’s atmosphere.

Specific Elements of Creepy Effectiveness

Nosferatu’s creeping dread is meticulously crafted. The film excels by employing a variety of techniques, from the unsettling visual language to the subtle, yet pervasive, narrative structure. The film’s success stems from its capacity to build suspense gradually, keeping the viewer on the edge of their seat, anticipating the next unsettling moment.

Narrative and Visual Techniques

The film’s narrative structure is crucial in establishing its creepy atmosphere. The slow, deliberate pace, coupled with the enigmatic nature of the narrative, allows the viewer to become immersed in the world of Nosferatu. The story’s unfolding mystery is intertwined with the visual language of the film.

- Visual Storytelling: Nosferatu’s visual language is deliberately unsettling. The film masterfully uses shadows, close-ups, and stark imagery to create a claustrophobic and oppressive environment. This visual style is used to foreshadow impending danger and build a sense of foreboding that is both palpable and unforgettable.

- Atmosphere and Setting: The film’s setting plays a significant role in its effectiveness. The decaying, gothic architecture, the oppressive darkness, and the isolated landscapes all contribute to the film’s unsettling atmosphere. The film effectively uses its settings to enhance the feeling of isolation and impending doom.

- Sound Design: The use of sound, particularly the eerie music and unsettling sound effects, contributes significantly to the film’s overall creepiness. These elements, often used sparingly, build a sense of foreboding and create a constant sense of unease.

Comparison with Other Horror Films

Compared to contemporary horror films that rely heavily on jump scares and graphic violence, Nosferatu’s approach is refreshingly different. It demonstrates that horror can be achieved through subtle suggestion, meticulous atmosphere building, and a profound understanding of human anxieties. Films like “The Exorcist,” while employing different techniques, also explore psychological terror, but Nosferatu achieves a unique blend of atmosphere and suspense.

Why Nosferatu’s Horror is Effective

Nosferatu’s effectiveness lies in its ability to evoke a deep sense of dread and unease without relying on cheap thrills. The film creates a pervasive sense of fear by using visual cues and atmosphere, tapping into the primal anxieties of isolation and the unknown. This builds a lasting impression that is truly unsettling.

Examples of Achieving Balance, What to watch nosferatu is creepy in the best way possible

The film demonstrates this balance in numerous scenes. The unsettling close-ups of Nosferatu’s face, the ominous presence of the creature in the darkness, and the slow, deliberate approach of the vampire are all crucial examples. The film’s visual techniques and careful pacing amplify the sense of dread.

Table of Techniques

| Technique | Description | Example |

|---|---|---|

| Visual Language | Use of shadows, close-ups, and stark imagery | Close-ups of Nosferatu’s face, shots of the decaying castle |

| Narrative Pace | Slow, deliberate pace, building suspense | Slow reveal of Nosferatu’s intentions, the long, drawn-out journey |

| Setting and Atmosphere | Decaying architecture, darkness, and isolation | The decaying castle, the isolation of the village, the oppressive darkness |

| Sound Design | Eerie music and unsettling sound effects | The eerie score, the creaking sounds, the silence |

Final Conclusion

In conclusion, Nosferatu’s enduring creepiness stems from a masterful combination of visual and narrative techniques. Its unique approach to horror, using shadows, suspenseful pacing, and unsettling imagery, sets it apart from other early horror films. The film’s impact on the vampire genre and horror cinema as a whole is significant. Nosferatu’s legacy lives on, making it a must-watch for any horror enthusiast.

This analysis has only scratched the surface of what makes Nosferatu such a captivating and chilling experience.