Trudeau Canada US tariffs have sparked a complex and multifaceted debate, impacting trade relations and various sectors. This exploration delves into the historical context of trade disputes, Trudeau’s administration’s approach, and the multifaceted effects on specific industries. From the automotive sector to agricultural products, the narrative unravels the intricate web of economic repercussions and international diplomacy.

The analysis examines the historical trajectory of US-Canada tariff disputes, highlighting key agreements and their outcomes. It also scrutinizes Trudeau’s specific policies and actions in response to US tariff measures, assessing their impact on Canadian businesses and consumers. Furthermore, this discussion explores the broader international context, considering the roles of global trade organizations and the approaches of other nations.

Historical Context of US-Canada Tariffs

The US-Canada trade relationship, while often lauded as a model of free trade, has been punctuated by periods of tension and tariff disputes throughout history. Understanding this historical context is crucial to comprehending the current trade dynamics and the potential implications of future policy changes. These disputes have often stemmed from differing views on trade practices, industrial protection, and national interests.The complex tapestry of tariffs and trade agreements between the two countries reflects a dynamic interplay of economic interests and geopolitical considerations.

From early disagreements over resource extraction to modern anxieties about national security, the narrative of US-Canada trade is one of both cooperation and contention.

Chronological Overview of Trade Disputes

The history of US-Canada tariff disputes is marked by alternating periods of cooperation and conflict. Early disputes revolved around resource extraction and manufacturing, with both countries seeking to protect their domestic industries. The evolution of trade agreements and subsequent renegotiations highlight the constant tension between national interests and the benefits of free trade.

- Early 20th Century: The imposition of tariffs on various goods reflected a protectionist stance in both countries, driven by a desire to support domestic industries. Tariffs on agricultural products and manufactured goods were common, leading to retaliatory measures and trade friction.

- Post-World War II: The establishment of the General Agreement on Tariffs and Trade (GATT) and subsequent agreements significantly reduced tariffs between the US and Canada. This period saw increased trade liberalization and a move towards freer trade, albeit with occasional exceptions for specific industries.

- 1980s-1990s: Disagreements over automotive trade, notably the “Canada-US Free Trade Agreement” (CUSFTA), brought renewed tariff discussions. The agreement, finalized in 1989, aimed to eliminate tariffs on a wide range of goods, significantly altering the trade landscape.

- 2000s-Present: The North American Free Trade Agreement (NAFTA) and its successor, the United States-Mexico-Canada Agreement (USMCA), further streamlined trade between the three nations. While these agreements have fostered significant trade growth, periodic disputes regarding tariffs and trade practices continue.

Major Events and Agreements

Key trade agreements have profoundly shaped the US-Canada tariff landscape. Understanding these events provides context for contemporary debates.

- Canada-US Free Trade Agreement (CUSFTA, 1989): This agreement significantly reduced tariffs between the two countries, promoting increased trade volumes and economic integration. Specific provisions addressed automotive trade, creating a more unified market. It marked a turning point in the trade relationship.

- North American Free Trade Agreement (NAFTA, 1994): NAFTA expanded the trade agreement to include Mexico. It aimed to eliminate tariffs and other trade barriers among the three countries, leading to significant economic growth and interdependence. However, it also faced criticism for its impact on specific industries, such as agriculture.

- United States-Mexico-Canada Agreement (USMCA, 2020): USMCA superseded NAFTA, retaining many of its provisions while incorporating some changes related to labor and environmental standards. The agreement aimed to maintain and strengthen the existing trade relationship, but continued debate over tariffs on specific goods persists.

Impact on Specific Industries

Tariffs have had a demonstrable impact on various sectors.

- Automotive: The automotive industry has been a frequent point of contention in US-Canada trade disputes. Tariffs have influenced production locations, supply chains, and the overall competitiveness of the sector. The impact of tariffs on car prices and consumer choices is significant.

- Agricultural Products: Agricultural products have often been subject to trade disputes. Different agricultural practices and policies in the two countries can lead to tariffs and trade barriers. The impact on farmers and consumers is considerable, depending on the specific agricultural product.

Key Trade Agreements and Impact on Tariffs

| Agreement | Impact on Tariffs |

|---|---|

| CUSFTA | Reduced tariffs significantly, leading to increased trade. |

| NAFTA | Further reduced tariffs and barriers, promoting trilateral trade. |

| USMCA | Maintained and updated provisions of NAFTA, with potential for adjustments in specific sectors. |

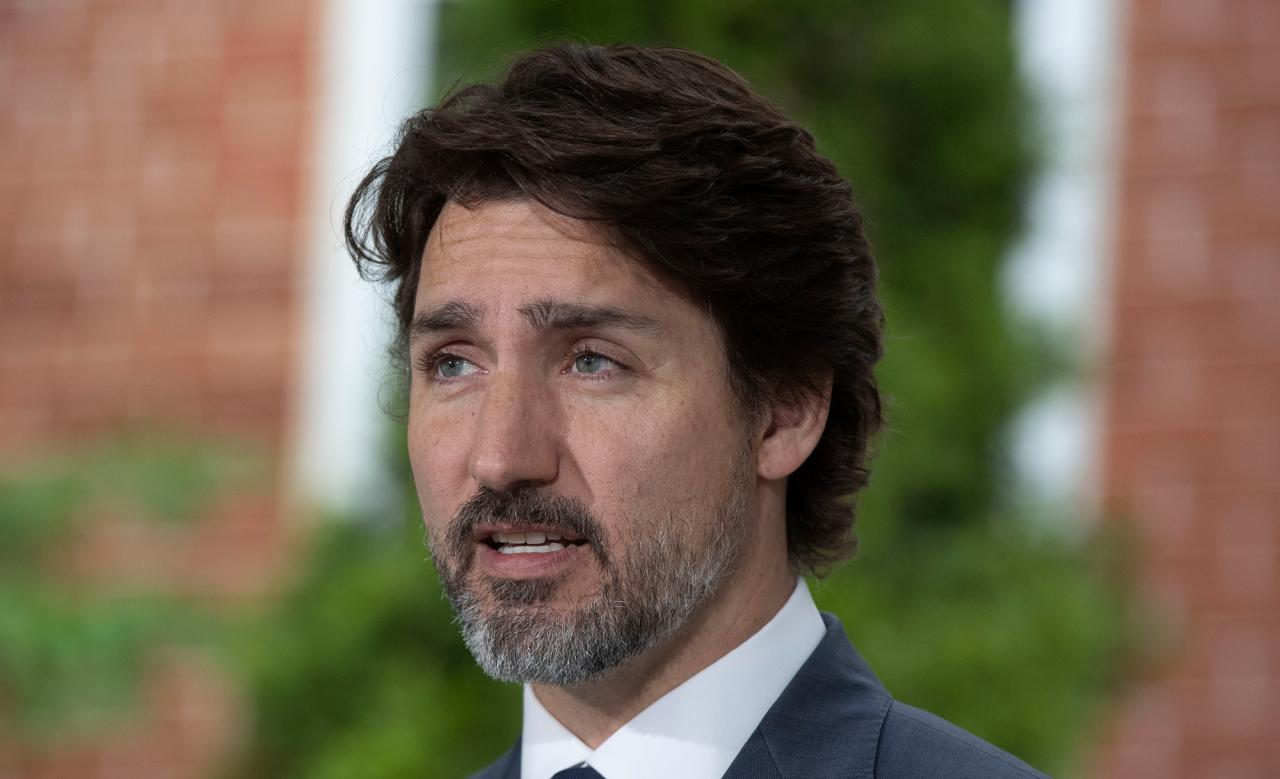

Trudeau’s Approach to US-Canada Trade

The Trudeau government’s approach to trade with the United States, particularly regarding tariffs, has been a complex dance between maintaining strong economic ties and defending Canadian interests. Navigating the often-turbulent waters of international trade requires careful consideration of various factors, including economic realities, political dynamics, and public opinion. Trudeau’s administration has consistently sought to balance these competing pressures.Trudeau’s stance on trade policy with the US emphasizes the importance of a mutually beneficial relationship.

He has recognized the economic interdependence between the two countries and has worked to mitigate potential negative impacts of tariffs on Canadian businesses and consumers. This approach has been pursued through a combination of diplomatic engagement, legal challenges, and diversification of trade partners.

Trudeau’s Stance on US Tariffs

The Trudeau government has consistently expressed concerns about US tariffs, arguing that they can disrupt established trade patterns and harm Canadian businesses. A key aspect of this stance has been the assertion that tariffs are not an effective or desirable approach to resolving trade disputes. Instead, the government has prioritized dialogue and negotiation as primary tools for resolving trade-related issues.

Key Policies and Initiatives

The Trudeau administration has introduced several policies aimed at managing the impact of US tariffs on Canadian businesses. These initiatives have ranged from supporting industries facing challenges due to tariffs to exploring alternative trade partnerships with other nations. Canada has also pursued legal avenues to challenge tariffs deemed unfair or protectionist.

Specific Actions in Response to US Tariff Actions

In response to specific US tariff actions, the Trudeau administration has undertaken various measures. These include:

- Initiating consultations and negotiations with the US government to address concerns and seek solutions.

- Seeking alternative markets for Canadian exports to reduce reliance on the US market.

- Utilizing legal mechanisms to challenge tariffs deemed unjustified, like initiating World Trade Organization (WTO) dispute resolution proceedings.

These actions reflect the government’s commitment to protecting Canadian interests while maintaining a strong trade relationship with the United States.

Assessment of Outcomes

The effectiveness of these policies and actions has varied. Some have resulted in positive outcomes, while others have encountered challenges. A comprehensive evaluation requires a nuanced understanding of the specific circumstances surrounding each instance.

| Trudeau Administration Action | Reported Outcome |

|---|---|

| Initiating consultations with US government | Mixed results, some negotiations led to minor adjustments, others were unsuccessful. |

| Seeking alternative markets | Canada has diversified its export destinations, but the shift has been gradual and hasn’t fully mitigated the impact of tariffs. |

| Challenging tariffs through legal mechanisms | Some cases have been successful in mitigating the impact of tariffs, while others have been unsuccessful or are ongoing. |

Impact of Tariffs on Specific Sectors: Trudeau Canada Us Tariffs

Tariffs, those taxes on imported goods, can have a significant and often unpredictable impact on various sectors of an economy. When applied between trading partners like the US and Canada, the ripple effects can be felt from manufacturing plants to grocery stores, impacting both businesses and consumers. Understanding these impacts is crucial for evaluating the long-term effects of such trade policies.The effects of tariffs aren’t uniform across all industries.

Some sectors are more vulnerable to price increases, supply chain disruptions, and reduced market access than others. This analysis will delve into the specific impacts on Canadian industries, examining the interplay between employment, pricing, and the availability of goods.

Manufacturing Sector

The manufacturing sector, a cornerstone of Canada’s economy, is highly susceptible to tariff fluctuations. Tariffs increase the cost of imported raw materials and components, leading to higher production costs for Canadian manufacturers. This, in turn, can lead to reduced competitiveness in the global market.

- Increased production costs for companies reliant on imported components or raw materials, leading to potential price increases for consumers.

- Potential job losses in manufacturing sectors heavily reliant on imports or exporting to the affected market.

- Shift in production locations to countries with more favorable trade agreements, reducing the Canadian manufacturing base over time.

Agricultural Sector

Canada’s agricultural sector is another major contributor to the economy. Tariffs can directly impact farmers’ ability to export their products to the US market, a major trading partner. Import tariffs on Canadian agricultural products into the US, or vice versa, can reduce market access and decrease revenue for Canadian farmers.

- Reduced market access for Canadian agricultural products in the US market, potentially impacting farmers’ incomes and livelihoods.

- Potential for supply chain disruptions for agricultural products, which can affect the prices and availability of food in both countries.

- Increased costs for agricultural inputs, like fertilizers or machinery, due to tariffs on imported goods, further reducing profit margins for farmers.

Energy Sector, Trudeau canada us tariffs

The energy sector is a significant player in the Canadian economy, particularly with the export of resources to the US. Tariffs on energy products can directly affect the profitability of Canadian energy companies and have a ripple effect through the wider economy.

- Reduced profitability for Canadian energy companies due to tariffs on exported products.

- Potential job losses in the energy sector, especially in areas of extraction and export.

- Impact on the wider economy due to reduced energy exports, impacting investment and growth.

Table: Comparing Tariff Impacts on Canadian Industries

| Industry | Impact on Employment | Impact on Prices | Impact on Market Access |

|---|---|---|---|

| Manufacturing | Potential job losses in import-dependent sectors | Higher prices for consumer goods | Reduced competitiveness in export markets |

| Agriculture | Reduced farm incomes and potential job losses | Higher prices for agricultural products | Decreased export opportunities |

| Energy | Potential job losses in extraction and export | Potential price increases for energy products | Reduced export capacity and profitability |

International Relations and Tariffs

The global landscape of trade is often fraught with tension, and tariffs are a frequent tool employed in these disputes. Understanding the broader context of these conflicts, the role of international organizations in mediating them, and the diverse approaches of different nations is crucial to comprehending the complexities of international trade. This exploration delves into the international context of trade disputes, examining the mechanisms for resolving them, and contrasting the approaches of various nations.The international context of trade disputes is multifaceted, encompassing political, economic, and social factors.

Trade wars, often initiated by tariffs, can have cascading effects on global markets, affecting supply chains, investment decisions, and consumer prices. These disputes often arise from perceived unfair trade practices, differing interpretations of trade agreements, or strategic national interests.

Global Trade Organizations and Mediation

The World Trade Organization (WTO) plays a critical role in mediating trade disputes. Its dispute settlement system provides a framework for addressing trade disagreements between member countries. The WTO’s process involves consultations, panel reports, and appeals, aiming to resolve conflicts through a structured and impartial procedure. Success hinges on adherence to WTO rules and regulations, but challenges remain in enforcing these agreements.

Different Approaches to Trade Disputes

Nations employ various strategies when faced with trade disputes. Some prioritize bilateral negotiations and agreements, while others lean on multilateral platforms like the WTO. Cultural nuances, economic priorities, and political ideologies influence these approaches. Understanding these differing perspectives is essential for navigating the intricacies of international trade.

| Country | Approach to Trade Disputes | Example |

|---|---|---|

| United States | Historically, a blend of bilateral negotiations and unilateral actions, with a tendency towards protectionist measures. | Imposition of tariffs on steel and aluminum imports in 2018. |

| European Union | Primarily relies on multilateral agreements and WTO dispute settlement mechanisms, emphasizing free trade principles. | Initiating disputes against the US over tariffs on imported steel and aluminum. |

| China | Often employs a combination of retaliatory tariffs, bilateral agreements, and participation in multilateral trade forums. | Responding to US tariffs on Chinese goods with tariffs on US imports. |

| Canada | Focuses on multilateral agreements, bilateral discussions, and utilizing WTO dispute settlement mechanisms when necessary. | Negotiating trade agreements and addressing tariff disputes with the US through diplomatic channels. |

Public Opinion and Political Discourse

The imposition of US tariffs on Canadian goods sparked a complex tapestry of public reactions and political debates in both nations. Public sentiment, often shaped by media portrayals and economic anxieties, played a significant role in shaping the political landscape and the eventual course of negotiations. The ensuing political discourse, encompassing diverse viewpoints and interests, further complicated the already intricate trade relationship.The Canadian public’s response to the tariffs was multifaceted, reflecting a spectrum of concerns about the economic repercussions and the implications for bilateral relations.

Trudeau’s Canada-US tariffs are definitely a hot topic right now, but it’s easy to get sidetracked by the broader issues at play. For example, the recent student protests surrounding immigration arrests, as detailed in this article about student protests immigration arrest , highlight the complex social and political currents impacting trade negotiations. Ultimately, these intertwined events are all part of a bigger picture when considering the current state of Canada-US trade relations.

Political leaders, meanwhile, grappled with the challenge of balancing domestic interests with the need for maintaining a strong international presence and fostering constructive dialogue with the United States.

Public Reaction to US Tariffs in Canada

Canadian public opinion on US tariffs varied significantly across different sectors and demographic groups. Initial responses were characterized by concern about job losses and economic instability, particularly in sectors directly affected by the trade measures. These anxieties fueled public discourse, influencing political decisions and shaping the narrative around the trade conflict.

Political Discourse Surrounding Tariffs

The political discourse surrounding US tariffs was intense and often polarized, reflecting the significant stakes involved. In Canada, political parties took opposing stances, with some advocating for retaliatory measures while others prioritized diplomatic solutions. The US political scene witnessed a similar dynamic, with debates between protectionist and free-trade advocates.

Media Portrayal of Tariff Issues

Media outlets played a crucial role in shaping public perceptions of the tariff dispute. News coverage often highlighted the potential negative economic impacts, generating anxieties and fears about job losses and economic uncertainty. Different media outlets, however, presented varying perspectives, sometimes focusing on the potential for diplomatic resolutions or on the broader implications of the trade conflict.

Public Response to Tariffs by Sector and Time Period

| Sector | Time Period | Public Response |

|---|---|---|

| Automotive | 2018-2019 | Significant concern about job losses and supply chain disruptions. Protests and demonstrations were held in affected communities. |

| Agricultural Products | 2018-2020 | Farmers voiced concerns about reduced export markets and potential financial hardship. Government support programs were implemented to mitigate the impacts. |

| Aluminum and Steel | 2018 | Public outcry over the impact on Canadian manufacturers and workers. This galvanized support for retaliatory actions from some sectors. |

| General Public (all sectors) | 2018-2020 | A mix of support for retaliatory measures and calls for diplomatic solutions. Public opinion was largely negative regarding the economic impacts. |

Note: This table provides a generalized overview of public responses. Specific details and nuances varied across different communities and segments of the population.

Future Implications of Tariffs

The ongoing and potential future implications of tariffs between the US and Canada demand careful consideration. While the immediate effects on specific sectors are readily apparent, the long-term ramifications are more complex and extend beyond economic indicators. Predicting the precise trajectory of future trade relations requires analyzing the interplay of economic forces, political considerations, and the potential for unforeseen events.Understanding these implications is crucial for both governments and businesses operating in the bilateral trade landscape.

Future scenarios are influenced by the political climate, global economic trends, and the willingness of both countries to engage in constructive dialogue. The potential responses from each side, and strategies for mitigating the impact of tariffs, are key components in managing this evolving relationship.

Potential Future Scenarios

The future of US-Canada trade relations hinges on several key factors. One scenario involves a continued escalation of protectionist measures, driven by political pressures and economic anxieties. Another potential scenario envisions a de-escalation, with both countries recognizing the mutual benefits of a strong trade relationship. A third possibility is a period of fluctuating tariffs, driven by shifting political tides and economic conditions.

These diverse possibilities necessitate a comprehensive approach to understanding and mitigating potential negative impacts.

Potential Responses by the Canadian Government

The Canadian government has several tools at its disposal to respond to future tariffs. These include diversification of trade partners, strengthening domestic industries, negotiating new trade agreements, and exploring alternative routes for exporting goods. Importantly, the Canadian government could consider retaliatory tariffs, but this would likely depend on the specific circumstances and the magnitude of the US tariffs.

Potential Strategies for Mitigating Negative Impacts

Businesses and industries can implement various strategies to mitigate the potential negative impacts of tariffs. Diversification of supply chains and export markets, focusing on innovation and cost reduction, and exploring opportunities in new markets are all crucial steps. Companies should also consider lobbying their governments to advocate for fairer trade practices and explore legal avenues to challenge unfair trade practices.

Trudeau’s Canada-US tariffs are definitely a hot topic right now, but did you know there’s also a free pizza lunar eclipse party at the Exploratorium for Pi Day? It’s a fun event, perfect for families and science enthusiasts, and a great way to take a break from all the trade talk. Free pizza, lunar eclipse viewing, and Pi Day festivities might be just the distraction needed to get a fresh perspective on the Canadian-American trade negotiations.

Hopefully, it’ll bring a little more clarity to the future of those tariffs.

Table of Potential Future Scenarios and Responses

| Potential Future Scenario | Potential US Response | Potential Canadian Response |

|---|---|---|

| Continued escalation of protectionist measures | Further increases in tariffs on Canadian goods, potentially targeting specific sectors | Retaliatory tariffs on US goods, diversification of trade partners, investment in domestic industries, exploration of alternative export routes |

| De-escalation and normalization of trade relations | Reduction or removal of tariffs on Canadian goods | Negotiation of new trade agreements, focus on mutually beneficial trade relationships, increased trade facilitation |

| Fluctuating tariffs | Periodic increases or decreases in tariffs based on political or economic conditions | Agile adjustment of trade strategies, diversification of export markets, monitoring of economic trends, preparedness for potential disruptions |

Comparative Analysis of Trade Agreements

Navigating the intricate web of trade agreements between the US and Canada reveals a fascinating tapestry of compromises, benefits, and challenges. These agreements, often evolving over time, have profoundly shaped the economic landscape of both nations. Understanding the nuances of these deals is crucial for comprehending the ongoing dynamics of their trade relationship.The diverse array of trade agreements between the US and Canada, from foundational to contemporary, reflects the evolving nature of international trade.

These agreements have been instrumental in shaping the tariff landscape, influencing the flow of goods and services, and impacting industries in both countries.

Different Trade Agreements Between the US and Canada

Numerous agreements have defined the trade relationship between the US and Canada. These include early bilateral agreements, more comprehensive free trade agreements, and evolving discussions on modern trade challenges. The context of each agreement is critical in evaluating its impact.

Comparison of Provisions and Impact on Tariffs

Different trade agreements have varying provisions regarding tariffs. Some agreements aim for the complete elimination of tariffs on specific goods, while others may phase them out over time or maintain tariffs on certain products. This variation in approach has led to different outcomes in terms of trade flows and industry competitiveness.

Benefits and Drawbacks of Different Agreements

Each trade agreement between the US and Canada offers both advantages and disadvantages. The elimination of tariffs, for example, can boost trade volumes and lower consumer prices, but it can also lead to job losses in certain sectors that are unable to compete with cheaper imports. The balance between these benefits and drawbacks is often complex and context-dependent.

Trudeau’s Canada-US tariffs are definitely a hot topic right now, but they’re impacting more than just trade. The ripple effects are starting to show in the Bay Area housing market inventory, which is currently experiencing a significant dip. This could be connected to the overall economic uncertainty caused by the tariffs, as well as the general shift in the market.

Hopefully, the situation will stabilize soon, and these tariffs won’t continue to affect the housing market further. bay area housing market inventory The long-term impact of these tariffs on the Canadian and American economies remains to be seen.

Table Comparing and Contrasting Trade Agreements

| Agreement Name | Effective Dates | Key Tariff Provisions | Impact on Specific Sectors | Benefits | Drawbacks |

|---|---|---|---|---|---|

| US-Canada Free Trade Agreement (CUSFTA) | 1988-1994 | Phased elimination of tariffs on most goods; exceptions for certain industries | Increased trade, but challenges for some Canadian industries | Expanded market access, lower prices for consumers | Potential job losses in import-competing industries |

| North American Free Trade Agreement (NAFTA) | 1994-2020 | Elimination of tariffs on a significant portion of trade; rules of origin | Significant impact on manufacturing and agriculture, increased competition | Significant growth in trade, economic integration | Concerns about job losses in some sectors, environmental concerns |

| USMCA (United States-Mexico-Canada Agreement) | 2020-present | Modernized rules of origin, updated dispute resolution mechanisms | Shift in production, adaptation in agricultural sectors | Reinforced North American trade bloc | Ongoing debates about the agreement’s effectiveness |

Case Studies of Specific Tariffs

Navigating the intricate web of US-Canada trade relations often involves navigating the complexities of tariffs. Understanding the specific impacts of tariffs on Canadian businesses, the government’s responses, and the procedures involved in imposing and resolving disputes provides valuable insight into the realities of international trade. This section delves into concrete examples of US tariffs on Canadian products, highlighting the effects and responses.

US Tariffs on Canadian Softwood Lumber

The softwood lumber dispute between the US and Canada is a long-standing and complex example of the impact of tariffs. For decades, the US has argued that Canadian lumber producers receive unfair subsidies, allowing them to export lumber at prices below fair market value. This perceived unfair competition has led to repeated imposition of tariffs by the US on Canadian softwood lumber.

- Impact on Canadian Businesses: The imposition of tariffs has significantly affected Canadian lumber companies, particularly smaller producers. Increased costs due to tariffs can reduce profitability and competitiveness, impacting employment and potentially leading to business closures. The tariffs have also disrupted supply chains and market access for Canadian producers.

- Canadian Government Responses: Canada has consistently challenged the US tariffs in international trade forums, arguing that they are not justified. Canada has also sought to implement countermeasures and retaliatory tariffs to address perceived US trade imbalances. This often involves intricate negotiations and legal challenges within the World Trade Organization (WTO) framework.

- Tariff Imposition and Dispute Resolution: The procedure involves initiating a complaint with the appropriate international trade body, such as the WTO, outlining the alleged violation of trade agreements. Evidence is presented, and investigations are conducted. If the complaint is upheld, sanctions or tariffs can be imposed. The dispute resolution process can be lengthy and complex, often involving appeals and counterarguments.

US Tariffs on Canadian Dairy Products

Another notable example involves tariffs on Canadian dairy products. US trade policies often target specific sectors, aiming to protect domestic industries.

- Impact on Canadian Businesses: The imposition of tariffs on Canadian dairy products has impacted Canadian dairy farmers and processors. The tariffs can increase production costs, reduce export revenues, and potentially diminish market share. These impacts can be particularly acute for smaller producers.

- Canadian Government Responses: Canada has implemented various measures to mitigate the negative impacts of US tariffs on dairy products, such as negotiating trade agreements, seeking alternative export markets, and supporting domestic producers.

- Tariff Imposition and Dispute Resolution: The imposition and resolution of tariffs on Canadian dairy products are typically handled through negotiations and diplomatic channels. These processes can involve complex trade agreements and the enforcement of established trade rules.

Case Study Example – Detailed Procedure

- Initiation: A complaint is filed with the relevant international trade body (e.g., WTO) alleging unfair trade practices, such as subsidized exports.

- Investigation: The trade body investigates the complaint, gathering evidence and examining the validity of the claims.

- Dispute Resolution: The investigation may result in a ruling. If the ruling is unfavorable, the complainant may impose retaliatory tariffs on specific imports.

The opposing party may appeal or negotiate to resolve the dispute.

Last Recap

In conclusion, the Trudeau Canada US tariffs saga reveals a complex interplay of economic interests, political strategies, and international relations. The impact on various sectors, from manufacturing to agriculture, underscores the far-reaching consequences of these trade disputes. The future implications are significant, demanding careful consideration of potential scenarios and responses by both governments. This discussion highlights the need for nuanced understanding of global trade dynamics.