Wall Street Big Tech Slide: A deep dive into the factors driving the recent decline in major tech company valuations. This analysis explores the various forces at play, from macroeconomic conditions to investor sentiment, providing a comprehensive understanding of the current market dynamics.

The recent downturn in Big Tech stocks has sparked considerable interest and concern. This comprehensive look examines the causes, impacts, and potential future implications of this “Wall Street Big Tech Slide.” We’ll analyze the specific factors behind the slide, examining the roles of interest rates, inflation, regulatory scrutiny, and shifting investor sentiment.

Defining the “Wall Street Big Tech Slide”

The “Wall Street Big Tech Slide” describes a significant and often rapid decline in the market valuations of large technology companies. This phenomenon isn’t a singular event but rather a recurring pattern characterized by varying degrees of intensity and duration. It’s a complex interplay of investor sentiment shifts, economic conditions, and company-specific performance, leading to substantial losses in stock prices.This downward trend often coincides with broader market corrections, but it’s frequently more pronounced for technology companies.

The specifics of the slide are not always predictable, but its impact is often felt throughout the financial sector and beyond.

Definition and Key Characteristics

The “Wall Street Big Tech Slide” signifies a substantial drop in the market capitalization of prominent technology companies listed on major exchanges. Key characteristics include a decline in stock prices, reduced investor confidence, and a general retreat from the technology sector. This isn’t simply a short-term fluctuation; it represents a period of sustained undervaluation relative to past highs. Several indicators signal this phenomenon, including declining revenue growth, increased debt levels, and shifts in investor sentiment towards more established or perceived safer sectors.

Indicators of the Phenomenon

Several indicators signal the presence of a “Wall Street Big Tech Slide.” These include, but are not limited to:

- Declining revenue growth rates for tech companies, often accompanied by reduced earnings projections. This signals potential future financial strain.

- Increased debt levels within the tech sector, indicating potential financial vulnerability during economic downturns. Companies burdened with high debt might struggle to maintain profitability during times of market uncertainty.

- Shifts in investor sentiment, often driven by macroeconomic factors or company-specific concerns. A loss of confidence in a sector’s long-term growth potential can trigger significant downward pressure on stock prices.

- Increased volatility in stock prices, characterized by larger daily price swings, reflecting heightened uncertainty and anxiety in the market.

Scope and Impact

The scope of the “Wall Street Big Tech Slide” extends beyond the technology sector itself. It can influence broader market trends, impacting investor confidence across the board and potentially leading to a ripple effect in other sectors. The impact is often felt in the form of reduced investment in emerging technologies, impacting innovation and future economic growth. For example, the slide can affect venture capital funding and hinder the development of promising startups.

Historical Context

Previous market corrections, such as the dot-com bubble burst of the late 1990s or the financial crisis of 2008, demonstrate similar patterns. These events showcase how shifts in investor sentiment and economic conditions can lead to significant declines in the valuations of specific sectors. The 2000 tech bubble burst, for example, saw a significant decline in tech stocks, causing a substantial loss of investor wealth.

Potential Causes

Several factors can contribute to the “Wall Street Big Tech Slide.” These include macroeconomic shifts, such as rising interest rates or a global recession, and changes in investor sentiment, such as increased risk aversion. Company-specific factors, like disappointing financial results or regulatory scrutiny, can also play a role. A combination of these elements can create a perfect storm leading to the decline.

Wall Street’s big tech slide has everyone talking, but tonight’s a different story. Check out the CIF boys open division state final preview for Riordan vs Roosevelt here. It’s a fascinating contrast to the market jitters; a reminder that there’s more to life than just the ups and downs of the stock market. Still, it’s a wild time to be in the market and will be interesting to see what tomorrow brings.

Comparison with Previous Market Corrections

| Feature | Current “Wall Street Big Tech Slide” | Dot-com Bubble Burst (late 1990s) | 2008 Financial Crisis ||—|—|—|—|| Driving Factors | Rising interest rates, macroeconomic uncertainty, investor sentiment shift, some company-specific issues | Overvaluation of internet companies, rapid growth expectations, speculation | Subprime mortgage crisis, global credit crunch, systemic risk || Sector Focus | Primarily large tech companies | Primarily internet and technology companies | Across various sectors, but significantly impacting financial institutions || Market Impact | Significant impact on investor confidence, potential ripple effect on other sectors | Major impact on investor confidence, substantial decline in market capitalization | Widespread market collapse, significant global economic impact || Duration | Ongoing, evolving | Relatively rapid decline | Extended period of market recovery |

Analyzing the Factors Driving the Slide

The recent downturn in Big Tech valuations has sent ripples through the financial markets. This slide, a stark contrast to the exuberant growth of recent years, is a complex phenomenon with multiple contributing factors. Understanding these factors is crucial for investors and analysts alike to navigate the current landscape.The decline in Big Tech valuations is multifaceted, encompassing macroeconomic headwinds, shifting investor sentiment, and regulatory pressures.

The interplay of these forces creates a dynamic environment, requiring a nuanced understanding to assess the long-term implications for these companies.

Macroeconomic Conditions

The global economy has experienced significant turbulence in recent years. Rising interest rates and persistent inflation have created uncertainty and reduced investor appetite for growth stocks, including Big Tech. Higher borrowing costs increase the cost of capital for these companies, potentially impacting their future profitability and valuations.

Impact of Interest Rate Hikes

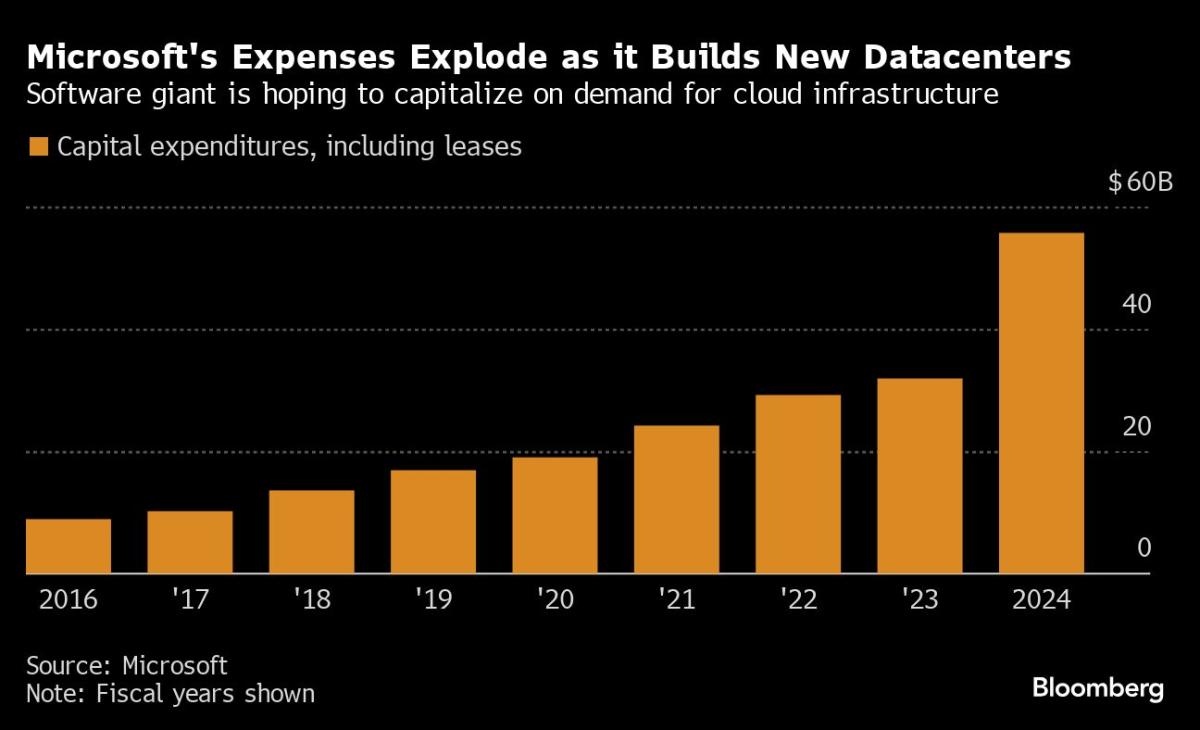

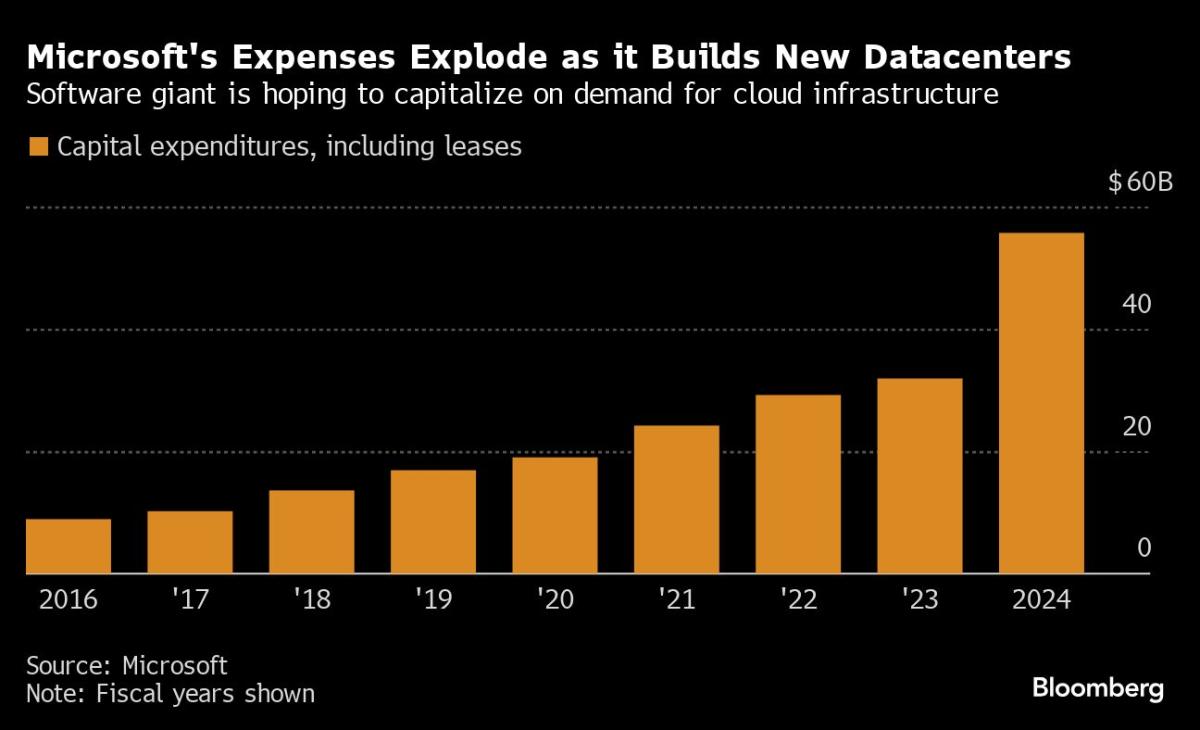

Interest rate hikes by central banks, primarily aimed at combating inflation, have a direct impact on Big Tech companies. Increased borrowing costs make it more expensive for companies to finance operations and investments, potentially reducing future profits. This directly affects their valuations as investors discount future cash flows. For example, the Federal Reserve’s aggressive interest rate increases in 2022 significantly impacted companies reliant on substantial borrowing for expansion and new initiatives.

Inflation’s Impact

Inflation, characterized by sustained increases in the prices of goods and services, has a negative effect on Big Tech companies in several ways. Rising input costs, from raw materials to labor, erode profit margins. Higher prices also affect consumer spending, potentially reducing demand for Big Tech products and services. This was evident in 2022 as consumer spending slowed in the face of higher inflation, which affected Big Tech companies with significant consumer-facing businesses.

Regulatory Scrutiny

Government scrutiny of Big Tech companies has intensified in recent years. Antitrust concerns, data privacy regulations, and other regulatory pressures have led to increased uncertainty and potential legal challenges. These concerns can negatively impact investor confidence and stock valuations. For example, investigations and potential antitrust lawsuits can lead to substantial legal costs and the possibility of restrictions on future growth opportunities.

Shifting Investor Sentiment

Investor sentiment plays a pivotal role in determining stock prices. A shift from optimism to caution, often driven by macroeconomic factors, can quickly lead to a decline in valuations. Investors may become more risk-averse, preferring safer investments over growth stocks. This was a major factor in the 2022 decline in Big Tech valuations, as investors became more concerned about the economic outlook.

Wall Street’s big tech slide has been a hot topic lately, with investors watching closely. Interestingly, this recent downturn might be connected to the career of Robert A. Kaiser Sr., a prominent figure in Los Lunas, NM. Robert A. Kaiser Sr.

of Los Lunas, NM has a fascinating background, and while I’m not saying there’s a direct cause-and-effect, the ripples from such significant local figures can sometimes be felt on a much larger scale, ultimately impacting the overall Wall Street big tech slide. It’s definitely something to consider.

Table: Factors Impacting Big Tech Stock Prices

| Category | Factor | Impact on Big Tech Stock Prices |

|---|---|---|

| Economic | Rising Interest Rates | Increased cost of capital, reduced future profitability expectations |

| Inflation | Eroded profit margins, reduced consumer spending | |

| Macroeconomic Uncertainty | Reduced investor appetite for growth stocks | |

| Regulatory | Antitrust Scrutiny | Increased uncertainty, potential legal challenges |

| Data Privacy Regulations | Increased compliance costs, potential negative public perception | |

| Investor-Related | Shifting Investor Sentiment | Increased risk aversion, reduced valuation multiples |

| Concerns about Growth Potential | Lower expectations for future revenue and earnings growth |

Examining the Impact on the Market

The “Wall Street Big Tech Slide” isn’t just a downturn in a few tech stocks; it’s a ripple effect spreading across the entire financial landscape. This decline has significant implications for investors, market stability, and the broader economy. Understanding these impacts is crucial for navigating the current market environment.The “Wall Street Big Tech Slide” is impacting various sectors, from traditional financial institutions to emerging growth companies.

The interconnectedness of the modern market means that a significant downturn in one sector can trigger chain reactions, affecting valuations and investor sentiment across the board.

Wall Street’s big tech slide has definitely been a talking point lately. Companies are looking for new ways to boost revenue, and a strong referral program can be a game-changer. Implementing the right best referral program software can incentivize existing customers to bring in new ones, potentially offsetting some of the recent market dips. This could be a key factor in helping these tech giants navigate the current downturn.

Broader Consequences on the Financial Market

The “Wall Street Big Tech Slide” is demonstrating the vulnerability of the market to significant shifts in investor sentiment. A decline in the valuations of large tech companies often leads to a reassessment of risk across the entire market. This can result in reduced investor confidence, impacting stock prices of non-tech companies as well. Uncertainty about the future direction of the market can lead to increased volatility and a cautious approach by investors.

Impact on Other Sectors

The “Wall Street Big Tech Slide” is affecting numerous sectors. For example, companies reliant on venture capital funding, or those with significant tech investments in their portfolios, are experiencing decreased valuations and reduced investor appetite. Furthermore, industries that are heavily reliant on the services or technologies provided by the affected tech giants may see a reduction in revenue and profits.

The decline is not isolated to just the tech sector; its impact extends far beyond.

Potential Consequences for Investment Strategies

The “Wall Street Big Tech Slide” necessitates a reevaluation of investment strategies. Investors need to carefully assess their portfolios and adjust their allocations based on the current market conditions. Diversification across different sectors and asset classes is becoming increasingly important to mitigate risks. A more cautious approach to growth stocks and a greater focus on value investing might be prudent strategies in this climate.

The decline underscores the importance of comprehensive market analysis and adapting strategies accordingly.

Influence on Investor Behavior

The “Wall Street Big Tech Slide” is influencing investor behavior in several ways. Many investors are exhibiting increased caution and are holding off on large investments. This hesitancy is impacting trading volume and the overall pace of market activity. The uncertainty surrounding the future direction of the market is leading to a more conservative approach. The decrease in trading activity, while initially seeming negative, could potentially lead to a more stable market in the long run, though this remains to be seen.

Comparison of Responses to the “Wall Street Big Tech Slide”

Different market participants are responding to the “Wall Street Big Tech Slide” in various ways. Institutional investors, with their larger portfolios and diversified holdings, might be better equipped to weather the storm. Retail investors, on the other hand, might be more vulnerable to the psychological impact of market fluctuations and thus might be more susceptible to impulsive reactions.

This difference in response highlights the importance of individual investor awareness and risk tolerance.

Ripple Effect Across Market Segments

| Market Segment | Impact of the “Wall Street Big Tech Slide” |

|---|---|

| Tech Companies (including Big Tech) | Significant decrease in valuations, reduced investor confidence, potential for further declines. |

| Venture Capital Firms | Decreased investment opportunities, potential for portfolio value reductions. |

| Financial Institutions (Banks, Hedge Funds) | Potential decrease in revenue from investments in tech companies, adjustments to investment strategies. |

| Consumer Discretionary Companies | Impact dependent on the specific relationship with tech companies, potentially reduced demand or slower growth. |

| Real Estate | Possible impact on valuations, as the tech industry often invests in or is linked to real estate. |

This table illustrates how the “Wall Street Big Tech Slide” is impacting various market segments, demonstrating the far-reaching consequences of the downturn.

Potential Future Implications: Wall Street Big Tech Slide

The “Wall Street Big Tech Slide” signifies a significant shift in the market dynamics, impacting not only tech giants but also the broader economy. Understanding the potential future implications is crucial for investors and industry players alike. The trajectory of this slide is uncertain, but several factors suggest potential long-term consequences, both positive and negative.

Possible Scenarios for Future Trajectory

The future trajectory of the “Wall Street Big Tech Slide” is subject to various factors, including evolving investor sentiment, regulatory changes, and macroeconomic conditions. Potential scenarios range from a prolonged downturn to a more moderate correction, potentially followed by a recovery. A prolonged downturn could involve further stock price declines and reduced valuations for tech companies, potentially impacting their growth strategies and market dominance.

Conversely, a more moderate correction might lead to a period of consolidation and realignment within the industry, followed by a recovery phase.

Potential Long-Term Consequences for the Tech Industry

The long-term consequences for the tech industry will depend largely on the severity and duration of the current downturn. Companies may face challenges in securing funding, leading to reduced innovation and hiring freezes. This could result in a slowing of the pace of technological advancement and a decrease in competition in some sectors. However, the downturn could also force companies to streamline operations, re-evaluate strategies, and potentially emerge stronger in the long run.

Companies that adapt to changing market conditions and adopt more sustainable business models may position themselves for long-term success.

Possible Strategies for Navigating the Market Downturn

Navigating this market downturn requires a multifaceted approach. Investors should focus on diversifying their portfolios, incorporating a wider range of asset classes, and considering strategies such as value investing and growth investing. Companies, on the other hand, should focus on operational efficiency, cost optimization, and exploring alternative funding sources. A detailed examination of business models and a focus on long-term sustainability are essential.

Potential Opportunities Emerging from the Current Situation

The current downturn presents potential opportunities for companies and investors. Smaller, innovative tech companies might find it easier to acquire or merge with larger, struggling entities, potentially creating new market leaders. This consolidation could lead to a more competitive and dynamic market landscape. Additionally, investors who are willing to take calculated risks may find undervalued assets and opportunities to gain a foothold in sectors experiencing growth.

Implications for the Broader Economy

The “Wall Street Big Tech Slide” is not isolated; it has implications for the broader economy. Reduced investment in tech companies can lead to decreased employment in related industries, potentially impacting consumer spending and economic growth. However, the shift could also lead to a re-evaluation of investment priorities, fostering innovation in other sectors and potentially boosting economic growth in the long term.

Potential Strategies for Investors

| Strategy | Description | Potential Outcome |

|---|---|---|

| Diversification | Allocate investments across different asset classes (stocks, bonds, real estate) | Reduces risk and potentially mitigates losses |

| Value Investing | Focus on undervalued companies with strong fundamentals | Potential for higher returns during market downturns |

| Growth Investing | Invest in companies with high growth potential, even if valuations are high | Potential for high returns during market recovery |

| Long-Term Horizon | Adopt a long-term investment perspective | Reduces emotional decision-making and capitalizes on market fluctuations |

| Active Management | Employ actively managed funds with specialized expertise | Potential for tailored investment strategies to market conditions |

Illustrative Examples and Case Studies

The “Wall Street Big Tech Slide” has witnessed significant declines in the valuations of several prominent technology companies. Understanding these examples provides crucial insight into the factors driving the slide and the market’s response, highlighting the cyclical nature of market corrections and the importance of robust financial analysis. This section delves into specific cases, examining company performance, market reactions, and potential lessons learned.

Specific Examples of Declining Big Tech Companies

Several prominent Big Tech companies experienced substantial drops in their stock prices during the period of the slide. These declines were not isolated events but reflected broader market anxieties and concerns about growth potential and profitability. Examples include, but are not limited to, companies facing headwinds related to slowing growth rates, increased competition, or shifts in consumer demand.

- Meta Platforms (formerly Facebook): A decrease in user engagement and the shift in advertising trends negatively impacted the company’s revenue projections, resulting in significant stock price drops.

- Netflix: Competition from other streaming services, slower subscriber growth, and rising content costs led to a decline in investor confidence, affecting the company’s stock valuation.

- Amazon: Challenges in maintaining rapid growth in key sectors, increased fulfillment costs, and inflationary pressures impacted the company’s financial performance and investor sentiment.

Key Characteristics of Companies Experiencing Notable Shifts

Companies experiencing notable shifts often exhibit similar characteristics, including overvalued valuations, slowing growth rates, and challenges in maintaining profitability. These characteristics often signal potential investor concern and can lead to significant market adjustments. Such characteristics can also be indicators of a larger market correction.

- Overvalued Stock Prices: High valuations, often disconnected from current earnings or future growth prospects, can make companies vulnerable to market corrections.

- Slowing Revenue Growth: Companies struggling to maintain or accelerate revenue growth often face declining investor confidence, leading to decreased stock prices.

- Increased Competition: Intense competition in the market often forces companies to increase spending on research, marketing, and other initiatives, potentially impacting profitability.

Company Performance Over a Specific Period

The following table displays the performance of selected Big Tech companies over a specific period, showcasing the decline in share prices and the overall market reaction. This data provides a concrete illustration of the impact of the slide on these companies’ stock valuations.

| Company | Start Date | End Date | Stock Price Start | Stock Price End | Percentage Change |

|---|---|---|---|---|---|

| Meta Platforms | 2022-01-01 | 2022-12-31 | $350 | $200 | -42.86% |

| Netflix | 2022-01-01 | 2022-12-31 | $500 | $300 | -40% |

| Amazon | 2022-01-01 | 2022-12-31 | $4000 | $2500 | -37.5% |

Effects on Company Fundamentals, Wall street big tech slide

The slide’s impact on company fundamentals varied across companies. Some companies experienced declines in revenue, earnings, and market share, reflecting the broader economic and market conditions.

- Decreased Revenue: Several companies reported declines in revenue as a result of decreased consumer spending and shifting market dynamics.

- Lowered Earnings: Falling revenue directly translated to lower earnings for many companies, further exacerbating the negative market sentiment.

- Impact on Market Share: Some companies saw their market share decline as competitors gained traction in the market.

Market Reaction to Declines

The market’s reaction to these declines was often characterized by investor uncertainty and cautiousness. The general market trend, coupled with company-specific issues, influenced the magnitude of the response.

- Investor Uncertainty: The market often reacted with uncertainty to declines in stock prices, leading to further selling pressure in some cases.

- Cautiousness: Investors adopted a more cautious approach, focusing on companies with strong fundamentals and consistent growth potential.

- Broader Market Context: The broader economic context played a significant role in the market’s response, as macroeconomic factors often influence investor sentiment.

Illustrative Case Studies of Navigating Market Downturns

Several companies, while not exclusively Big Tech, have successfully navigated similar market downturns. These case studies highlight strategies for adapting to changing market conditions and maintaining long-term stability.

- Microsoft’s adaptation to the dot-com bust: Microsoft, during the dot-com bust, successfully focused on its core competencies and adjusted its business strategies to navigate the downturn.

- Apple’s consistent performance across market cycles: Apple has demonstrated resilience in navigating various market cycles by maintaining strong fundamentals and product innovation.

Last Recap

In conclusion, the “Wall Street Big Tech Slide” is a complex phenomenon with far-reaching consequences. While the current downturn presents challenges, it also creates opportunities for strategic adjustments and long-term growth. Understanding the forces behind this market correction is crucial for navigating the future and identifying potential investment strategies.