Git reset vs revert vs rebase: Navigating these Git commands is crucial for any developer. They allow you to manipulate your commit history, a critical aspect of version control. Understanding the subtle differences between these commands is key to effectively managing your codebase and collaborating smoothly with others. This comprehensive guide dives deep into each command, exploring their purpose, effects, and ideal use cases, helping you master these essential Git tools.

Git’s branching model is fundamental to understanding these commands. Commits, branches, and history are the building blocks of your code’s evolution. Efficient management of this history is essential to productive development and collaboration. We’ll meticulously examine the distinct behaviors of `git reset`, `git revert`, and `git rebase` to illuminate the nuances of each.

Introduction to Git

Git is a distributed version control system that tracks changes to files over time. This allows developers to collaborate effectively, revert to previous versions, and manage codebases efficiently. Understanding Git’s fundamental concepts is crucial for anyone working with software development projects.Git’s branching model is a powerful feature that enables parallel development. Developers can create branches to work on new features or bug fixes without affecting the main codebase.

These branches can be merged back into the main branch when the work is complete, ensuring a smooth integration process.Fundamental to Git are commits, branches, and the history. Commits record changes to the codebase, branches represent distinct lines of development, and the history documents all the changes and decisions made throughout the project’s lifecycle. This historical record is crucial for understanding the evolution of the code and for resolving conflicts or reverting to previous states.

Mastering these concepts is essential for effective version control and collaboration.

Git Branching Model

Git’s branching model is a key component of its design. It enables parallel development streams, allowing teams to work on new features or bug fixes independently without disrupting the main codebase. Branches act as independent copies of the repository’s state, enabling simultaneous work on multiple tasks. Merging these branches back into the main codebase ensures that the changes are incorporated smoothly.

This branching structure facilitates effective collaboration and reduces the risk of conflicts during integration.

Commits, Branches, and History

Commits are snapshots of the project’s state at a specific point in time. They record the changes made to the files, and include a message describing the purpose of the changes. Branches are distinct lines of development. They allow multiple independent lines of work to be tracked and integrated later. The Git history is a complete record of all commits, branches, and merges, forming a visual timeline of the project’s evolution.

Understanding the commit history is critical for troubleshooting, resolving conflicts, and understanding the evolution of the project.

Comparing Git Reset, Revert, and Rebase

Understanding the differences between `git reset`, `git revert`, and `git rebase` is crucial for effective Git usage. These commands allow for manipulation of the commit history in different ways, each with specific advantages and disadvantages.

| Command | Purpose | Effect on History | Use Cases |

|---|---|---|---|

git reset |

Moves the HEAD pointer to a different commit, effectively discarding commits. | Changes the current branch’s history by moving the HEAD pointer, altering the branch’s history directly. | Discarding local changes, reverting to a previous state when you realize you’ve made a mistake in the current branch. Also, useful when you want to start over from a particular commit. |

git revert |

Creates a new commit that undoes the effects of a specific commit. | Creates a new commit that reverses the changes of the targeted commit, preserving the entire commit history. | Undoing a mistake without altering the branch’s history, useful when you need to reverse changes that have already been pushed to a remote repository. Preserves the complete commit history. |

git rebase |

Moves commits from one branch to another, rewriting the history. | Changes the branch’s history by rewriting the commit order, making the branch’s history linear. | Integrating changes from a branch into another, aligning a branch’s history with the main branch, creating a cleaner, linear history. |

Understanding Git Reset: Git Reset Vs Revert Vs Rebase

Git reset is a powerful command that allows you to modify the commit history of your Git repository. It’s a crucial tool for correcting mistakes, reverting to previous states, and managing your project’s evolution. However, it’s important to understand that `git reset` directly manipulates the commit history, which can lead to data loss if not used carefully. This article delves into the different types of `git reset` operations and their impact on your repository.Git reset offers three distinct modes, each with varying effects on the working directory, staging area, and commit history.

Understanding these differences is vital to avoid unintended consequences. The three modes are `–hard`, `–mixed`, and `–soft`. Each affects the state of your project differently.

Different Git Reset Modes

The `git reset` command allows for different levels of modification to your project’s commit history. These modes alter the working directory, staging area, and commit history in distinct ways.

Navigating Git’s reset, revert, and rebase commands can feel like navigating a political landscape, especially when you’re trying to understand their subtle differences. Think of it like choosing the best way to amend a historical record. For example, the San Jose City Council recently appointed Carl Salas to temporarily serve as District 3 representative, a temporary solution to a political void.

Ultimately, each method—reset, revert, or rebase—has its own implications for your project’s history, and understanding these nuances is key to maintaining a clean and efficient workflow.

- `git reset –hard`: This mode performs the most aggressive changes. It discards all uncommitted changes in the working directory, resets the staging area to match the specified commit, and effectively removes all commits after the target commit from the commit history. This operation is irreversible in the sense that you lose any local changes not yet committed.

- `git reset –mixed`: This is the default mode. It moves the commit pointer to the specified commit, but it does not delete any local changes in the working directory. The staging area is updated to reflect the state of the specified commit. This mode is ideal for correcting minor mistakes and is the most commonly used option.

- `git reset –soft`: This mode leaves your working directory and the changes you’ve made completely untouched. It only moves the commit pointer to the specified commit and updates the staging area to reflect that point. This approach is useful for temporarily abandoning recent commits and potentially moving changes to a different branch or rewriting history.

Examples of `git reset` Scenarios, Git reset vs revert vs rebase

Understanding when to use each mode is crucial for effective Git usage.

- Fixing a mistake in a file: If you’ve made a mistake in a file that’s already been staged, use `git reset –mixed` to revert the staging area to the correct state without losing your uncommitted changes.

- Discarding unwanted changes: If you’ve made changes you don’t want to commit, `git reset –hard` (with extreme caution) can discard them, but be mindful of data loss. A more cautious approach would be to revert the file and then use `git reset –mixed`.

- Preparing to rebase: `git reset –soft` allows you to prepare your commits for rebasing without affecting the working directory. This is a useful step before rebasing on a different branch.

Impact of `git reset` Options

This table summarizes the effects of each `git reset` option on the repository’s state.

| Option | Effect on Working Directory | Effect on Staging Area | Effect on Commit History |

|---|---|---|---|

| `git reset –hard` | Discards all uncommitted changes | Resets to the specified commit | Removes commits after the target commit |

| `git reset –mixed` (default) | Preserves uncommitted changes | Resets to the specified commit | Moves commit pointer to the target commit |

| `git reset –soft` | Preserves all uncommitted changes | Resets to the specified commit | Moves commit pointer to the target commit |

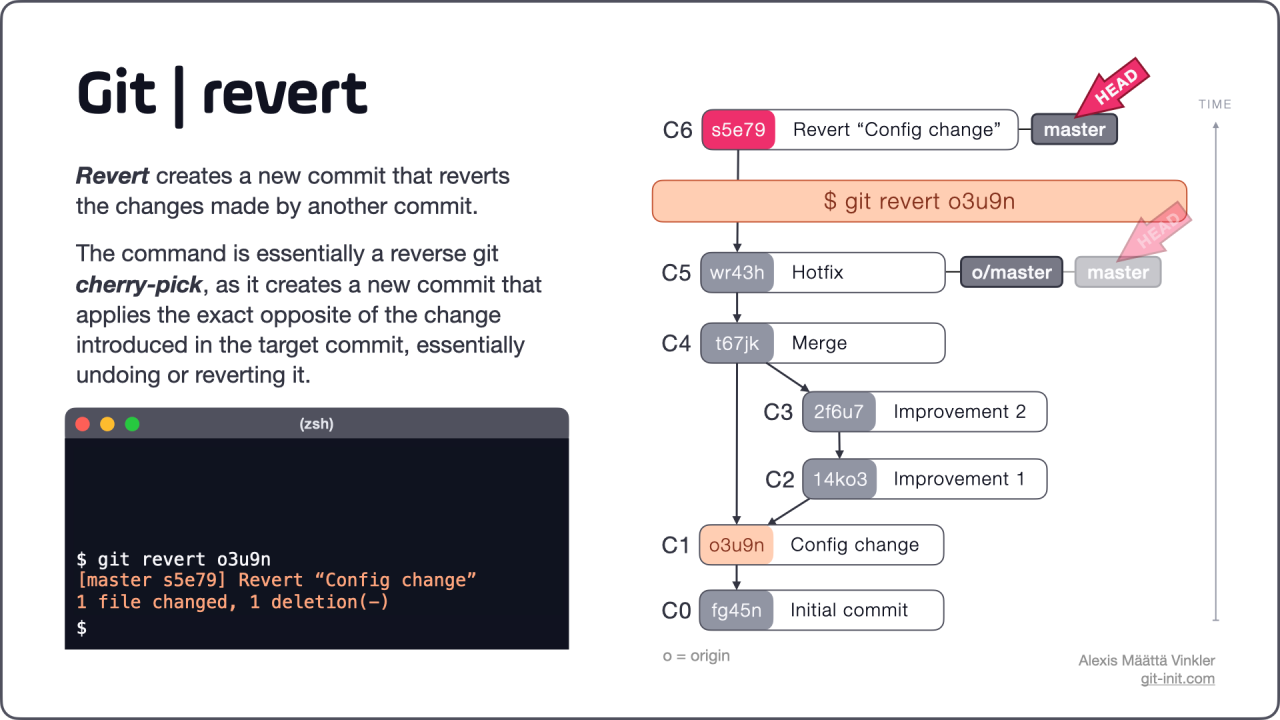

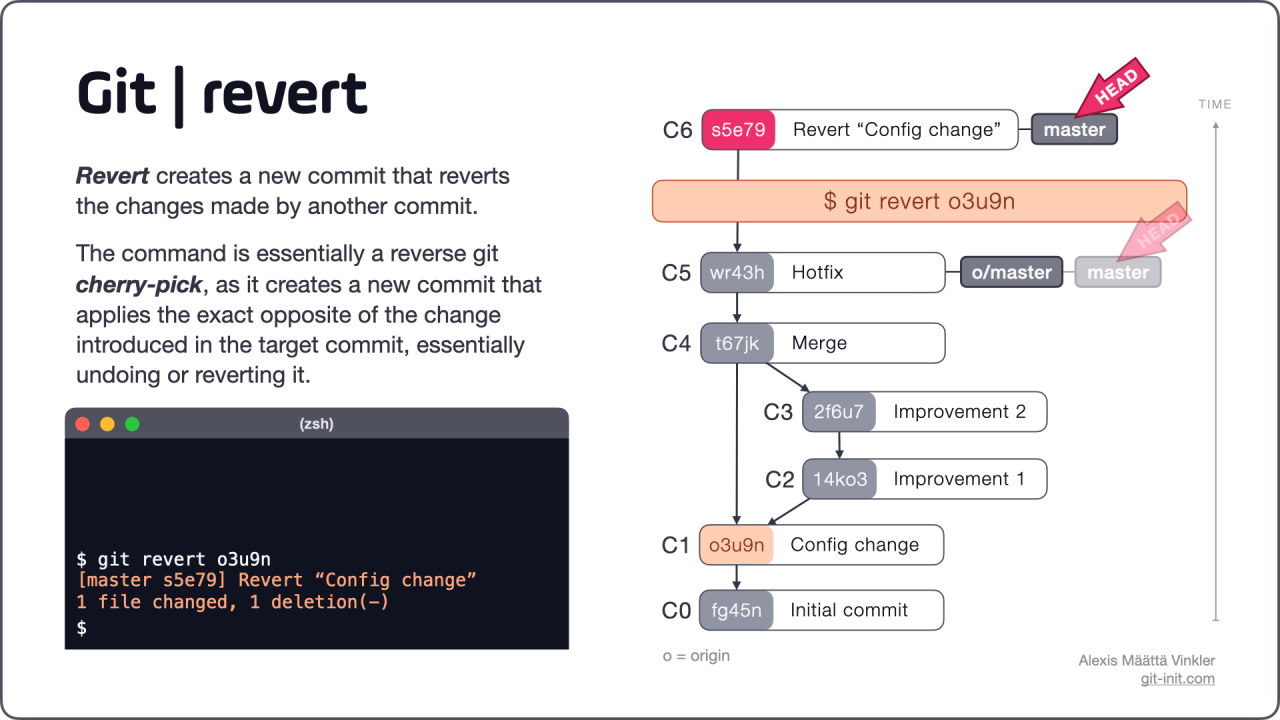

Exploring Git Revert

Git revert is a powerful command for undoing changes in a Git repository without altering the commit history in a destructive way. It’s particularly useful when you need to undo a specific commit while preserving the entire history of your project. Unlike `git reset`, `git revert` doesn’t alter the commit history, but instead creates a new commit that undoes the effects of the target commit.

Purpose of Git Revert

The `git revert` command is designed to undo changes introduced by a specific commit without altering the existing commit history. This is crucial for maintaining a clear and traceable record of development. Reverting a commit creates a new commit that reverses the effects of the original commit, thus preserving the integrity of the project’s history.

How Git Revert Creates a New Commit

When you use `git revert`, Git creates a new commit that applies the inverse changes of the targeted commit. This inverse operation is performed by analyzing the changes introduced in the original commit and creating a new commit that effectively undoes those changes. This new commit is not a direct overwrite of the original commit; it is a new commit added to the commit history, reflecting the reversal.

Impact on Commit History

`git revert` significantly impacts the commit history in a controlled manner. It preserves the original commit history, adding a new commit that undoes the effects of the target commit. This approach ensures that the project’s development history remains intact, allowing for easier tracking and understanding of the changes made. The original commit remains in the history, enabling easy retrieval of the commit in question and its contents.

This contrasts with `git reset`, which can rewrite history.

Examples Demonstrating Preservation of Commit History

Imagine a scenario where you’ve committed a series of changes to a project. Later, you realize a particular commit introduced an unwanted bug. Using `git revert`, you can create a new commit that undoes the problematic commit’s effects. The previous commits remain untouched, and the project history remains accurate and comprehensive. This method ensures that the complete history is preserved.

This is a key difference from `git reset`, which discards commits and potentially alters the project’s entire history.

Comparison between Git Revert and Git Reset

| Command | Effect on History | Impact on Branching |

|---|---|---|

git revert |

Preserves the entire commit history by creating a new commit that undoes the changes of the target commit. | Does not affect the branch structure. The original commit remains, and a new revert commit is added. |

git reset |

Can alter or remove commits from the history, potentially rewriting the project’s past. | Can significantly affect the branch structure, potentially altering the branch’s history. |

The table highlights the crucial difference between `git revert` and `git reset` regarding their impact on the commit history and branching structure. `git revert` maintains the complete history, while `git reset` can alter it. This distinction is critical for maintaining a clear and traceable project history.

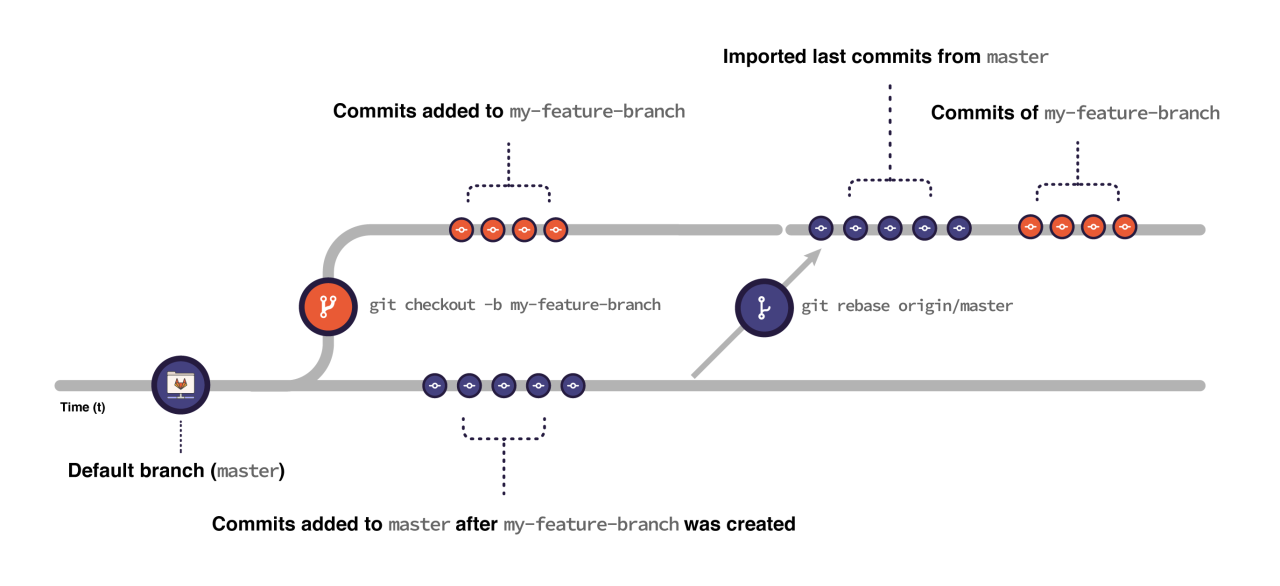

Delving into Git Rebase

Git rebase is a powerful command that allows you to rewrite your commit history by applying commits on top of a new base. This process can streamline your commit history, making it easier to follow and understand. However, it’s crucial to understand the implications of rewriting history, especially when working with others or collaborating on projects.

Navigating Git’s reset, revert, and rebase commands can be tricky, like navigating a complex investigation. Just as a detective needs to carefully consider past actions and potential misconduct, like the recent case of a San Diego Navy detective sentenced for choking a sailor unconscious and lying about prior misconduct here , understanding these Git commands involves carefully choosing the right approach to history.

Ultimately, each command handles a different aspect of your project’s past, so selecting the right one is crucial, just like a detective’s choice of approach can make or break a case.

Purpose of Git Rebase

Git rebase is primarily used to tidy up the commit history. It allows you to reorganize commits on a branch, making the linear progression of changes clearer and more straightforward. This is particularly useful when you want to present a clean, linear story of development for your code. For instance, if you made several small commits on a feature branch and want to consolidate them into a single, larger commit, rebase can achieve this.

Another scenario is when you want to integrate your work with a new base commit from a different branch, maintaining a clean linear history.

How Git Rebase Rewrites Commit History

The core function of `git rebase` is to move commits from one branch to another. This is done by taking the commits from the source branch and applying them sequentially on top of the target branch. This essentially changes the parent commits of each affected commit. This alteration directly impacts the commit history, changing the commit graph’s structure.

Figuring out Git reset, revert, and rebase can be tricky, but understanding the differences is key. Think of it like fixing a messy project – sometimes you need to undo a specific commit, or maybe you want to rewrite history to make it cleaner, like how Miss Manners might want to handle the chaos at miss manners birthday party showboat.

Ultimately, choosing the right command depends on the specific situation, just like choosing the right party etiquette for a tricky social gathering. Each command has its own strengths and weaknesses when it comes to maintaining a clean and understandable Git history.

Imagine moving a set of Lego blocks from one area to another, adjusting their connections to fit the new arrangement. The commits’ parent-child relationships are altered to reflect the new location in the history.

Advantages of Using Git Rebase

- Linear History: Rebase creates a cleaner, more linear commit history, making it easier to understand the evolution of the code. This is especially helpful in a team environment, where a clear, chronological sequence is more easily tracked. A linear history streamlines code reviews, making it simpler to follow the development process.

- Simplified Integration: Rebase makes integrating changes from a feature branch into the main branch smoother. By replaying the commits on the main branch, it avoids the complex merge commits that `git merge` can produce, leading to a simpler and more organized project history.

- Improved Readability: The reorganized commit history is easier to follow, understand, and audit, leading to a more maintainable codebase.

Disadvantages of Using Git Rebase

- History Rewriting: A crucial consideration is that rebase alters the commit history. This can cause problems if other developers have already based their work on the commits being rebased. This can be disruptive to a collaborative environment if not handled carefully.

- Potential Conflicts: If there are conflicts during the rebase process, resolving them can be more complex than with `git merge`.

- Loss of Context: If the commits being rebased have important context (e.g., the original commit message provides insights into the developer’s intent), the context can be lost or harder to find after the rebase.

Impact on Remote Repository

Rebase only affects the local repository. If you want the changes to be reflected in the remote repository, you must push the rebased branch to the remote, which will replace the original commits with the new ones on the remote.

Scenarios Where Git Rebase is Beneficial

- Feature Branch Integration: When integrating a feature branch into the main branch, rebase can create a clean linear history.

- Fixing a Branch with Multiple Commits: Rebase is beneficial when fixing a branch with multiple commits and then integrating them into the main branch. This can simplify the workflow, providing a clearer view of the changes.

- Creating a Clearer History: When you want to organize and simplify the commit history on a branch, rebase can help in creating a cleaner and more easily understandable record of the development process.

Avoiding Conflicts When Rebasing

Careful commit messages and code reviews can significantly minimize conflicts. Thorough testing before rebasing can also prevent unexpected issues.

Comparing Git Rebase with Git Merge and Git Revert

| Command | Impact on History | Workflow | Advantages | Disadvantages |

|---|---|---|---|---|

| `git rebase` | Rewrites the commit history | Can be more complex; requires pushing to remote | Creates a cleaner, linear history; simplifies integration | Can cause problems for collaborators; potential for conflicts; rewriting history |

| `git merge` | Creates a merge commit | Simpler, preserves the original history | Preserves original history; easier to revert to previous states | Can create complex merge commits; might not be as efficient for a linear history |

| `git revert` | Creates new commits that undo changes | Preserves original history | Useful for undoing mistakes; doesn’t rewrite history | Creates additional commits; not ideal for multiple commits |

Practical Scenarios and Use Cases

Mastering Git’s `reset`, `revert`, and `rebase` commands is crucial for efficient and organized development. These commands allow you to manipulate the commit history in various ways, but understanding their specific use cases is key to using them effectively. Choosing the right tool for the job is paramount to avoiding unintended consequences and maintaining a clean and understandable project history.

Real-World Examples of `git reset`

The `git reset` command is primarily used for quickly moving the branch pointer to a different commit. This is especially helpful in situations where you’ve made a mistake and want to discard some commits, or when you need to temporarily abandon work on a specific feature.

- Discarding incomplete work: Imagine you’ve started a new feature branch, but realized it’s not the right direction. A `git reset –hard HEAD~2` command could swiftly move your branch pointer back two commits, discarding all the intermediate work you’ve done since the second-to-last commit.

- Re-applying a specific commit: Suppose you have a bug in a commit that has already been pushed to a remote repository. `git reset –soft HEAD~1` could isolate the buggy commit, allowing you to re-apply it with the bug fix in a subsequent commit, rather than having to redo the whole process.

- Switching to a different development path: If a team decides to switch focus on a different feature, `git reset` can be employed to quickly re-establish the branch pointer to a previously committed point, preparing the team for the new direction.

When `git revert` is the Preferred Choice

`git revert` is a superior option to `git reset` when you need to undo changes without altering the project’s commit history. It creates a new commit that undoes the effects of the target commit.

- Preserving history: `git revert` creates a new commit, which preserves the complete commit history, unlike `git reset`, which can alter or delete parts of the history. This is vital for collaboration, as it allows everyone to see the exact changes that were made and reversed.

- Handling errors on remote branches: If you’ve pushed a faulty commit to a remote branch, `git revert` is ideal for fixing the issue without affecting the rest of the branch’s history, and preserving the record of the change.

- Maintaining a clear audit trail: In a collaborative environment, `git revert` leaves a clear record of the reversal, making it easier to understand why certain changes were undone. This is a key aspect of maintaining a transparent and understandable history.

When `git rebase` is More Suitable than `git merge`

`git rebase` is a more suitable option than `git merge` when you want to integrate your work into the main branch in a cleaner way. It rewrites the commit history by applying your commits directly onto the top of the main branch.

- Linear history: `git rebase` creates a linear commit history, streamlining the project’s development. This can make it easier to follow the evolution of the project, as the commit history is presented as a series of continuous steps.

- Avoiding merge commits: If you want to avoid creating merge commits, especially in small teams, `git rebase` can help create a clean, linear history. This can be especially helpful when integrating multiple small feature branches.

- Presenting a more streamlined history: When working on isolated features, rebase allows for a clean, focused history by incorporating your changes directly into the main branch’s history. This provides a clear picture of the feature’s evolution.

Decision-Making Flowchart

A flowchart (which cannot be rendered here) would visually guide you through choosing the appropriate command based on the context: Is the goal to modify the local branch’s history or create a new commit? Do you need to preserve the entire commit history, or is a cleaner, linear history preferred?

Collaborative Development Guide

In a collaborative environment, using these commands requires careful consideration of the project’s workflow. All changes should be communicated clearly within the team. This includes a clear understanding of when `git reset`, `git revert`, or `git rebase` should be employed, and the rationale behind the decision.

- Establish clear guidelines: Document the team’s preferred workflow for using these commands. Define which situations call for which command. This helps ensure consistency and avoid conflicts.

- Thorough communication: Before using `git reset`, `git revert`, or `git rebase`, inform the team about the intended action and the reasoning behind it. This is crucial for transparency and collaboration.

- Testing and review: Always thoroughly test changes before pushing them to a shared repository. If a mistake is discovered, `git revert` can help to address the problem without disrupting the entire project history.

Advanced Techniques and Considerations

Mastering Git’s reset, revert, and rebase commands involves more than just basic usage. Advanced techniques unlock powerful control over your project’s history, but require careful consideration to avoid unintended consequences. Understanding how to handle conflicts and strategically use interactive rebasing is crucial for maintaining a clean and efficient workflow, especially in collaborative environments. This section delves into these advanced aspects.Interactive rebasing allows for a more refined approach to restructuring your commit history.

It empowers you to rearrange commits and rewrite your project’s timeline, often leading to a cleaner and more understandable history, particularly when working with branches. However, this flexibility necessitates careful attention to potential pitfalls.

Interactive Rebasing with `git rebase -i`

Interactive rebasing, initiated with `git rebase -i`, enables you to modify the order and content of commits before merging them into the target branch. This powerful feature provides granular control over your commit history, allowing you to rearrange commits, squash multiple commits into one, or even edit commit messages. This process, while offering flexibility, necessitates careful attention to potential conflicts.

Handling Conflicts During Rebasing

Conflicts are inevitable when merging changes from different branches. During interactive rebasing, conflicts may arise if the target branch has advanced since you branched off. These conflicts require manual resolution before the rebase can continue.

- Identify the Conflict: Git will indicate the conflicting files with specific markers. These markers typically highlight the discrepancies between the staged and target branch versions.

- Resolve the Conflict: Manually edit the conflicting files, merging the necessary changes. Ensure your local changes are incorporated accurately.

- Stage and Continue: After resolving the conflicts, stage the updated files with `git add

`. Once all conflicts are resolved, execute `git rebase –continue` to resume the rebase process.

Backing Up the Repository

Before performing any significant operations like rebasing or resetting, creating a backup copy of your repository is paramount. This backup acts as a safety net in case you encounter unforeseen issues or make mistakes during the process. Tools like `git clone` can be used to create a local copy of your repository.

Identifying and Resolving Conflicts

Conflict resolution is a critical skill when working with Git. The process typically involves examining the conflicting files, understanding the differences, and manually merging the changes to reconcile the discrepancies. Tools such as a text editor with a diff view can aid in conflict resolution.

- Understanding Conflicts: Conflicts manifest as marked differences in the file’s content, usually indicating where the local and remote versions diverge.

- Manual Resolution: Manually resolve the discrepancies by editing the conflicting files. Often, Git provides visual markers to pinpoint the points of divergence.

- Staging and Continuing: Once the conflicts are resolved, stage the modified files and continue the rebase or merge process.

Preventing Common Errors

Maintaining a clean and consistent workflow minimizes errors when using Git’s advanced features. Careful planning and verification steps are crucial to avoid unexpected issues.

- Backup Regularly: Always back up your repository before performing significant operations like rebasing or resetting. This precaution ensures you can revert to a previous state if necessary.

- Understand Branching: A thorough understanding of branching strategies and their interactions is crucial to avoid conflicts and maintain a clear commit history.

- Test Thoroughly: After making changes to your repository, thoroughly test your code to identify and resolve any bugs or issues before committing them to the main branch. This proactive approach minimizes the potential for introducing errors into the main branch.

Best Practices for Production

In a production environment, using Git’s advanced features demands extra caution. Following best practices ensures a smooth and controlled workflow.

- Thorough Testing: Always thoroughly test changes in a staging or development environment before deploying to production. This mitigates the risk of introducing errors into the live system.

- Careful Commit Messages: Precise and descriptive commit messages are essential for understanding the changes and facilitating collaboration.

- Automated Testing: Integrate automated testing into your workflow to ensure that changes don’t introduce regressions or other unintended consequences.

Last Word

In conclusion, mastering `git reset`, `git revert`, and `git rebase` empowers you to confidently manage your Git repository. This guide has explored the intricacies of each command, from the foundational concepts to advanced techniques. By understanding their unique effects on your commit history and working directory, you’ll be better equipped to make informed decisions in various development scenarios.

Remember to always prioritize backups and understand the potential consequences of each command, especially in collaborative environments.