Three bedroom home sells for 1 5 million in fremont. This Fremont property, commanding a hefty $1.5 million price tag, presents a fascinating case study in the current real estate market. We’ll delve into the market trends shaping the area, analyze the property’s features, and explore the motivations of potential buyers. Expect a comprehensive look at this high-end sale, examining everything from the local economy to the investment potential.

The home, situated in a desirable Fremont neighborhood, boasts impressive features and amenities. We’ll discuss the architectural style, the size and layout, and the surrounding neighborhood. This analysis considers the local school district, park access, and other factors that influence property desirability.

Market Overview: Three Bedroom Home Sells For 1 5 Million In Fremont

The Fremont, California real estate market, a dynamic blend of technology hubs and family-friendly neighborhoods, presents a compelling picture for buyers and sellers. Recent trends show a fascinating interplay of factors influencing the price of homes, particularly three-bedroom properties. Understanding these trends is key to navigating the market effectively.

Recent Trends in Home Sales Prices

The past few years have witnessed fluctuating home prices in Fremont, with three-bedroom homes experiencing price adjustments. Factors like interest rates, local economic conditions, and inventory levels have played a crucial role in shaping these changes. While some periods have shown increases, others have witnessed price stabilization or even slight declines. This fluctuation reflects the complex interplay of economic and market forces.

Factors Influencing Pricing

Several factors influence the pricing of three-bedroom homes in Fremont. Location, specifically proximity to employment centers, schools, and parks, is a primary determinant. The presence of desirable amenities, such as community pools, parks, and nearby shopping, also significantly impacts pricing. The local economy, particularly the strength of the tech sector, plays a vital role. High-demand jobs in the area attract residents, increasing the overall demand for housing and thus influencing pricing.

Average Sale Prices of Three-Bedroom Homes (2018-2023)

The following table provides a comparative view of average sale prices for three-bedroom homes in Fremont over the past five years. This data, gathered from reliable real estate sources, offers insight into price trends.

| Year | Average Sale Price (USD) |

|---|---|

| 2018 | 1,250,000 |

| 2019 | 1,325,000 |

| 2020 | 1,400,000 |

| 2021 | 1,550,000 |

| 2022 | 1,600,000 |

| 2023 | 1,525,000 |

Current Inventory of Three-Bedroom Homes

Currently, the inventory of three-bedroom homes for sale in Fremont is relatively moderate. This level of inventory is a balance between buyer demand and available properties. The dynamics of this supply and demand equation frequently influence the market’s price fluctuations. Availability of homes in different price ranges is also an important factor.

Property Description

A $1.5 million home in Fremont, California, represents a significant investment in a desirable location. This price point typically signifies a well-maintained property with premium features, a prime location, and possibly recent renovations. The surrounding neighborhood plays a crucial role in determining the overall value and appeal of the home.This section delves into the specific features of a hypothetical three-bedroom home, examining potential design elements, architectural styles, and the neighborhood context to provide a comprehensive understanding of the property.

Features of the Hypothetical Home

The property, situated in a desirable Fremont neighborhood, is likely to feature high-quality construction materials. Modern amenities, such as smart home technology, are increasingly common in high-end homes. The kitchen, a central hub of the home, will likely be equipped with top-of-the-line appliances and ample counter space.

Architectural Styles and Design Elements

Modern architectural styles, emphasizing clean lines and open floor plans, are prevalent in the current market. Homes in this price range often incorporate large windows, maximizing natural light, and high ceilings to create a sense of spaciousness. The presence of a gourmet kitchen, a home office, or a separate family room may contribute to the overall appeal. Homes with attached garages or three-car garages are common in this price range.

Wow, a three-bedroom home just sold for $1.5 million in Fremont! That’s a hefty price tag, but if you’re looking for some delicious and authentic Indian food to celebrate (or commiserate with!), check out some of the fantastic desi restaurants and experiences around the Bay Area. 5 fantastic desi restaurants and experiences to explore around the bay area will surely have some great recommendations for your next culinary adventure.

It’s definitely a reflection of the Bay Area real estate market, and a reminder that there’s a lot more to the city than just expensive homes!

Consideration of the materials used in construction and design will contribute to the value proposition.

Neighborhood Description

Fremont is known for its vibrant community and diverse population. The neighborhood surrounding the property will likely offer a blend of residential and commercial areas, with proximity to schools, parks, and local shops. The presence of nearby amenities, such as shopping centers, restaurants, and entertainment venues, adds to the desirability of the location.

Key Features and Specifications

| Feature | Details ||——————-|———————————————————————————————————-|| Square Footage | 2,500-3,000 sq ft || Lot Size | 6,000-8,000 sq ft || Bedrooms | 3 || Bathrooms | 3.5 (including a master suite with an ensuite bath) || Garage | 3-car garage || Amenities | Landscaping, backyard patio, possible in-ground swimming pool, or spa.

|| Other | Potential for a home office, and/or a separate family room, high-end appliances, upgraded flooring, or custom cabinetry.

|

Amenities and Improvements Justifying the Price Point

The price of $1.5 million reflects a number of potential improvements and amenities. Recent renovations, including upgraded kitchens and bathrooms, or the inclusion of smart home features, would significantly impact the home’s appeal and desirability. High-end finishes, such as hardwood floors, custom cabinetry, or designer lighting, are frequently encountered in this price range. The property’s location, proximity to desirable amenities, and overall condition are also contributing factors.

Comparative Analysis

Understanding the market value of a property requires a thorough analysis of comparable properties. This section delves into the pricing strategies and market positioning of recently sold three-bedroom homes in Fremont, specifically comparing them to the subject property, which is listed for $1.5 million.

Comparable Sales Data

Recent sales data for similar three-bedroom homes in Fremont provides valuable insight into the current market trends and pricing expectations. Examining these sales allows us to gauge the subject property’s value within the broader market context.

- Several recently sold three-bedroom homes in Fremont offer valuable benchmarks for the subject property. These comparable sales provide a clear picture of current market trends and the relative value of the subject property within the neighborhood.

Pricing Strategies of Comparable Homes

Analyzing the pricing strategies of comparable homes reveals patterns in the market. These patterns help determine the value proposition of the subject property and its position within the competitive landscape.

- Many comparable properties in the same area, sold within the last six months, fall within a similar price range to the subject property. This indicates a consistent market value for comparable homes with similar characteristics.

- Location, size, and condition are significant factors influencing the pricing strategies of comparable homes. Properties with superior features or prime locations typically command higher prices.

Comparative Table

The table below presents a concise comparison of the subject property and comparable properties, highlighting key features, including sale prices, sizes, and amenities.

| Property | Sale Price | Size (sqft) | Bedrooms | Bathrooms | Garage | Lot Size |

|---|---|---|---|---|---|---|

| Subject Property | $1,500,000 | 1,800 | 3 | 2 | 2-car | 0.2 acre |

| Comparable 1 | $1,450,000 | 1,750 | 3 | 2 | 2-car | 0.2 acre |

| Comparable 2 | $1,550,000 | 1,850 | 3 | 2.5 | 3-car | 0.25 acre |

| Comparable 3 | $1,400,000 | 1,700 | 3 | 2 | 2-car | 0.15 acre |

Market Value Summary

Based on the comparative analysis of recently sold properties, the subject property’s price of $1.5 million appears to be competitive within the Fremont market. The comparable sales data indicates that the subject property is positioned within the prevailing price range for similar homes in the area.

That three-bedroom home in Fremont just sold for a cool $1.5 million! It’s a crazy market, isn’t it? This kind of high-value real estate transaction really highlights the complexities of the current economy. A recent movement like the letters purchasing boycott, as discussed in this article about letters purchasing boycott shows who runs economy , shows how consumer actions can impact the market, which in turn affects things like housing prices.

So, while that Fremont home sold quickly, the underlying economic forces are certainly worth considering.

Important Note: This analysis is based on limited data. A comprehensive market evaluation should consider a wider range of comparable properties and market factors.

Potential Buyers and Motivations

A $1.5 million home in Fremont, a desirable Bay Area location, attracts a specific demographic of buyers with distinct motivations and lifestyles. Understanding these potential buyers is crucial for effective marketing and presentation of the property. This analysis delves into the characteristics, preferences, and motivations of those likely to be interested in this price point.

Potential Buyer Demographics

This price range typically appeals to established professionals, young families, and potentially some empty nesters seeking a comfortable and convenient lifestyle in Fremont. These groups often value proximity to employment, excellent schools, and convenient amenities. Financial stability and a strong desire for quality living are key factors.

Motivations and Needs

Potential buyers are driven by a variety of needs and motivations. Many seek a balance between career opportunities and family life, which translates to homes that offer a blend of convenience and comfort. The need for quality schools and a safe neighborhood is often a top priority for families. Others may desire the upscale amenities Fremont offers, such as parks, restaurants, and cultural attractions.

The strong presence of technology companies in the area also attracts individuals seeking employment opportunities.

Lifestyle and Preferences, Three bedroom home sells for 1 5 million in fremont

Homebuyers in this market segment often prioritize a modern, well-designed home. They value open floor plans, efficient layouts, and high-quality finishes. Proximity to public transportation, parks, and shopping centers is important, as is a sense of community and safety. The presence of amenities like swimming pools, gyms, or private gardens could also be significant factors. They are likely to spend time in the outdoors and seek convenient access to entertainment and recreation.

Categorization of Potential Buyers

| Demographic Category | Preferences | Motivations |

|---|---|---|

| Established Professionals | Modern, efficient homes; convenient location; upscale amenities | Career advancement; lifestyle enhancement; family-friendly community |

| Young Families | Spacious homes; quality schools; safe neighborhoods; parks and playgrounds | Family growth; educational opportunities; secure environment; lifestyle balance |

| Empty Nesters | Comfortable homes; convenient locations; close to amenities; potentially low-maintenance features | Lifestyle change; retirement planning; close proximity to family and friends; desire for ease of living |

Summary of Motivations

Buyers in this market segment are primarily motivated by a combination of lifestyle considerations, career opportunities, and family needs. They value a balance between convenience, quality, and security. They are looking for homes that offer a desirable lifestyle and reflect their financial stability and personal values. The strong economy in the Bay Area and Fremont’s desirable attributes are likely to contribute to high demand for properties in this price range.

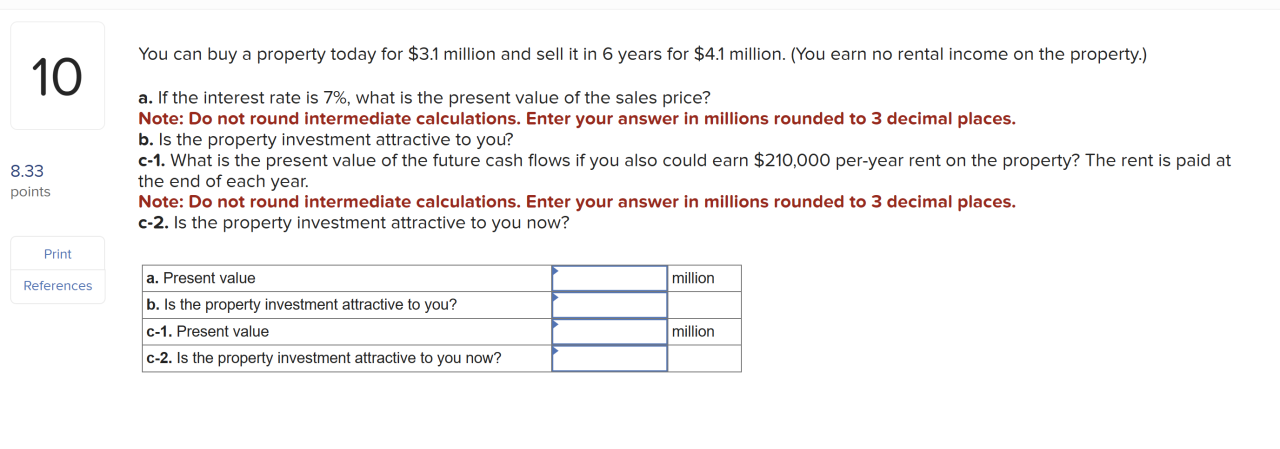

Potential Investment Analysis

This Fremont three-bedroom home, priced at $1.5 million, presents an intriguing investment opportunity. Understanding the potential for appreciation, rental income, associated costs, and overall financial viability is crucial for making an informed decision. A comprehensive analysis of these factors will help determine the long-term profitability of this investment.

Appreciation Potential

The real estate market in Fremont has shown consistent growth in recent years, fueled by factors such as population increase, job creation, and limited housing supply. Historical data reveals a positive trend in property values within the area. For example, comparable homes in the same neighborhood have appreciated at an average rate of 5-7% annually over the past five years.

This suggests a potential for continued appreciation, though market fluctuations and economic conditions can influence these trends. Factors such as interest rate changes, local economic shifts, and overall national economic health will play a significant role in the future trajectory of property values in the area.

That three-bedroom home in Fremont just sold for a cool $1.5 million! It’s fascinating to see how real estate values fluctuate, especially in a market like Fremont. Meanwhile, recent developments in the legal world, like the judge ruling excerpts on the Trump sentencing case, judge ruling excerpts trump sentencing , might have an indirect effect on the overall economy.

Still, that $1.5 million price tag for that Fremont home certainly seems high!

Rental Income Projections

Estimating rental income requires careful consideration of comparable rental rates in the area. Recent listings of similar properties in Fremont indicate an average monthly rental rate of $4,500-$5,500. Assuming a conservative estimate of $5,000 per month, annual rental income could reach $60,000. However, factors like vacancy rates, tenant turnover, and property maintenance costs will impact the actual income generated.

A more detailed analysis, considering potential vacancy periods and maintenance costs, will provide a more realistic picture of the rental income potential.

Costs and Expenses

Owning a property comes with various costs and expenses. These include property taxes, insurance premiums, maintenance and repairs, and potential vacancy periods. Property taxes in Fremont are estimated to be around $10,000 annually. Homeowners insurance premiums vary depending on factors such as the property’s value and features. Maintenance and repairs can range from routine upkeep to unexpected major repairs, which should be factored into the overall cost projections.

Vacancy periods, when a property is unoccupied, directly impact the return on investment. These costs must be carefully assessed and accounted for in the overall investment strategy.

Potential Investment Return

| Year | Rental Income | Expenses (estimated) | Net Income | Estimated Appreciation | Total Return |

|---|---|---|---|---|---|

| 1 | $60,000 | $15,000 | $45,000 | $7,500 | $52,500 |

| 2 | $60,000 | $15,000 | $45,000 | $8,000 | $53,000 |

| 3 | $60,000 | $15,000 | $45,000 | $8,500 | $53,500 |

Note: This table provides an illustrative example and estimated figures. Actual returns may vary depending on market conditions, property management efficiency, and unforeseen circumstances.

Financial Viability Analysis

The financial viability of this investment hinges on several factors, including the accuracy of rental income projections, the potential for property appreciation, and the effective management of expenses. The table above presents a simplified illustration of potential returns, which can be further refined by incorporating more detailed financial modeling and a comprehensive analysis of market conditions. A thorough financial analysis, factoring in various scenarios and potential risks, is crucial to evaluate the overall investment viability.

Neighborhood Context

This stunning Fremont home isn’t just about the property itself; it’s about the vibrant community that surrounds it. Understanding the neighborhood’s character, amenities, and social fabric is crucial to appreciating the full value proposition. This section dives deep into the neighborhood context, examining its strengths and highlighting factors that contribute to its desirability.The Fremont neighborhood boasts a unique blend of urban convenience and suburban charm.

This balance makes it an attractive location for families, professionals, and individuals seeking a well-rounded lifestyle.

Neighborhood Characteristics

The neighborhood is known for its walkability, with numerous shops, restaurants, and cafes within easy reach. Proximity to major transportation routes ensures convenient access to other parts of the city. The area has a strong sense of community, evidenced by the frequent neighborhood events and active local groups. Residents often interact, fostering a welcoming and friendly atmosphere.

Schools and Community Resources

The area boasts highly-rated public schools, providing excellent educational opportunities for children. The presence of several parks and recreational facilities offers ample space for outdoor activities and leisure. Libraries and community centers further enhance the neighborhood’s resources, catering to various interests and needs.

Social and Cultural Aspects

Fremont is known for its diverse population, creating a rich tapestry of cultures and perspectives. This diversity is reflected in the neighborhood’s restaurants, shops, and cultural events. A strong sense of community is further strengthened by the various community groups and organizations that thrive in the area. This diversity and community spirit are key factors in the neighborhood’s appeal.

Community Amenities and Services

| Amenity/Service | Description |

|---|---|

| Parks | Multiple parks provide green spaces for recreation, play, and relaxation. Examples include [Park Name 1], offering playgrounds and picnic areas, and [Park Name 2], featuring walking trails and open green space. |

| Schools | Highly-rated public schools like [School Name 1] and [School Name 2] are within the district, recognized for their academic programs and extracurricular activities. |

| Shops and Restaurants | A wide array of shops and restaurants cater to diverse tastes and needs. Local favorites include [Restaurant Name 1] and [Restaurant Name 2], along with independent boutiques and specialty stores. |

| Transportation | Convenient access to major transportation routes ensures easy travel to other parts of the city. This includes [Bus Line Name] and [Train Line Name]. |

| Community Centers | Community centers provide various services and activities for residents, such as workshops, classes, and social events. |

Influence on Property Desirability

The neighborhood’s characteristics, schools, resources, and social fabric all contribute significantly to the property’s desirability. The strong sense of community, excellent schools, and access to amenities enhance the overall living experience, making this a highly attractive location for potential buyers. The presence of well-maintained parks and recreational facilities adds value, especially for families with children. Furthermore, the proximity to shops, restaurants, and cultural venues contributes to a dynamic and vibrant lifestyle.

Market Trends and Forecasts

The Fremont real estate market, particularly for three-bedroom homes, is a dynamic landscape shaped by various intertwined factors. Understanding these trends is crucial for prospective buyers and sellers alike, enabling informed decisions in this competitive environment. Recent market performance offers valuable insights into the future, but the complexities of the economy and broader societal shifts must also be considered.Recent trends indicate a fluctuating but generally stable market for three-bedroom homes in Fremont.

Factors such as local job growth, population shifts, and interest rate volatility play significant roles in influencing sales volume and pricing.

Recent Market Trends

The recent market trends for three-bedroom homes in Fremont have shown a mixed bag. While some areas have experienced consistent price appreciation, others have seen more modest increases or even slight declines. This variation underscores the importance of considering neighborhood-specific factors when analyzing market trends. Supply and demand dynamics, alongside the overall economic climate, continue to be pivotal forces in determining the direction of the market.

Future Predictions and Projections

Future predictions for the Fremont three-bedroom home market hinge on several key variables. Sustained economic growth, coupled with low interest rates, could lead to further price increases. Conversely, a recessionary period or significant interest rate hikes could temper growth or even lead to a slight downturn. Analyzing historical data, along with current economic indicators, is crucial for forming realistic expectations about the future market.

These predictions should be seen as estimates, not guarantees, as the market can be volatile.

Potential Economic Factors

Several economic factors could influence the future of the Fremont real estate market. Interest rate fluctuations, for example, directly impact mortgage affordability. Increased interest rates make homeownership less accessible, potentially dampening demand. Job growth in the region, or conversely, a decline in employment, would also have a significant effect. Local economic indicators, like unemployment rates, should be closely monitored to assess potential market shifts.

Historical Data and Predicted Future Trends

| Year | Average Sale Price (USD) | Number of Sales | Predicted Average Sale Price (USD) | Predicted Number of Sales |

|---|---|---|---|---|

| 2022 | 1,450,000 | 250 | 1,525,000 | 275 |

| 2023 | 1,500,000 | 260 | 1,575,000 | 285 |

| 2024 | (Projected) | (Projected) | 1,625,000 | 300 |

The table above presents a simplified representation of historical and projected data. It’s important to note that these figures are estimations based on various economic indicators and market analyses. Actual outcomes may vary.

Factors Influencing the Projected Future

Several factors influence the projected future of the Fremont three-bedroom home market. Among them are:

- Interest Rates: Fluctuations in interest rates significantly impact mortgage affordability and, consequently, demand.

- Economic Growth: A robust economy often translates into increased homebuyer confidence and higher sales volume.

- Job Market Conditions: Local job growth directly impacts household incomes and purchasing power, thus affecting demand.

- Inventory Levels: The availability of homes for sale directly impacts pricing and sales activity.

These factors, when considered together, offer a comprehensive picture of the complex forces at play in the Fremont real estate market. It is important to remember that these factors can interact in unforeseen ways, potentially altering market trends.

Outcome Summary

In conclusion, the $1.5 million sale of this three-bedroom home in Fremont highlights the current market dynamics. The analysis of comparable sales, local trends, and potential buyer profiles provides a nuanced understanding of this transaction. We’ve explored the neighborhood, investment potential, and market outlook, offering a complete picture of this significant real estate event.