Biden admin to forgive debt for students of former San Diego based Ashford University. This initiative promises significant financial relief for those impacted by the closure of Ashford University. The program, a complex undertaking, involves navigating the intricacies of student loan forgiveness policies, and evaluating the potential ramifications for former students, taxpayers, and the higher education sector as a whole.

Understanding the specific circumstances surrounding Ashford’s closure, the Biden administration’s approach to student loan forgiveness, and the potential impact on former students is crucial for a complete picture of this important development.

Ashford University, a former San Diego institution, closed its doors, leaving many students with outstanding student loan debt. This article delves into the historical context of the university’s closure, highlighting its founding, mission, and the specific challenges faced by students. We will also examine the Biden administration’s broader student loan forgiveness policies, comparing them to previous administrations’ approaches.

The potential impact on former Ashford students, including potential obstacles and solutions, will also be explored.

Background on Ashford University

Ashford University, a now-defunct institution located in San Diego, California, offered a unique blend of online education and affordability. Founded with the aim of providing accessible higher education, it attracted a significant student body, particularly those seeking flexible learning options. However, its eventual closure left a considerable impact on its former students.Ashford University’s online format, coupled with its focus on affordability, resonated with a diverse student population.

This model, while appealing to many, ultimately proved challenging to maintain financial stability in the competitive higher education landscape.

Founding and Location

Ashford University was established in 2002. Its San Diego location placed it in a region with a robust higher education tradition, though its unique online format offered a different approach. The institution aimed to cater to students who might not have had access to traditional, on-campus programs.

The Biden administration’s decision to forgive student loan debt for former Ashford University students in San Diego is a welcome relief, but it pales in comparison to the recent political developments. For example, the latest line in the political landscape suggests a good week for Daniel Lurie, a good week for Daniel Lurie, a bad week for Karen Bass , which is certainly interesting given the ongoing debate about student loan forgiveness programs.

Ultimately, though, this debt relief for Ashford students is a positive step for those affected, regardless of the political maneuvering.

Mission and Programs

Ashford University’s mission was to provide affordable and accessible higher education. Their program offerings focused on undergraduate degrees in various fields, including business, liberal arts, and technology. The university targeted a specific student demographic – adult learners, often working professionals or those seeking a second career – and its financial aid policies were designed to support these individuals.

Student Demographics and Financial Aid

Ashford University attracted a large number of working adults and students with family obligations. Financial aid policies were tailored to assist these students. This focus on accessibility and affordability was a key part of their appeal.

Closure and Impact

The university’s closure in 2022 left many students in a challenging situation. The sudden cessation of operations impacted students who had already invested time and money into their education. The loss of access to their degree programs, coupled with the potential loss of financial aid, presented significant hurdles.

| Date | Event | Description |

|---|---|---|

| 2002 | Founding | Ashford University was established in San Diego, California. |

| 2022 | Closure | Ashford University ceased operations, impacting thousands of students. |

Biden Administration’s Student Loan Forgiveness Policies

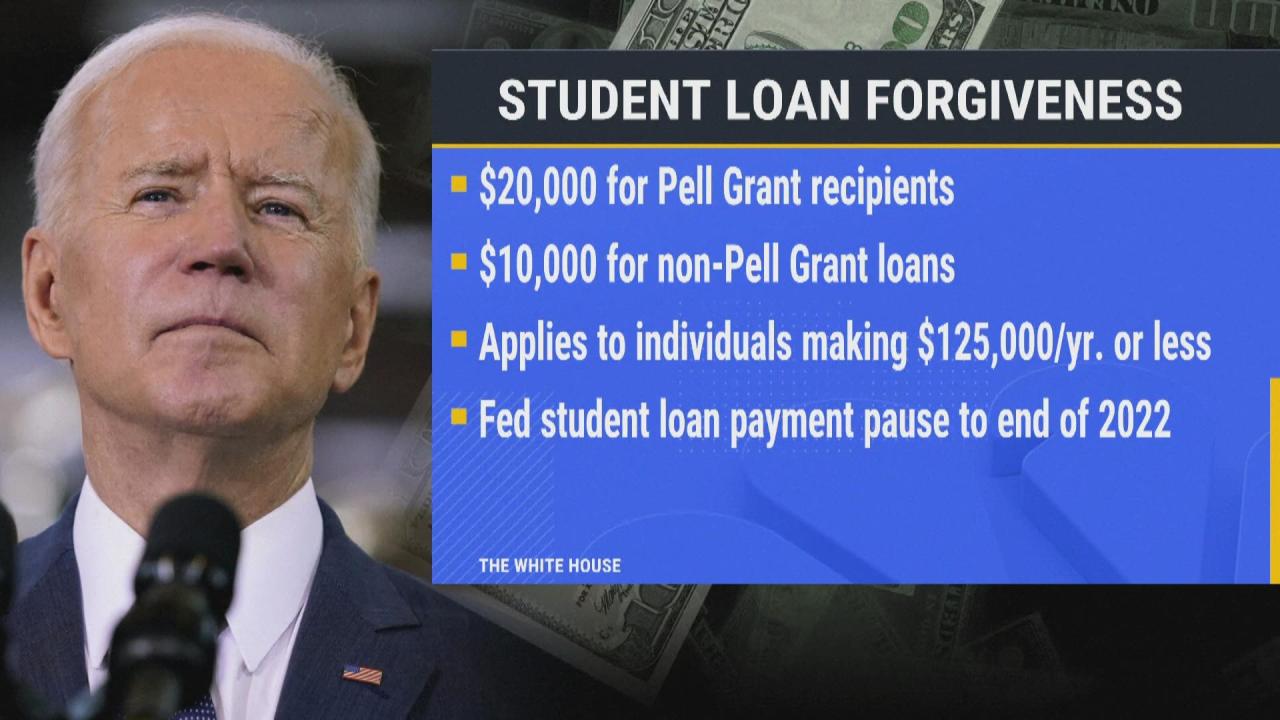

The Biden administration has taken a significant step toward addressing the substantial student loan debt burden facing millions of Americans. This initiative aims to provide relief and opportunity for those struggling with these financial obligations, while also considering the broader economic implications. The administration’s approach to student loan forgiveness is a complex issue, with diverse viewpoints on its effectiveness and long-term consequences.The administration’s policies are designed to address the financial strain of student loan debt and offer pathways to financial stability.

The Biden administration’s move to forgive student loan debt for former Ashford University students in San Diego is a significant step. While this is happening, it’s interesting to note that China is reportedly considering selling TikTok’s US operations to Elon Musk, potentially impacting the social media landscape. Ultimately, these seemingly disparate events highlight a broader trend of significant financial and social shifts.

The Ashford University debt forgiveness is still a crucial step for many former students.

These policies aim to stimulate economic activity and reduce the impact of student debt on individuals’ financial well-being. However, the specific programs and eligibility criteria vary, and it’s essential to understand the nuances to navigate the process effectively.

Eligibility Criteria for Loan Forgiveness Programs

The eligibility criteria for student loan forgiveness programs under the Biden administration are multifaceted and often based on factors such as income, the type of loan, and the institution that issued the loan. These criteria are meant to ensure that the programs reach those most in need. Understanding these criteria is crucial for determining eligibility and navigating the application process.

- Income-driven repayment plans: These plans adjust monthly payments based on borrowers’ income and family size. Many borrowers may qualify for a significant reduction in their monthly payments, allowing them to focus on other financial priorities.

- Public Service Loan Forgiveness (PSLF): This program provides forgiveness for qualifying individuals working in public service jobs, such as teachers, nurses, and firefighters. The criteria for PSLF are quite specific and often involve demonstrating consistent employment in a qualifying field.

- Borrower Defense to Repayment (BDR): This program allows borrowers to have their loans discharged if they were defrauded by a school or faced specific circumstances that prevented them from completing their studies.

Comparison with Previous Administrations’ Policies

The Biden administration’s approach to student loan forgiveness represents a departure from previous administrations. While some initiatives existed, the scale and scope of the Biden administration’s programs are notably different. This shift in policy reflects the growing recognition of the need for significant student debt relief.

- Historical context: Previous administrations have focused on various approaches to student loan debt, ranging from limited loan modifications to targeted assistance programs for specific groups. The Biden administration, however, is focusing on more comprehensive and widespread relief programs, aiming to impact a broader range of borrowers.

- Emphasis on income-driven plans: Income-driven repayment plans are a cornerstone of the Biden administration’s approach, providing greater flexibility and potentially alleviating financial strain on borrowers.

Key Features of Different Forgiveness Programs

A comparison of different loan forgiveness programs can provide clarity on their eligibility criteria, the amount forgiven, and deadlines. The table below highlights these features:

| Program Name | Eligibility Requirements | Amount Forgiven | Application Deadlines |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | 10 years of qualifying employment in a public service job | Full loan balance | Ongoing; specific deadlines vary based on individual circumstances |

| Borrower Defense to Repayment (BDR) | Evidence of school fraud or other extenuating circumstances that prevented completion of studies | Full loan balance | Ongoing; specific deadlines vary based on individual circumstances |

| Income-Driven Repayment Plans | Based on income, family size and loan type | Variable; may result in forgiveness of some portion of the debt over time | Ongoing; specific deadlines vary based on individual circumstances |

Impact on Former Ashford Students

The Biden administration’s student loan forgiveness initiative presents a complex picture for former Ashford University students. While the potential for significant financial relief exists, hurdles and challenges must be considered. Understanding the specific implications for this student population is crucial for a complete picture of the program’s effects.The program’s success in providing financial relief to former Ashford students hinges on several factors.

The potential benefits are substantial, yet obstacles must be carefully evaluated. Navigating the intricacies of the forgiveness process, including eligibility criteria and application procedures, is essential for maximizing the program’s impact.

Potential Effects of Student Loan Forgiveness

The relief from student loan debt can significantly impact the financial well-being of former Ashford students. This can lead to increased disposable income, allowing for more savings, investments, or debt consolidation. Reduced financial strain could potentially improve their overall quality of life, enabling them to focus on other life goals. For instance, those burdened by high student loan payments might now afford to start a business or pursue further education, opening new avenues for career advancement.

Financial Relief Provided

Potential financial relief could vary greatly based on the individual’s loan amount and terms. A significant portion of student loan debt could be forgiven, leading to substantial savings and reduced monthly payments.

This relief could be especially valuable for students who have struggled to repay their loans, particularly those who encountered financial hardships during or after graduation. For example, individuals who experienced job market shifts or unexpected personal circumstances might find that the program significantly improves their financial position.

Obstacles to Accessing Loan Forgiveness

Former Ashford students, like other borrowers, may face various obstacles in accessing loan forgiveness. Eligibility requirements, such as specific program participation and degree completion, could be a challenge for some. Furthermore, navigating the application process and meeting all documentation requirements might present additional obstacles. Documentation requirements and eligibility criteria might be complex and challenging for former students who have had significant life changes since their student loan was taken out.

Legal and Regulatory Challenges

Legal and regulatory challenges surrounding the program could also affect former Ashford students.

Potential legal disputes or regulatory changes related to the forgiveness program could impact the timeline and accessibility of the relief. Any delays or modifications to the program’s structure could affect the financial benefits to the former Ashford students. The program’s ongoing legal and regulatory environment will shape the experience of those attempting to gain relief from their student loan debt.

Potential Outcomes for Ashford Students

| Aspect | Positive Outcomes | Negative Outcomes |

|---|---|---|

| Financial Relief | Reduced debt burden, increased disposable income, improved financial stability | Potential for administrative issues, delayed or incomplete relief, lack of awareness of the program |

| Employment Opportunities | Increased ability to pursue further education or career advancement, reduced financial strain, increased motivation | Potential for challenges in accessing the program if they are no longer eligible, lack of program awareness, bureaucratic issues |

| Personal Well-being | Improved financial well-being, improved quality of life, increased focus on personal goals | Potential for increased stress or anxiety during the application process, potential for disappointment if not eligible |

Public Perception and Discussion: Biden Admin To Forgive Debt For Students Of Former San Diego Based Ashford University

Student loan forgiveness, a politically charged issue, has sparked a wide range of opinions from various stakeholders. The potential impact on individuals, the economy, and the future of higher education necessitates a nuanced understanding of the perspectives involved. The Biden administration’s recent actions regarding student loan forgiveness for former Ashford University students add another layer to this complex discussion.Public sentiment regarding student loan forgiveness is deeply divided.

Arguments for and against the policy often hinge on different values and priorities. Those in favor highlight the potential for economic relief and social mobility, while opponents emphasize the fairness of the system and the financial burden on taxpayers.

Public Opinions on Student Loan Forgiveness

The public’s perspective on student loan forgiveness is multifaceted and reflects the diverse interests of various groups. Students who have accumulated substantial debt often view forgiveness as a vital lifeline, offering a path toward financial stability and reduced stress. Conversely, taxpayers may view the cost of loan forgiveness as a burden on the public treasury, questioning its equitable distribution and potential long-term effects on the economy.

Lenders and financial institutions also have a vested interest, as forgiveness can impact their revenue streams and investment strategies.

Arguments for Student Loan Forgiveness

Advocates for student loan forgiveness often point to the significant financial hardship faced by many borrowers. High student loan debt can hinder individuals from achieving financial independence, impacting homeownership, starting families, and investing in their future. Proponents argue that forgiveness can stimulate the economy by increasing consumer spending and reducing financial strain on individuals. A 2022 article in the

The Biden administration’s move to forgive student loan debt for former Ashford University students in San Diego is a big deal. This highlights the complex web of financial aid and the need for robust systems to manage these programs. Effective grant management systems, like the ones reviewed on best grant management systems , are crucial for ensuring these types of initiatives are implemented smoothly and fairly.

Hopefully, this will help alleviate some of the financial burdens faced by those impacted by Ashford University’s closure.

New York Times*, for example, detailed how student loan debt can impede upward mobility and limit opportunities for young adults.

Arguments Against Student Loan Forgiveness

Critics of student loan forgiveness often raise concerns about the fairness of the system. They contend that forgiveness disproportionately benefits those who have already made choices about their education and careers, while leaving other taxpayers to shoulder the burden. Some argue that forgiveness could discourage future students from taking on the financial responsibility associated with higher education. Furthermore, critics express concerns about the potential long-term impact on the economy and the solvency of the federal government.

Political Implications for the Biden Administration

Student loan forgiveness carries significant political implications for the Biden administration. The decision to forgive debt for former Ashford University students is likely to be met with both praise and criticism from different political factions. Public reaction could influence voter sentiment in upcoming elections and potentially affect the administration’s broader agenda.

Broader Implications for Higher Education and Student Debt

The student loan forgiveness program has broad implications for higher education and the future of student debt in the US. It could affect future enrollment decisions, tuition costs, and the overall financial structure of educational institutions. The long-term impacts of this policy on both individual borrowers and the economy require careful monitoring and analysis.

Viewpoints on Student Loan Forgiveness

| Viewpoint | Supporting Argument | Evidence/Source |

|---|---|---|

| Pro-Forgiveness | Student loan forgiveness can alleviate financial hardship and stimulate economic growth. | Research from various economic institutions, e.g., the Brookings Institution, highlighting the correlation between reduced debt and increased spending. |

| Anti-Forgiveness | Forgiveness is unfair to taxpayers and could discourage future students from taking on educational debt. | Statements from conservative think tanks, like the Heritage Foundation, arguing that loan forgiveness is a form of wealth redistribution. |

| Neutral | The policy’s long-term effects on the economy and higher education are still uncertain and require further study. | Academic articles and reports that highlight the lack of conclusive data on the long-term impacts of student loan forgiveness programs. |

Potential Challenges and Solutions

The Biden administration’s initiative to forgive student loan debt for former Ashford University students presents a complex logistical undertaking. Ensuring accurate identification of eligible borrowers, resolving potential disputes, and managing the administrative burden are critical for a smooth and equitable implementation. This section will explore the potential hurdles and propose pragmatic solutions.

Verification of Enrollment and Eligibility

Accurate verification of enrollment and eligibility for former Ashford students is paramount. Incorrect identification can lead to ineligible borrowers receiving forgiveness or eligible borrowers being overlooked. A robust system for validating enrollment records, potentially leveraging partnerships with the university’s archives or student information systems, is essential. This includes verifying degrees earned, course completion, and time of enrollment to match specific loan programs.

- Streamlining Verification Processes: Implementing a streamlined verification process, potentially using online portals and automated systems for initial eligibility checks, can expedite the process. This approach reduces manual data entry and potential errors. Clear, concise instructions and FAQs for students will help ensure correct data submission. Examples of such systems include online portals for document uploads and automated matching algorithms to cross-reference student records with loan applications.

- Data Integration and Collaboration: Establishing robust data sharing agreements between the Department of Education, Ashford University, and private loan providers can help avoid discrepancies and ensure accurate data integration. This can involve the use of secure data transfer protocols to guarantee data integrity.

Resolving Potential Disputes, Biden admin to forgive debt for students of former san diego based ashford university

Disputes regarding eligibility, enrollment status, or loan amounts are inevitable in any large-scale loan forgiveness program. A well-defined dispute resolution mechanism is crucial to address these concerns promptly and fairly.

- Establishing Dispute Resolution Mechanisms: Creating a dedicated dispute resolution team with clear procedures and timelines will help manage the volume of complaints effectively. This should include multiple tiers of appeals, with options for mediation and arbitration. The establishment of clear communication channels is also critical for this. Transparency in the process is vital for maintaining trust and fostering a positive public perception.

- Appeals Process and Timelines: Establishing a structured appeals process with specific timelines for each stage can ensure that student concerns are addressed promptly and fairly. Providing clear and easily accessible information about the appeals process will prevent misunderstandings and potential delays.

Administrative and Logistical Challenges

The sheer volume of student loans and the administrative complexity involved in a large-scale forgiveness program pose substantial challenges. Efficient processes are required to manage the administrative burden, ensuring accuracy and timeliness.

- Automation and Technology: Implementing automation tools, software, and technological solutions can significantly reduce manual labor, streamline tasks, and minimize the risk of human error. Leveraging artificial intelligence and machine learning for data analysis and processing can accelerate the forgiveness process while maintaining accuracy.

- Resource Allocation: Adequately allocating resources, including staff, funding, and technology, is critical to managing the administrative burden effectively. Planning for potential increases in workload, especially during peak periods, is also essential.

Table of Potential Challenges and Solutions

| Potential Challenges | Suggested Solutions |

|---|---|

| Verifying enrollment and eligibility for former Ashford students | Streamlining verification processes, leveraging data integration and collaboration |

| Resolving potential disputes regarding eligibility, enrollment status, or loan amounts | Establishing dispute resolution mechanisms, including appeals processes with clear timelines |

| Managing the administrative burden of a large-scale forgiveness program | Implementing automation and technology, adequate resource allocation, and planning for peak periods |

Illustrative Case Studies (hypothetical)

The Biden administration’s student loan forgiveness initiative, particularly for former Ashford University students, presents a complex web of potential outcomes. Understanding how this policy might affect individuals directly requires exploring realistic, though hypothetical, scenarios. These case studies highlight the potential benefits and challenges of the forgiveness program, focusing on the practical application and impact on the lives of those affected.

Scenario 1: The Overburdened Graduate

“Sarah, a former Ashford University graduate, accrued substantial student loan debt during her time at the institution. While she found employment in her field, the debt significantly hindered her ability to save for a home and start a family. Her monthly payments consumed a substantial portion of her income, leaving little room for financial growth.”

Sarah’s situation underscores a common concern for former Ashford students. Loan forgiveness could significantly ease her financial burden. To apply, she’d need to verify her enrollment at Ashford, gather necessary documentation, and complete the application process. After forgiveness, Sarah could see a substantial increase in her disposable income. This increased income could translate into more substantial savings, potentially allowing her to purchase a home or invest in other assets.

Scenario 2: The Mid-Career Professional

“Mark, a former Ashford student working in a mid-level position, has consistently made payments on his student loans but feels the weight of the debt affecting his career choices. He’s now considering further education, but the looming debt is a significant deterrent.”

Mark’s situation is relevant because loan forgiveness could unlock opportunities for professional advancement. The forgiveness program could motivate him to pursue further education or training, potentially leading to higher-paying positions. He’d need to gather similar documentation to Sarah, demonstrating enrollment and debt verification. The relief from loan payments could directly translate into more savings and allow him to invest in his professional development.

The impact on his career trajectory could be significant.

Scenario 3: The Recent Graduate

“Emily, a recent Ashford graduate, took out loans to fund her education. She’s currently struggling to find employment in her field and faces a daunting prospect of high debt-to-income ratio.”

Emily’s scenario emphasizes the immediate impact of student loan forgiveness on recent graduates. Loan forgiveness would help alleviate immediate financial strain, allowing her to focus on finding suitable employment. The process for her is similar to the previous two scenarios, requiring verification of enrollment and loan details. The reduced financial pressure could lead to increased job searching intensity and potentially a faster path to securing stable employment, thereby improving her financial well-being.

Last Point

The Biden administration’s move to potentially forgive student loan debt for former Ashford University students is a significant development, potentially providing substantial financial relief to those affected. However, navigating the complex processes and potential challenges involved will be crucial to ensure equitable and effective implementation. This effort represents a crucial step towards addressing the complex issue of student loan debt in the wake of university closures.

The long-term implications for the higher education sector and the future of student loan forgiveness remain to be seen.