What is payroll cycle? It’s the intricate process businesses use to calculate and distribute employee wages. From calculating gross pay to ensuring timely payments, understanding the steps involved is crucial for smooth operations. This process encompasses everything from recording work hours to managing deductions, and ultimately, ensuring employees receive their compensation accurately and on time.

This guide delves into the various aspects of a payroll cycle, including its different types, key components, and the technology that powers it today. We’ll explore the essential elements, the steps involved, and the legal considerations that make a seamless payroll cycle so important for businesses of all sizes.

Defining Payroll Cycle

Understanding the payroll cycle is crucial for any business, big or small. A well-managed payroll process ensures timely payments, maintains compliance with labor laws, and minimizes errors. This process impacts employee morale and financial stability, directly affecting the overall health of the organization.The payroll cycle is a systematic series of steps followed to calculate and distribute employee wages.

It’s a recurring process that begins with recording hours worked and concludes with paying employees and filing necessary tax reports. This structured approach ensures accuracy and reduces the risk of costly mistakes.

Payroll Cycle Definition

The payroll cycle encompasses all the tasks involved in calculating and distributing employee wages. This includes tracking work hours, calculating earnings, deducting taxes and other withholdings, and ultimately issuing payments to employees. A well-defined payroll cycle is critical for maintaining accurate financial records, complying with tax regulations, and maintaining positive employee relations.

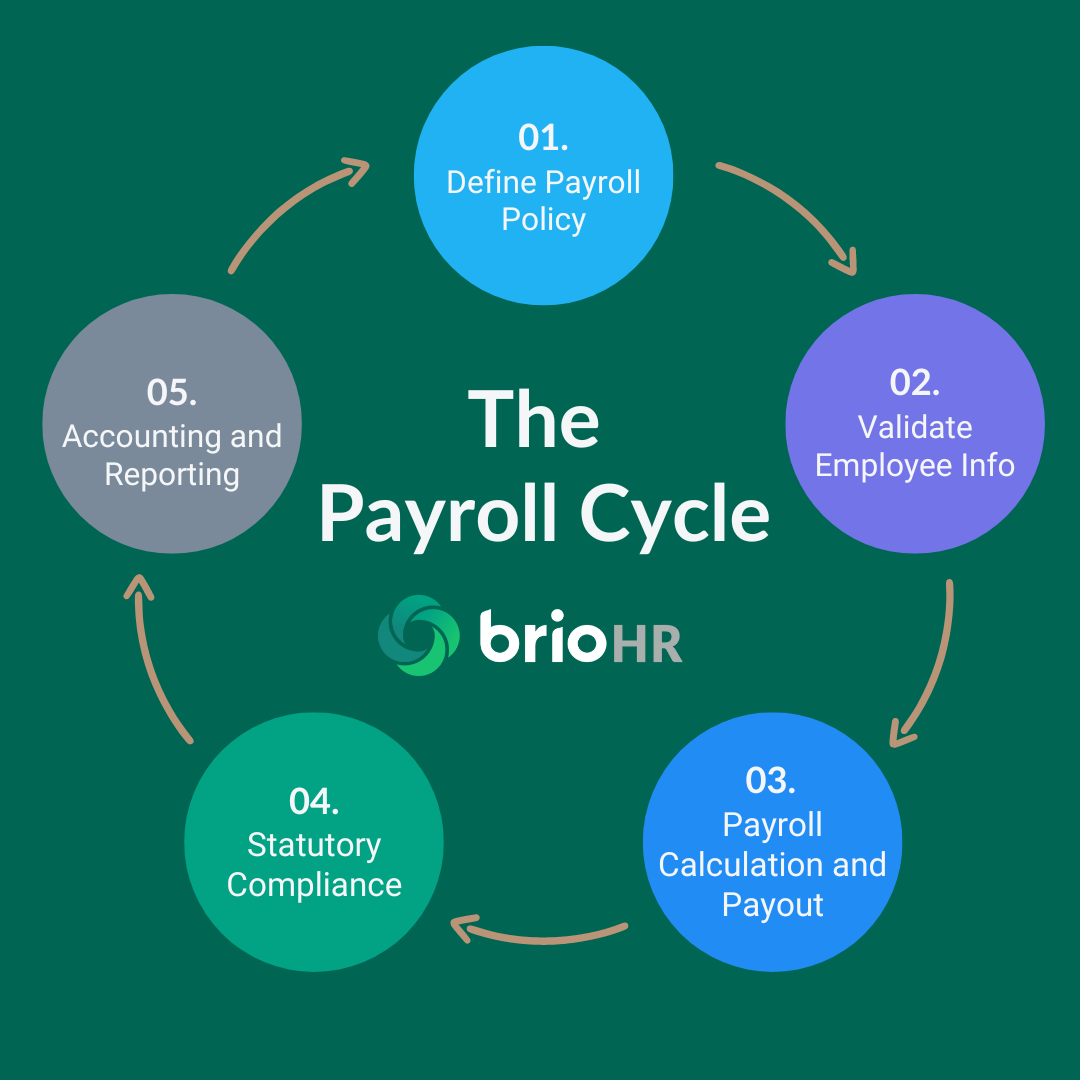

Key Stages of a Typical Payroll Cycle

A typical payroll cycle involves several distinct stages, each playing a vital role in the process. These stages ensure that employees receive their wages accurately and on time, and that the company complies with all applicable laws.

- Time and Attendance Recording: This stage involves accurately recording the hours worked by each employee. Methods vary from manual time sheets to automated timekeeping systems. Accurate recording is paramount for accurate wage calculation.

- Payroll Data Input: The recorded time and attendance data, along with employee details (salary, benefits, deductions) are entered into the payroll system. This stage requires meticulous attention to detail to avoid errors.

- Earnings Calculation: The payroll system calculates gross earnings based on the employee’s pay rate and hours worked. Overtime pay, bonuses, and other incentives are also factored in at this stage.

- Deduction Calculation: This step involves calculating and deducting various withholdings from gross earnings. These include taxes (federal, state, and local), health insurance premiums, retirement contributions, and other employee-selected deductions.

- Net Pay Calculation: Subtracting deductions from gross earnings results in the net pay amount, which is the actual amount paid to the employee. This amount should be verified for accuracy before processing.

- Payroll Payment: The calculated net pay is disbursed to employees via various methods, such as direct deposit, check, or other forms. Compliance with payment deadlines is crucial for employee satisfaction.

- Payroll Reporting and Compliance: This final stage involves preparing and submitting required reports to government agencies, such as tax forms and other legal documents. Meeting deadlines is crucial for avoiding penalties and maintaining compliance.

Types of Payroll Cycles

Different types of payroll cycles are employed depending on the frequency of employee compensation. The most common types include:

- Weekly Payroll: Employees are paid every week, often on a Friday. This provides employees with frequent income, but can increase administrative overhead.

- Bi-Weekly Payroll: Employees are paid every two weeks. This structure offers a balance between frequency and administrative burden.

- Semi-Monthly Payroll: Employees receive payment twice a month, usually on the 15th and the last day of the month. This approach simplifies the payment process and reduces the administrative burden.

- Monthly Payroll: Employees are paid once a month. This structure is simpler in terms of administrative tasks but may not provide the same level of income frequency as other cycles.

Comparison of Payroll Cycle Structures

| Payroll Cycle | Frequency | Administrative Burden | Employee Benefit |

|---|---|---|---|

| Weekly | Every week | High | High frequency of income |

| Bi-Weekly | Every two weeks | Moderate | Good balance of frequency and administrative burden |

| Semi-Monthly | Twice a month | Moderate | Good balance of frequency and administrative burden |

| Monthly | Once a month | Low | Lower frequency of income |

The best payroll cycle structure depends on various factors, including company policies, employee preferences, and regulatory requirements. Each structure has its own advantages and disadvantages.

Key Components of Payroll Cycle

The payroll cycle is a crucial process for any business, ensuring timely and accurate compensation for employees. Properly managing this cycle not only fosters a positive employee experience but also helps maintain financial stability and legal compliance. Understanding the key components of the payroll cycle is essential for streamlining operations and minimizing errors.Accurate data input is paramount to a successful payroll cycle.

Errors in employee information, hours worked, or deduction details can lead to significant financial discrepancies and legal issues. Robust timekeeping systems and clear communication channels are vital to minimizing these errors and maintaining accurate records.

Essential Elements of a Payroll Cycle

A well-structured payroll cycle relies on several interconnected elements. These elements, when properly implemented, create a smooth and efficient process.

- Employee Information: Accurate and up-to-date employee records are critical. This includes details like name, address, social security number, bank account information, and tax withholdings.

- Timekeeping Systems: These systems track employee hours worked, providing the basis for calculating gross pay. Different methods exist, including manual time sheets, automated time clocks, and online time tracking portals. The chosen method should be efficient and secure, allowing for easy verification and reporting.

- Payroll Software: Modern payroll processes frequently leverage specialized software to manage various tasks, from data input to calculation and reporting. Payroll software simplifies complex calculations, streamlines the process, and reduces the likelihood of errors.

- Payroll Deductions: This includes mandatory deductions like taxes (federal, state, and local) and voluntary deductions such as health insurance premiums, retirement contributions, and union dues.

- Gross Pay Calculation: The method for calculating gross pay varies depending on the employee’s compensation structure (hourly, salaried, commission-based). Understanding these variations is critical to ensure accurate calculations.

- Payment Processing: This involves transferring funds to employees’ accounts using appropriate channels, such as direct deposit or checks. The method should be secure, timely, and transparent to employees.

- Payroll Reporting: This involves generating reports for internal use (e.g., tracking expenses) and for compliance purposes (e.g., tax reporting). Clear and detailed reports are vital for accurate financial record-keeping.

Importance of Accurate Data Input

Data accuracy is the bedrock of the payroll cycle. Inaccurate data can lead to:

- Financial discrepancies: Incorrect calculations can result in underpayment or overpayment of employees, leading to financial issues for both the company and employees.

- Legal issues: Payroll errors can trigger audits from tax authorities, leading to penalties and legal ramifications.

- Employee dissatisfaction: Delays or inaccuracies in paychecks can negatively impact employee morale and trust in the company.

Role of Timekeeping Systems

Timekeeping systems are essential for calculating the hours worked by employees. Accurate timekeeping data directly impacts gross pay and subsequent payroll deductions. A robust system minimizes the possibility of errors.

- Accuracy: Reliable timekeeping systems provide accurate records of employee work hours.

- Efficiency: Automated systems often reduce manual data entry, saving time and resources.

- Compliance: These systems ensure compliance with labor laws and regulations related to working hours.

Significance of Payroll Deductions

Payroll deductions are a crucial part of the payroll process. They ensure compliance with tax laws and provide employees with benefits.

- Tax Compliance: Payroll deductions cover various taxes, including federal, state, and local income taxes, as well as Social Security and Medicare taxes.

- Employee Benefits: Deductions cover employee benefits such as health insurance, retirement plans, and life insurance.

- Accuracy and Transparency: Clear communication and accurate record-keeping regarding deductions are crucial for employees and the company.

Methods for Calculating Gross Pay

Gross pay is the total earnings before any deductions. Different methods exist depending on compensation structures.

- Hourly Wage: Gross pay is calculated by multiplying the hourly wage by the number of hours worked.

Gross Pay = Hourly Wage × Hours Worked

Understanding the payroll cycle is key for any business, big or small. It’s essentially the process of calculating and distributing employee wages. But in a city like San Jose, where the housing market is impacting many people’s finances, san jose affordable home apartment economy property real estate house prices directly affect employee budgets, and thus, how much they can afford to spend on necessities like groceries and rent.

Ultimately, a smooth payroll cycle is crucial for employee satisfaction and business success.

- Salaried Employees: Salaried employees receive a fixed amount of pay per pay period. The gross pay is typically the same each pay period.

- Commission-Based Employees: Gross pay is calculated based on a percentage of sales or other performance metrics.

Common Payroll Deductions

Payroll deductions encompass various items. A detailed understanding of each is crucial for accurate processing.

| Deduction Type | Description | Example Rate |

|---|---|---|

| Federal Income Tax | Based on employee’s filing status and income. | 10% – 25% |

| State Income Tax | Varies by state and is dependent on state tax rates. | 3% – 10% |

| Social Security Tax | A mandatory deduction based on a percentage of earnings. | 6.2% |

| Medicare Tax | Another mandatory deduction based on a percentage of earnings. | 1.45% |

| Health Insurance | Premium payments for employee health insurance coverage. | $100 – $500+ |

| Retirement Contributions | Employee’s contribution to a retirement plan. | 3% – 10% |

| Union Dues | Contribution to the union. | $10 – $50 |

Payroll Cycle Process

The payroll cycle is a critical administrative process that ensures timely and accurate compensation to employees. A smooth and efficient payroll cycle is essential for maintaining employee morale and avoiding potential legal issues. Understanding the sequence of events within this cycle, from data input to final distribution, is key to successful payroll management.The payroll cycle involves a series of steps designed to accurately calculate and distribute employee earnings.

Each step is crucial to ensuring the process runs smoothly, reducing errors, and meeting legal requirements. The specifics might vary depending on the size and structure of the organization, but the core principles remain constant.

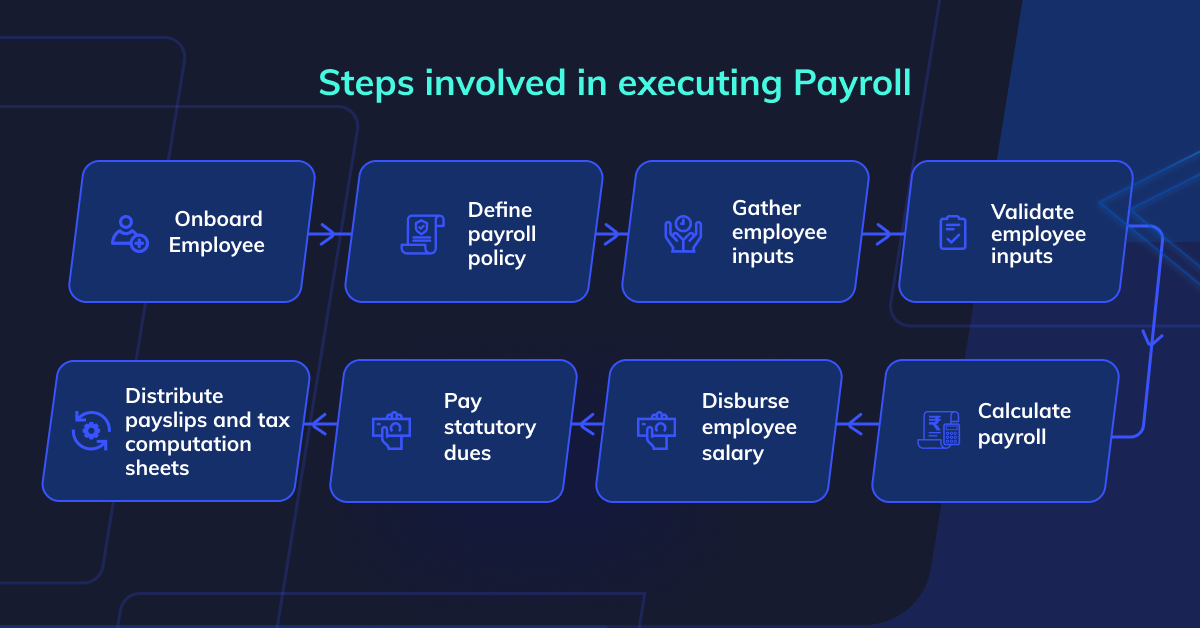

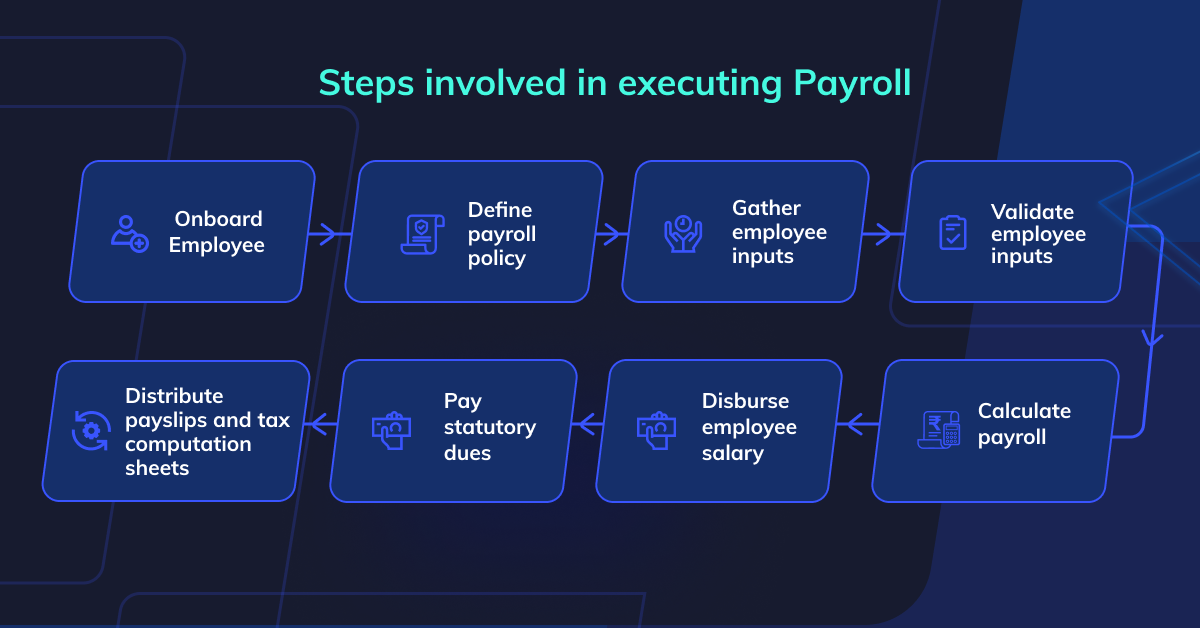

Sequence of Events in a Payroll Cycle

The payroll cycle is a sequential process, starting with recording employee hours and ending with the distribution of paychecks. This sequence ensures that all steps are followed and that no crucial information is overlooked.

- Timekeeping: Employee hours worked are recorded, usually through time clocks, time sheets, or online systems. Accurate timekeeping is essential for calculating wages accurately.

- Data Input: The recorded time and other relevant employee data (such as pay rates, deductions, and benefits) are input into the payroll system. This step is critical, as any errors here can ripple through the entire process.

- Payroll Calculation: The payroll system calculates gross pay, deductions (taxes, insurance, retirement contributions, etc.), and net pay for each employee. Formulas are used to calculate gross pay based on hours worked and pay rates. Deductions are applied based on predefined rates and employee choices.

- Payroll Review and Approval: A critical review process is conducted to validate the accuracy of the calculations and ensure compliance with all applicable regulations. A supervisor or designated employee checks the calculations and approves the payroll.

- Pay Stub Generation: Detailed pay stubs are generated, showing each employee’s gross pay, deductions, and net pay. These serve as important records for employees.

- Payroll Distribution: Net pay is disbursed to employees through various methods like direct deposit or paper checks. The method of payment is often pre-determined and communicated to employees.

- Record Keeping: All payroll documents are archived, complying with relevant legal and company requirements. This includes keeping records of hours worked, pay stubs, and tax forms.

Calculating Net Pay

Net pay is the amount an employee receives after all deductions are subtracted from gross pay. Understanding the calculation process is crucial for employees and payroll professionals alike.

- Gross Pay Calculation: Gross pay is the total amount earned before any deductions. It’s calculated by multiplying the employee’s hourly rate by the total hours worked.

- Deduction Calculation: Deductions include federal and state income taxes, social security, Medicare, health insurance premiums, retirement contributions, and other voluntary deductions. Specific formulas and rates are used for each deduction.

- Net Pay Calculation: Net pay is determined by subtracting the total deductions from the gross pay.

Net Pay = Gross Pay – Total Deductions

Generating Pay Stubs

Pay stubs are essential documents for employees, providing details about their earnings and deductions.

- Header Information: The pay stub includes essential employee information like name, employee ID, pay period, and address.

- Earnings Details: The stub lists all earnings, including regular pay, overtime pay, and any bonuses.

- Deduction Information: A breakdown of all deductions, including taxes (federal, state, social security, Medicare), health insurance, and retirement contributions, is shown.

- Net Pay Amount: The final amount an employee receives after all deductions are subtracted from gross pay.

- Company Information: The pay stub displays the employer’s name, address, and contact details.

Distributing Payroll Information

Payroll information distribution methods depend on company policy and employee preferences.

- Direct Deposit: A secure and convenient method where net pay is deposited directly into the employee’s bank account.

- Paper Checks: Traditional method where a physical check is mailed to the employee.

- Other Methods: Some companies offer other methods, such as payroll cards or mobile payment options.

Payroll Cycle Flowchart

[A visual flowchart would be presented here, depicting the steps in the payroll cycle as a series of interconnected boxes and arrows. It would show the sequence of events from timekeeping to distribution. The illustration would clearly label each step and highlight the flow of information.]

Examples of Payroll Tasks

Examples of different payroll tasks within the cycle:

- Timekeeping: Recording employee hours worked on time sheets.

- Data Input: Entering employee data into the payroll system.

- Payroll Calculation: Calculating overtime pay for employees who worked more than 40 hours in a week.

- Review and Approval: Checking the accuracy of calculated deductions.

- Pay Stub Generation: Creating a pay stub for an employee with multiple deductions.

- Distribution: Disbursing employee pay through direct deposit.

Payroll Cycle Frequency and Timelines

Payroll processing is a crucial aspect of running any business. Understanding the frequency and timelines associated with payroll cycles is essential for accurate and timely payment of employee wages, which directly impacts employee morale and company operations. Effective management of the payroll cycle minimizes risks and ensures compliance with relevant labor laws.The frequency of a payroll cycle significantly impacts various aspects of a company, including administrative overhead, employee expectations, and financial planning.

The payroll cycle is essentially a series of steps businesses follow to calculate and distribute employee wages. It’s a crucial process, especially for teams like the San Jose Sharks, who need to manage the salaries of players like William Eklund, considering recent NHL trade deadline moves involving players like Fabian Zetterlund, Mike Grier, and Tyler Toffoli. This Sharks roster shuffling clearly highlights the importance of meticulous payroll calculations to ensure everyone gets paid accurately and on time.

Ultimately, a smooth payroll cycle is essential for any organization’s financial health.

Choosing the right frequency involves careful consideration of these factors, ensuring a balance between efficiency and employee satisfaction.

Factors Influencing Payroll Cycle Frequency

Several factors influence the frequency of a payroll cycle. Company policies, industry norms, and employee preferences all play a role in determining the best schedule. Payroll cycle frequency also depends on the size and complexity of the organization, and whether it uses in-house or outsourced payroll services.

Common Payroll Cycle Timelines

The most common payroll cycle frequencies are weekly, bi-weekly, semi-monthly, and monthly. Each frequency offers unique advantages and disadvantages, which are explored in the following sections.

Pros and Cons of Different Frequencies

- Weekly Payroll: This frequency offers the benefit of faster paychecks, boosting employee morale and potentially reducing turnover. However, it often leads to increased administrative workload for payroll departments and higher overall processing costs. Weekly payroll is often preferred by companies with hourly employees, ensuring timely compensation for work completed.

- Bi-weekly Payroll: This frequency strikes a balance between weekly and monthly payments. It reduces the administrative burden compared to weekly payroll while still providing relatively quick payment to employees. Bi-weekly payroll is a popular choice for most companies due to the manageable workload and timely payments.

- Semi-monthly Payroll: This frequency divides the monthly payroll into two payments, typically around the 15th and the last day of the month. It helps with cash flow management, spreading the payment burden over the month. Semi-monthly payroll is beneficial for companies that need to maintain consistent cash flow.

- Monthly Payroll: This frequency involves a single payment at the end of each month. It simplifies payroll administration and reduces processing costs. However, employees might receive payment later than other frequencies, potentially impacting morale. Monthly payroll is often chosen by smaller companies or those with simpler payroll needs.

Importance of Meeting Payroll Deadlines

Meeting payroll deadlines is critical for maintaining a positive employer-employee relationship. Failure to meet deadlines can lead to legal issues, strained employee relations, and damage to the company’s reputation. Prompt payment of wages is a fundamental aspect of labor law and ethical business practices.

Typical Payroll Cycle Timelines

| Payroll Frequency | Processing Time | Payment Time |

|---|---|---|

| Weekly | 2-3 business days | End of the week |

| Bi-weekly | 3-4 business days | Mid-week or end of the pay period |

| Semi-monthly | 4-5 business days | Around the 15th and last day of the month |

| Monthly | 5-7 business days | End of the month |

Methods to Ensure Payroll Deadlines are Met

Several methods can help ensure payroll deadlines are met. Implementing a robust payroll system, leveraging automated processes, and having a clear payroll schedule are crucial. Effective communication with employees and prompt resolution of any issues are equally important.

- Implementing a robust payroll system: A reliable and well-designed system is critical to streamline the entire payroll process, which helps to meet deadlines efficiently.

- Leveraging automated processes: Automation can significantly reduce manual tasks and improve processing speed, minimizing errors and ensuring timely payment.

- Establishing a clear payroll schedule: This schedule should clearly define the payment dates and deadlines, allowing everyone involved to stay informed and prepared.

- Effective communication with employees: Keep employees informed about payment dates and any potential delays. Regular communication can prevent unnecessary anxieties.

- Prompt resolution of issues: Quickly address any payroll-related problems to prevent delays and maintain a smooth workflow.

Payroll Cycle and Technology

The modern payroll cycle is increasingly reliant on technology. Automation and software solutions are transforming how companies handle payroll, impacting efficiency, accuracy, and overall cost. This shift has brought significant benefits, but also introduces new challenges related to security and risk management. Understanding these aspects is crucial for any organization navigating the complexities of today’s payroll landscape.

The Role of Technology in Modern Payroll Cycles

Technology has fundamentally reshaped the payroll cycle, automating many previously manual tasks. This includes data entry, calculation of deductions, and the generation of paychecks. The shift towards digital platforms has led to greater efficiency and reduced processing time, allowing companies to allocate resources more effectively.

Understanding the payroll cycle is key to a smooth operation, but it’s also important to remember the people behind the numbers. Celebrating employee appreciation day is a fantastic way to show your team you care, and a great way to boost morale. Check out some inspiring ideas for employee appreciation day celebrations at employee appreciation day ideas.

Ultimately, a well-managed payroll cycle is directly linked to happy employees, leading to higher productivity and a more positive work environment.

How Automation Impacts the Payroll Cycle

Automation streamlines the payroll process, reducing the risk of human error. Tasks such as data entry, tax calculation, and direct deposit are handled by software, minimizing the potential for mistakes in paychecks. This results in a more accurate and reliable payroll system. For example, automated systems can readily adjust for changes in employee information, like address updates or tax bracket changes, reducing the need for manual intervention and minimizing errors.

Benefits of Using Payroll Software

Payroll software offers numerous advantages. It simplifies complex calculations, ensuring compliance with tax regulations and other legal requirements. This often includes automatic updates to tax laws, eliminating the need for manual adjustments and reducing the chance of non-compliance penalties. Additionally, software solutions improve the accuracy and speed of payroll processing, reducing administrative burdens and freeing up valuable time for other tasks.

Potential Risks Associated with Technology in Payroll

While technology offers many benefits, it also presents potential risks. Data breaches, system failures, and inadequate security measures can compromise sensitive employee data, leading to significant financial and reputational damage. Cybersecurity measures are critical for protecting employee information, and organizations must implement robust security protocols to mitigate these risks. For instance, a data breach could result in the loss of sensitive employee information, such as social security numbers or bank account details, potentially leading to significant legal and financial ramifications.

Commonly Used Payroll Software Tools

Several payroll software solutions are available, each with varying features and functionalities. Popular options include ADP, Paychex, Gusto, and Xero. These tools provide a range of services, from basic payroll processing to comprehensive HR management functionalities. These systems are designed to handle different business needs and sizes, from small startups to large corporations.

How Payroll Software Streamlines the Process

Payroll software streamlines the entire payroll process by automating various stages, such as inputting employee data, calculating deductions, generating pay stubs, and processing direct deposits. This automation reduces the time and effort required for manual tasks, significantly improving overall efficiency.

How Technology Reduces Errors in Payroll Processing

Technology significantly reduces errors in payroll processing by automating complex calculations and validating data. Software solutions often incorporate built-in checks and balances to detect errors early in the process, minimizing the potential for inaccuracies. This leads to a more accurate and consistent payroll, avoiding potential disputes or legal issues. For example, software can flag inconsistencies in hours worked or deductions, ensuring that paychecks are accurate and compliant.

Importance of Data Security in Electronic Payroll Systems

Data security is paramount in electronic payroll systems. Protecting sensitive employee data, such as social security numbers and bank account details, is critical to prevent breaches and maintain compliance with privacy regulations. Robust security measures, including encryption, access controls, and regular security audits, are essential to safeguard employee information. A strong password policy, multi-factor authentication, and regular security updates are key elements in a comprehensive data security strategy.

Comparison of Payroll Software Solutions

| Software | Features | Pricing | Ease of Use | Customer Support |

|---|---|---|---|---|

| ADP | Comprehensive HR and payroll solutions | Variable, based on features | Generally considered user-friendly | Excellent reputation |

| Paychex | Wide range of payroll services | Variable, based on features | Good usability | Positive feedback |

| Gusto | Cloud-based platform | Competitive pricing | Intuitive interface | Responsive customer support |

| Xero | Integrates with accounting software | Affordable | User-friendly | Strong customer support |

This table provides a basic comparison. Detailed pricing, features, and support quality may vary depending on specific implementations and needs.

Legal and Regulatory Considerations: What Is Payroll Cycle

Payroll processing isn’t just about crunching numbers; it’s about adhering to a complex web of legal and regulatory requirements. Understanding these rules is crucial for businesses of all sizes to avoid penalties and maintain a fair and compliant workforce. Compliance isn’t just a matter of avoiding fines; it builds trust with employees and ensures a smooth, efficient payroll process.Navigating the legal landscape of payroll can seem daunting, but with a clear understanding of the rules and a commitment to meticulous record-keeping, businesses can confidently manage their payroll obligations.

The following sections detail the key aspects of legal and regulatory compliance in payroll.

Legal Requirements for Payroll

Payroll processes are heavily influenced by a myriad of legal requirements, varying significantly across jurisdictions. These regulations dictate everything from employee classification to tax withholding and record-keeping. Understanding these rules is paramount for accurate and compliant payroll processing.

Significance of Compliance with Labor Laws

Failure to comply with labor laws can lead to severe consequences. Penalties can range from fines to lawsuits and damage to a company’s reputation. The consequences of non-compliance extend beyond monetary penalties; they can affect employee morale and trust in the organization.

Importance of Accurate Record-Keeping

Accurate record-keeping is the bedrock of payroll compliance. Detailed records of employee hours, wages, deductions, and tax withholdings are essential for auditing purposes and for ensuring that employees receive the correct payments. This detailed documentation allows for transparency and facilitates the prompt resolution of any discrepancies. Furthermore, maintaining comprehensive records is vital for tax reporting and can help mitigate potential legal issues.

Impact of Tax Laws on Payroll Calculations

Tax laws are integral to payroll calculations. The specific taxes that are withheld and the rates applicable depend on the location and the employee’s status. Employers must accurately calculate and remit the correct amounts of taxes to the appropriate government agencies. Errors in tax calculations can result in significant penalties and audits. For example, failing to correctly withhold and remit federal income tax can lead to substantial penalties.

Different Legal Requirements for Various Jurisdictions

Payroll regulations vary considerably between states, countries, and even municipalities. Some jurisdictions have specific requirements regarding overtime pay, minimum wage, or employee benefits. For example, California has specific regulations regarding meal breaks and rest periods, while other states may have different standards. The specific rules need to be researched and understood to ensure compliance.

Common Payroll Compliance Issues

Several common pitfalls can lead to non-compliance. These include misclassifying employees, failing to remit taxes accurately, inadequate record-keeping, and not complying with overtime regulations. These issues can be avoided through proper training, consultation with legal experts, and maintaining meticulous records.

| Compliance Issue | Impact | Example |

|---|---|---|

| Misclassifying employees as independent contractors | Failure to withhold and pay employment taxes, potentially facing substantial penalties. | A company incorrectly classifies a delivery driver as an independent contractor, resulting in significant tax liabilities. |

| Failing to remit taxes accurately | Penalties from the tax authorities, damage to the company’s reputation. | A company submits incorrect tax forms leading to audits and penalties. |

| Inadequate record-keeping | Difficulty in proving compliance during audits, potential legal issues. | A company lacks detailed records of employee hours and wages, making it challenging to defend against audits. |

Payroll Cycle Challenges and Solutions

Navigating the payroll cycle smoothly is crucial for any business. From ensuring accurate calculations to managing compliance, various challenges can arise. This section delves into common problems and effective solutions to maintain a streamlined and error-free payroll process. Understanding these challenges is key to minimizing risks and maximizing efficiency.

Common Payroll Cycle Challenges

Payroll processing, while seemingly straightforward, can present a multitude of hurdles. Inaccurate data entry, inconsistent timekeeping, and complex tax regulations are just a few examples. These issues can lead to costly errors and damage employee morale. Addressing these challenges proactively is essential for maintaining a healthy and productive workforce.

- Inaccurate Data Entry: Mistakes in inputting employee data, such as incorrect hours worked, pay rates, or tax information, are a common source of payroll errors. This can lead to underpayments or overpayments, potentially creating financial issues for both employees and the company. Maintaining meticulous attention to detail during data entry is paramount.

- Timekeeping Issues: Inaccurate or missing time records can result in discrepancies in calculated wages. This can lead to disputes and frustration for employees and the employer. Implementing robust timekeeping systems, such as biometric time clocks or online time tracking, can help prevent these problems. Regular review and reconciliation of timecards are also crucial for accuracy.

- Complex Tax Regulations: Federal, state, and local tax laws can be intricate and subject to frequent changes. Failing to stay updated on these regulations can lead to penalties and compliance issues. Consulting with tax professionals and utilizing payroll software with tax calculation features is critical to maintaining compliance.

- System Errors: Technical glitches or software bugs in payroll systems can cause errors in calculations and data processing. Regular system maintenance and backups can mitigate the risk of system failures and data loss.

Importance of Accurate Data Entry

Accurate data entry forms the bedrock of a reliable payroll process. Errors in this stage propagate through the entire cycle, potentially resulting in incorrect calculations, missed payments, and legal ramifications. Maintaining data integrity is critical for employee satisfaction and company compliance.

- Reduced Errors: Implementing a system of data validation, including automatic checks and verification processes, can minimize the chance of errors. Double-checking data inputs by a second person can also help catch errors before they impact the final payroll calculation.

- Improved Efficiency: Accurate data ensures the payroll process runs smoothly. This saves time and resources, allowing payroll staff to focus on other important tasks. A well-organized and clean database facilitates easy access and reduces the time spent locating data.

- Enhanced Employee Satisfaction: Accurate paychecks and timely payments contribute to employee satisfaction and trust. This positive experience fosters a more productive and engaged workforce.

Potential Errors and Their Impact

Payroll errors can have a wide range of consequences, from simple inconvenience to severe legal and financial penalties. Understanding the potential impact of errors is essential for prevention.

| Error Type | Impact |

|---|---|

| Incorrect wage calculation | Underpayment or overpayment to employees, leading to disputes and potential legal action. |

| Missed or late payments | Employee dissatisfaction, potential for negative publicity, and legal penalties. |

| Non-compliance with tax regulations | Penalties from tax authorities, potential legal action, and damage to company reputation. |

Methods for Preventing and Resolving Payroll Errors

Proactive measures are essential to prevent payroll errors. Implementing robust procedures and using advanced technologies can significantly reduce the risk of mistakes.

- Regular Training: Providing employees involved in the payroll process with regular training on data entry procedures, tax regulations, and system functionalities is critical to minimizing errors. Thorough understanding of the entire payroll cycle process is essential.

- Error Detection Procedures: Implementing checks and balances in the process, such as automatic validation of data inputs, can prevent errors before they affect payroll calculations. Using independent review processes can further minimize the chance of errors.

- Prompt Error Resolution: Establishing a clear process for identifying and resolving errors promptly is vital. This includes a system for tracking errors, identifying their root cause, and implementing corrective actions.

Troubleshooting Payroll Issues

Addressing payroll problems swiftly and effectively is crucial for minimizing disruption and maintaining employee morale. A structured approach to troubleshooting is key.

- Identify the Problem: Carefully analyze the issue, gathering all relevant information, such as employee data, time records, and payment details. Determine the specific cause of the error.

- Isolate the Source: Trace the error to its source to pinpoint the specific area of the payroll system or process that needs correction. Detailed logs and audit trails can be invaluable in this step.

- Implement Solutions: Develop and implement solutions tailored to the specific problem. This may involve correcting data entry errors, updating time records, or making necessary adjustments to the payroll system.

Payroll Cycle for Different Business Structures

The payroll cycle, while fundamentally the same in its core principles, varies significantly depending on the structure of the business. Understanding these variations is crucial for both employers and employees to ensure accurate and timely compensation. Different business structures have unique administrative requirements and legal obligations related to payroll.Payroll processes for sole proprietorships, partnerships, and corporations differ significantly. This stems from variations in legal responsibilities, ownership structures, and administrative complexities.

Each business structure necessitates tailored payroll strategies to comply with relevant regulations and meet operational needs.

Sole Proprietorships, What is payroll cycle

Sole proprietorships are the simplest business structure. The owner typically handles all aspects of the business, including payroll. This streamlined approach means fewer administrative layers, but it also means the owner is directly responsible for payroll tasks, including calculating wages, withholding taxes, and remitting payments. This structure often has simpler payroll processes compared to other structures, but the owner must still adhere to all relevant labor laws and tax regulations.

The owner is responsible for tracking and paying taxes. Accuracy and timeliness are paramount, as errors can impact the owner’s personal finances.

Partnerships

Partnerships involve two or more individuals who share in the profits and liabilities of the business. Payroll in a partnership is similar to a sole proprietorship in that the partners are directly involved in the process, but with a collaborative approach. Each partner’s share of profits and responsibilities must be clearly defined and documented. The partners often need to agree on a clear division of labor and responsibilities regarding payroll.

They must ensure compliance with all relevant labor laws and tax regulations applicable to partnerships. A partnership agreement outlining profit-sharing and payroll responsibilities is essential.

Corporations

Corporations are more complex business structures, with a distinct legal entity separate from its owners. Payroll in a corporation involves more administrative complexities and specialized personnel. Corporations typically have designated payroll departments or outsource the function to payroll service providers. The corporation is responsible for all payroll-related tasks, including calculations, withholdings, and remittances. Payroll compliance in corporations is critical, as errors can lead to legal penalties and reputational damage.

Corporations often have a dedicated payroll system and a clear separation of duties. This ensures accuracy and efficiency.

Comparison Table

| Business Structure | Payroll Complexity | Payroll Responsibility | Legal Considerations |

|---|---|---|---|

| Sole Proprietorship | Low | Owner | Simpler, but compliance is crucial |

| Partnership | Moderate | Partners | Compliance with partnership agreement and labor laws |

| Corporation | High | Dedicated personnel or outsourced | Complex compliance with corporate regulations |

Conclusive Thoughts

In conclusion, understanding what is payroll cycle is essential for any business. The process, from initial timekeeping to final distribution, requires careful attention to detail, accuracy, and adherence to legal regulations. By implementing robust systems, and utilizing modern technology, businesses can ensure efficient and accurate payroll, ultimately leading to a happy and productive workforce.