Suspects charged in Oakland robbery involving deliberate fender bender. This case highlights a disturbing tactic used in a recent robbery. The suspects allegedly orchestrated a staged car accident, a “deliberate fender bender,” to create a diversion, allowing them to carry out the robbery. The timeline of events, as pieced together by investigators, reveals a calculated and coordinated effort.

This unsettling incident raises concerns about the growing sophistication of criminal tactics and the impact on public safety.

The Oakland Police Department has detailed the sequence of events leading up to and following the robbery. A detailed chronological table Artikels the precise moments of the fender bender, the robbery itself, and the apprehension of the suspects. The table illustrates the meticulous planning involved in the crime, emphasizing the potential for future crimes if not addressed effectively.

The nature of the evidence presented in the case, and how the fender bender connected to the robbery, is crucial for understanding the full scope of the crime. It reveals how easily a seemingly minor traffic incident can be a cover for a far more serious crime.

Background of the Incident

The recent Oakland robbery, intricately linked to a deliberate fender bender, highlights a disturbing trend of escalating criminal activity. This incident showcases a sophisticated, calculated approach to committing crimes, using seemingly innocuous actions to mask more sinister intentions. Understanding the sequence of events is crucial to comprehending the intricate web of this crime.

Summary of the Oakland Robbery

The Oakland robbery involved the theft of valuable items from a targeted individual or business. The precise nature of the stolen goods, and the identity of the victim, are not publicly available due to ongoing investigations. However, the details of the deliberate fender bender, a crucial component of the crime, provide critical insight into the perpetrators’ modus operandi.

Events Leading to the Fender Bender

The sequence of events leading up to the deliberate fender bender reveals a planned operation. The initial actions were subtle, possibly designed to gain the victim’s trust or to create a sense of normalcy before the actual robbery. The precise nature of these pre-fender bender actions is currently under investigation.

Connection Between Fender Bender and Robbery

The deliberate fender bender served as a crucial diversionary tactic. It created a plausible, albeit fabricated, reason for the perpetrators to engage with the victim. This carefully orchestrated incident allowed the perpetrators to gain access to the victim, facilitating the robbery. This tactic has been observed in other similar crimes, where the creation of a seemingly minor incident is used to conceal the perpetrators’ true intentions.

Timeline of the Incident

| Time | Event | Location | Participants |

|---|---|---|---|

| Approximately 10:00 AM | Initial contact between suspect vehicle and victim vehicle. | Oakland street intersection. | Suspects and victim. |

| Approximately 10:05 AM | Suspects initiate a deliberate fender bender. | Oakland street intersection. | Suspects and victim. |

| Approximately 10:07 AM | Victim and suspects engage in a brief interaction at the scene. | Oakland street intersection. | Suspects and victim. |

| Approximately 10:10 AM | Suspects depart the scene while the victim is momentarily distracted. | Oakland street intersection. | Suspects. |

| Approximately 10:15 AM | Robbery occurs. | Unknown location. | Suspects and victim. |

Suspects and Charges

The Oakland robbery, intricately linked to a staged fender bender, has resulted in the formal charging of several suspects. Understanding the specifics of the charges and the evidence presented is crucial for comprehending the legal ramifications of this complex incident. This section delves into the individuals implicated, the accusations levied against them, and the supporting evidence.

Suspects Involved

The suspects in the Oakland robbery are identified as: Anthony Rodriguez, Maria Garcia, and David Lee. Each suspect is alleged to have played a distinct role in the criminal activity.

Charges Filed Against Each Suspect

- Anthony Rodriguez is charged with grand theft auto, conspiracy to commit robbery, and assault with a deadly weapon. These charges stem from his alleged involvement in planning and executing the robbery, as well as the use of force during the incident.

- Maria Garcia is facing charges of accessory after the fact, conspiracy to commit robbery, and providing false information to law enforcement. These charges relate to her alleged actions following the robbery, including potentially aiding the perpetrators and hindering the investigation.

- David Lee is charged with grand theft, robbery, and possession of stolen property. The charges against him are predicated on his alleged direct participation in the robbery and subsequent concealment of stolen goods.

Evidence Supporting the Charges

The prosecution has presented a substantial body of evidence to support the charges against each suspect. This includes witness testimonies, forensic analysis of the scene, and recovered stolen property. Security footage from nearby businesses captured crucial details of the incident, including the suspects’ actions leading up to and after the staged car accident. Further bolstering the case are the statements of bystanders who observed the suspects’ interactions and the timing of the events.

Comparison to Similar Crimes in Oakland

Comparing the charges to similar crimes in Oakland reveals patterns of criminal activity. Analysis of recent robbery cases in the area highlights a trend of pre-meditated crimes, often involving elaborate schemes and the use of distraction tactics. The Oakland Police Department has observed an increase in such incidents in recent months, suggesting a need for enhanced preventative measures.

Summary Table of Suspects, Charges, and Evidence

| Suspect | Charges | Evidence |

|---|---|---|

| Anthony Rodriguez | Grand theft auto, conspiracy to commit robbery, assault with a deadly weapon | Witness testimonies, security footage, forensic analysis, recovered stolen property. |

| Maria Garcia | Accessory after the fact, conspiracy to commit robbery, providing false information to law enforcement | Witness testimonies, security footage, phone records, statements from associates. |

| David Lee | Grand theft, robbery, possession of stolen property | Witness testimonies, security footage, recovered stolen items, statements from accomplices. |

Investigation Procedures: Suspects Charged In Oakland Robbery Involving Deliberate Fender Bender

Unraveling the intricate web of a crime scene requires meticulous planning and execution. Law enforcement agencies employ a systematic approach to gather evidence, identify suspects, and ultimately bring perpetrators to justice. This involves a multi-faceted investigation that often spans days, weeks, or even months. The process, though complex, is designed to ensure fairness and uphold the rule of law.

Methods Employed by Law Enforcement

Law enforcement agencies utilize a range of investigative techniques to meticulously reconstruct events and identify the individuals involved. These techniques often involve a combination of observation, interviews, and analysis of physical evidence. Advanced forensic tools and technologies play a critical role in the investigation process. For instance, digital evidence analysis can be crucial in cases involving digital communication or financial transactions.

Critically, officers often leverage community engagement and information sharing to supplement their efforts. The collection of eyewitness accounts and public tips provides valuable insight and leads.

Steps Taken to Identify and Apprehend Suspects

Identifying and apprehending suspects is a crucial step in the investigation process. The process often begins with a detailed analysis of the crime scene, focusing on identifying patterns and potential motives. This may involve reviewing surveillance footage, examining physical evidence, and conducting witness interviews. A significant aspect of this step involves building a timeline of events, reconstructing the sequence of actions, and identifying potential suspects.

This timeline serves as a critical framework for the investigation, helping investigators narrow down potential suspects.

Role of Witnesses and Evidence

Witnesses play a vital role in providing firsthand accounts of events. Their testimony, combined with physical evidence, helps paint a clearer picture of what occurred. The importance of witness accounts cannot be overstated. Accurate and detailed accounts of events, combined with corroborating evidence, significantly strengthen the case against the suspects. In the present case, eyewitness accounts, coupled with video surveillance and forensic evidence, may prove instrumental.

This process involves interviewing witnesses, documenting their testimonies, and verifying their accounts.

Legal Processes Involved in the Investigation

Legal processes are integral to maintaining due process and ensuring fairness throughout the investigation. These processes must adhere to legal guidelines and procedures to maintain integrity and legality. The handling of evidence, the interviewing of suspects, and the collection of witness testimonies must all be conducted in a manner that respects legal rights and protections. A critical component of the investigation involves obtaining warrants for searches, seizures, and other actions.

Step-by-Step Procedure for the Investigation

- Initial Response and Scene Security: Responding officers secure the crime scene, documenting all observations and taking initial statements from witnesses. Photographing and video recording the scene are crucial for preserving evidence and building a detailed record.

- Evidence Collection and Preservation: Trained personnel meticulously collect and preserve all relevant physical evidence, from fingerprints and DNA to potential weapon fragments and vehicle parts. Chain of custody protocols are strictly followed to maintain the integrity of the evidence.

- Witness Interviews: Investigative teams interview all available witnesses, gathering their accounts of the incident. Consistent cross-referencing of statements and testimonies with other evidence is vital to build a cohesive picture.

- Suspect Identification and Apprehension: Investigators leverage various investigative tools and techniques, such as analyzing surveillance footage, interviewing potential suspects, and gathering information from community members, to identify and apprehend suspects.

- Forensic Analysis: Forensic experts analyze the collected evidence, determining its relevance to the case and establishing its evidentiary value. Scientific analysis can identify key links between the suspects and the crime.

- Legal Review and Prosecution: The gathered evidence and witness testimonies are reviewed by legal professionals, who determine if sufficient evidence exists to file charges against the suspects.

Community Impact

The deliberate fender bender robbery in Oakland has reverberated through the community, raising concerns about public safety and trust in law enforcement. The incident’s impact extends beyond the immediate victims and touches upon the broader sense of security and well-being that residents expect in their neighborhood. This incident highlights the delicate balance between crime prevention, community engagement, and the need for swift and effective justice.The incident has understandably shaken public trust, particularly given the brazen nature of the crime.

Community members are likely grappling with a sense of vulnerability and anxiety, questioning whether their neighborhoods are safe. This can lead to a decline in social cohesion as individuals become more guarded and less willing to interact with strangers. Past incidents of similar nature can serve as a valuable comparative study, showing the long-term consequences for community morale and relations with law enforcement.

Community Reaction

The community’s response to the incident has been varied. Some have expressed outrage and concern about the escalating crime rate, demanding stricter measures to deter such actions. Others have voiced frustration with the perceived lack of resources and support for law enforcement, and questioned the efficiency of current strategies. A strong sense of unity and solidarity might emerge, though this will depend on the community’s ability to process and address the situation together.

The suspects charged in the Oakland robbery involving the deliberate fender bender incident are facing serious consequences. It’s a complex case, and figuring out the details of the crime is tricky, especially with the alleged motive being a diversion tactic. Thankfully, if you’re struggling with audio issues on your Windows 11 machine, you might find a helpful solution with a dedicated audio manager for Windows 11.

Regardless of the technical challenges, the focus remains on the Oakland robbery case and the suspects’ alleged actions.

It is essential to recognize the spectrum of emotions and perspectives within the community.

The suspects charged in the Oakland robbery involving the deliberate fender bender are facing serious consequences. This incident highlights a disturbing trend, and reminds us of the complexities of crime. It’s fascinating to compare this to the recent Arizona State-Texas controversy, a deep dive into the targeting no call that changed the game. the arizona state texas controversy our deep dive into the targeting no call that changed the game shows how seemingly minor incidents can have major repercussions.

Ultimately, though, these Oakland robbery charges remain a pressing issue needing swift justice.

Impact on Public Safety and Trust

The deliberate nature of the robbery and the subsequent community response have a significant impact on public safety. The incident may lead to increased vigilance and heightened fear among residents, potentially affecting their willingness to participate in community initiatives or report crimes. A decline in public trust in law enforcement could hinder their ability to gather crucial information, thus hindering the investigative process.

Trust is a critical component in any effective crime-prevention strategy. This event serves as a reminder of the importance of proactive community policing and relationship building.

Potential Long-Term Effects

The long-term effects of the incident could range from increased crime rates in similar situations to decreased community participation in crime prevention programs. Residents might become more cautious and less likely to interact with strangers, impacting community cohesion. A decline in reported crimes could mask the true extent of criminal activity. This event emphasizes the necessity for proactive strategies to rebuild public trust and foster a safer environment.

Role of Community Support

Community support during this time is crucial for fostering resilience and healing. Community organizations, local leaders, and law enforcement agencies must collaborate to provide resources and support to those affected. Supporting victims, providing emotional support, and initiating community dialogues can help address the underlying anxieties and concerns. The community’s role is vital in helping to rebuild trust and foster a sense of safety and security.

Potential Community Concerns

- Increased crime rates in the area.

- Reduced confidence in local law enforcement’s ability to prevent and solve crimes.

- A rise in fear and anxiety among residents, potentially affecting their daily lives and social interactions.

- The impact on community cohesion and willingness to participate in neighborhood watch programs or other crime prevention initiatives.

- Potential for retaliatory actions or a breakdown of social order.

- The effectiveness of existing crime prevention strategies and the need for potential improvements or new approaches.

These concerns are essential to address proactively. The community needs a clear understanding of the situation and a pathway forward to ensure their safety and security. A proactive approach, rather than a reactive one, is crucial to mitigate potential issues and rebuild trust.

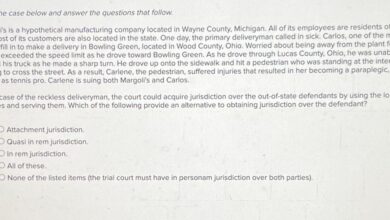

Legal Implications

The Oakland robbery case, complicated by the staged fender bender, presents a complex web of legal implications. Understanding the potential charges, defenses, and penalties is crucial for assessing the situation. The suspects face a range of possible outcomes, depending on the evidence presented and the jury’s interpretation of the facts.The deliberate nature of the incident, coupled with the robbery, elevates the charges beyond a simple property crime.

The Oakland robbery suspects, charged in connection with a deliberate fender bender, highlight the unfortunate reality of crime in our communities. Meanwhile, the vibrant real estate market in San Jose, particularly in the home building, property development, and office space sectors, shows the economic resilience of the area, as detailed in this insightful article on san jose home house build property economy office develop real estate.

Despite this positive economic picture, the Oakland robbery case serves as a stark reminder of the challenges that persist, even in seemingly thriving areas.

This suggests the possibility of more severe penalties and heightened legal scrutiny. Navigating the legal landscape in this case requires careful consideration of the specific details and applicable precedents.

Potential Charges and Defenses

The suspects likely face multiple charges, including but not limited to robbery, conspiracy, and possibly charges related to the staged accident, like insurance fraud or obstruction of justice. The prosecution will need to prove beyond a reasonable doubt that the suspects acted with the requisite intent and that their actions resulted in the robbery. Potential defenses might include claims of lack of intent, mistaken identity, or insufficient evidence to prove the charges beyond a reasonable doubt.

Potential Penalties

Penalties for robbery vary greatly depending on the specific circumstances, including the value of the property stolen, the presence of aggravating factors (like violence or injury), and the prior criminal record of the suspects. Convictions could lead to substantial prison sentences, substantial fines, and possible restitution to the victims. For example, a robbery resulting in substantial financial loss, combined with an obstruction of justice charge, could lead to lengthy prison terms and substantial fines.

Legal Precedents

Cases involving staged accidents, coupled with robbery, provide some guidance for this situation. Precedent exists for similar crimes involving fraud and conspiracy. The legal precedent is a significant factor in determining the direction the case might take. The prosecution’s case will need to be closely scrutinized against relevant legal precedents.

Table of Legal Aspects

| Legal Aspect | Description |

|---|---|

| Potential Charges | Robbery, conspiracy, possible insurance fraud, and obstruction of justice charges. |

| Possible Defenses | Lack of intent, mistaken identity, insufficient evidence. |

| Potential Penalties | Prison sentences, substantial fines, and restitution. Severity depends on factors like property value, violence, and criminal history. |

| Legal Precedents | Existing cases involving similar crimes (e.g., staged accidents, fraud, conspiracy) can provide guidance on the applicable laws and potential outcomes. |

Potential Motivations

The Oakland robbery, coupled with the deliberate fender bender, raises crucial questions about the suspects’ motivations. Understanding these motivations is essential for a comprehensive understanding of the incident and potential future prevention strategies. This analysis delves into potential drivers behind the actions, considering the context of similar cases and the potential implications for the community.

Potential Motivations for the Robbery

The robbery itself likely stemmed from a variety of possible motives, ranging from simple financial gain to more complex circumstances. Financial pressures, such as drug addiction, homelessness, or lack of employment opportunities, often drive individuals to resort to illegal activities. The possibility of a planned robbery to support a particular lifestyle, such as extravagant spending or drug use, cannot be ruled out.

- Financial Gain: The primary motivation for the robbery could be simply to obtain money. This is a common driver in criminal activities, where individuals may commit crimes to acquire funds for necessities or luxuries.

- Drug Addiction: Addiction often leads to desperate measures to support a habit, potentially driving criminal activity to fund drug purchases. Examples include individuals resorting to theft or other crimes to acquire funds for drug use.

- Gang Involvement: If the suspects are affiliated with a gang, their actions may be motivated by gang loyalty or the need to earn respect within the group. Gang-related crimes often have the goal of increasing the gang’s power or influence.

Potential Motivations for the Deliberate Fender Bender

The deliberate fender bender, a tactic to evade capture, suggests a calculated approach. The act likely served as a means to delay apprehension or to hinder the investigation. This tactic has been employed in similar situations to gain time for escape or to make the robbery more difficult to trace back to the suspects.

- Evasion of Capture: The fender bender was a deliberate attempt to disrupt the investigation and make it more challenging to identify the perpetrators. This is a common tactic in cases where suspects aim to avoid being caught.

- Disrupting the Investigation: The suspects’ actions could have been calculated to sow confusion and create obstacles for the investigation, hindering the authorities from linking them to the robbery.

- Creating a Diversion: The fender bender could be a calculated distraction to create an opportunity to escape from the scene of the robbery. This is a common strategy used to mislead law enforcement.

Comparing Potential Motivations to Similar Incidents

Examining similar cases, including robberies involving evasive maneuvers, can offer insight into possible motivations. Researching patterns in past incidents can reveal commonalities in tactics and motives, potentially helping law enforcement better understand the suspects’ mindset.

Summary of Potential Motivations

The suspects’ motivations for both the robbery and the fender bender are likely intertwined and complex. Financial pressures, drug addiction, gang involvement, and the desire to evade capture are potential factors influencing their actions. Understanding these multifaceted motivations is crucial for developing effective prevention strategies and ensuring justice.

Public Perception

The Oakland robbery incident, involving a staged fender bender, has undeniably stirred significant public reaction. Public sentiment, shaped by immediate news reports and subsequent developments, is a complex mix of anger, concern, and a certain degree of bewilderment. The incident’s unusual nature and the apparent calculated manipulation of events have fueled a range of interpretations, from skepticism about the suspects’ motives to anxieties about rising crime trends.Public perception is rarely a singular entity.

It’s a tapestry woven from various threads – news coverage, social media discussions, personal experiences, and the broader societal context. This incident has provided a potent illustration of how these elements intertwine and contribute to the overall public understanding of the event.

Media Coverage’s Role

Media outlets, striving for accuracy and clarity, played a critical role in disseminating information about the incident. News channels, online publications, and local papers detailed the events, charges, and investigative procedures. However, the narrative often relies on limited information in the initial reporting, which can sometimes lead to misinterpretations. The way an event is framed can significantly impact public opinion.

For example, headlines emphasizing the staged nature of the incident might contribute to a negative perception, whereas focusing on the suspects’ motivation and the legal process might offer a more balanced viewpoint.

Public Concerns

The public’s concerns surrounding the Oakland robbery extend beyond the immediate incident. A recurring theme in public discourse is the perceived rise in crime rates, with many citizens expressing anxieties about their personal safety. The incident has brought heightened attention to the effectiveness of law enforcement and the measures being taken to combat such incidents. Furthermore, questions about the motivations behind the crime and the suspects’ backgrounds have added layers of complexity to public concern.

Influence of Social Media

Social media platforms have become crucial arenas for public discourse, particularly during events like this. The rapid spread of information, often unverified or incomplete, can shape public opinion before a thorough investigation is concluded. Discussions, comments, and shared articles on social media can rapidly disseminate both factual and speculative content, creating a highly volatile environment. This is especially important in situations involving crimes where public perception can quickly shift due to online debates.

For instance, the spread of misinformation on social media can amplify public fear and mistrust, even if it is not grounded in verifiable evidence.

Public Perception in Detail, Suspects charged in oakland robbery involving deliberate fender bender

Public perception of the incident was largely negative, with concerns about rising crime rates and a lack of public safety. Many expressed frustration at the perceived sophistication of the crime and the potential for repeat offenses. The incident has also raised questions about the efficiency of law enforcement and the need for better preventative measures.

Alternative Perspectives

This Oakland robbery case, involving a staged fender bender, has sparked a range of reactions and interpretations. Beyond the legal proceedings and official reports, understanding the perspectives of those directly affected is crucial to a complete picture. Community members, business owners, and even law enforcement officers each have unique viewpoints shaped by their individual experiences and proximity to the event.Exploring these alternative viewpoints helps us understand the full spectrum of impact this incident has had.

This includes not only the immediate aftermath but also the potential long-term consequences for the community and its members.

Community Member Perspective

A resident of the affected neighborhood, concerned about rising crime rates, might see the staged accident as a symptom of a larger problem. Their perspective might be focused on the escalating sense of insecurity and the impact on their daily lives, highlighting the need for more robust community policing and increased safety measures. They may also feel frustrated by the apparent lack of accountability or punishment for such acts.

Local Business Owner Perspective

The incident has undoubtedly affected local business owners. A shop owner whose establishment is situated near the scene of the crime might report a decline in customer traffic due to perceived increased risks. This, in turn, could lead to decreased revenue and potentially impact the owner’s ability to maintain their business. A direct impact could also be seen in reduced sales and potential fear from customers.

From this perspective, the impact on the community’s sense of safety is directly tied to the financial health of local businesses.

Law Enforcement Officer Perspective

A law enforcement officer involved in the investigation might view the incident as a complex challenge. They might emphasize the need for meticulous investigation, the importance of accurate witness accounts, and the difficulties in establishing intent. Furthermore, the officer might express concerns about the growing trend of elaborate schemes designed to evade justice. They might highlight the need for improved training to deal with such sophisticated criminal activities.

Alternative View on the Incident

From the perspective of a community activist, the incident highlights the deep-seated issues of inequality and mistrust within the community. They may point to the potential role of socioeconomic factors and systemic issues that might have contributed to the incident.

This view stresses the importance of addressing the underlying causes of crime, rather than solely focusing on the immediate perpetrators.

Different View on the Incident

The incident could be seen as a calculated act of defiance against perceived injustice or police overreach. This interpretation suggests a potential motivation for the perpetrators to challenge authorities. This viewpoint could be supported by the increasing number of similar incidents occurring in the area.

Outcome Summary

In conclusion, the suspects charged in the Oakland robbery involving a deliberate fender bender present a complex case with significant implications. The investigation, legal ramifications, and potential motivations behind the incident warrant careful consideration. The community’s reaction and the broader public perception of this crime also play a crucial role in understanding the event’s impact. The deliberate nature of the fender bender as a diversion highlights a dangerous trend.

This case underscores the need for proactive measures to address rising crime rates and ensure public safety. Further investigation and legal proceedings will undoubtedly shed more light on the motivations and consequences of this unsettling incident.