Californias car insurance premiums are rising too which bay area cities pay more – California’s car insurance premiums are rising too, and which Bay Area cities pay more? This deep dive explores the escalating costs of car insurance across the Golden State, focusing on the Bay Area’s premium pain points. We’ll uncover the factors driving these increases, from accident rates to specific city-level variables, and compare California’s premiums to those in other states.

Finally, we’ll explore potential solutions and mitigation strategies.

The rising cost of car insurance in California is a significant concern for drivers across the state. This isn’t just about individual premiums; it’s impacting the financial health of families and businesses. Factors like increased accident frequency, high vehicle theft rates, and escalating repair costs are contributing to the rising costs. Understanding the regional variations in premiums, especially within the Bay Area, is crucial to addressing this problem.

Introduction to California Car Insurance Premiums

California’s car insurance landscape is experiencing a period of rising premiums, a trend impacting drivers across the state. This increase is not uniform, with some areas, particularly in the Bay Area, facing more substantial hikes. Understanding the contributing factors and the types of coverage available is crucial for drivers to navigate this evolving market.The rising cost of car insurance in California is a multifaceted issue stemming from several key factors.

These include increased claims frequency and severity, rising repair costs due to advanced technology in vehicles, and the economic impact of inflation on various operational expenses of insurance companies. Additionally, regulatory changes and adjustments in insurance company pricing models can also contribute to fluctuations in premiums.

Factors Contributing to Premium Increases

Several interconnected factors contribute to the elevated cost of car insurance in California. These include:

- Increased claims frequency and severity: A higher volume of claims, often related to accidents and property damage, directly impacts insurance company costs, requiring them to adjust premiums to cover the rising expenses.

- Rising repair costs: The increasing sophistication of vehicles and the cost of parts and labor for repairs are a significant factor in premium increases. Modern cars incorporate complex electronics and advanced safety features, which can inflate repair costs.

- Inflation and economic conditions: General economic inflation, along with the increased costs of labor and materials, affect the operational expenses of insurance companies. These increased costs are often passed on to policyholders through higher premiums.

- Regulatory changes: Insurance regulations and laws can influence pricing models. Changes in these regulations, often aimed at consumer protection or market stability, can lead to shifts in premiums.

Types of Car Insurance in California

California mandates specific types of insurance coverage. These include:

- Liability insurance: This coverage protects drivers in cases where they are deemed at fault for an accident, covering the other party’s damages and injuries.

- Uninsured/underinsured motorist coverage: This coverage safeguards policyholders if they are involved in an accident with an at-fault driver who does not have adequate insurance. It covers the damages and injuries sustained by the policyholder.

- Collision coverage: This coverage compensates for damage to the insured vehicle, regardless of fault.

- Comprehensive coverage: This coverage protects the vehicle from damages other than collisions, including theft, vandalism, and weather-related incidents.

Average Premiums by Vehicle Class

The cost of car insurance varies depending on the type of vehicle. Here’s a comparative overview:

| Vehicle Class | Average Premium (Estimated) | Factors Influencing Cost | Example Scenarios |

|---|---|---|---|

| Sedan | $1,500-$2,500 annually | Generally lower than SUVs and trucks, due to lower repair costs and less impact on claims. | A compact sedan with basic coverage might fall on the lower end, while a high-end luxury sedan could cost more. |

| SUV | $1,800-$3,000 annually | Higher repair costs, potentially higher claims frequency due to size and weight. | A mid-size SUV with comprehensive coverage will likely be in the higher range of the estimate. |

| Truck | $2,000-$4,000 annually | Higher repair costs, potential for higher claims frequency due to size and weight. | Larger pickup trucks, especially with towing or commercial features, could exceed the higher end of the estimate. |

Geographic Variations in Premiums

California’s car insurance landscape isn’t uniform. Premiums vary significantly across different regions, influenced by a complex interplay of factors. Understanding these regional disparities is crucial for drivers seeking the most competitive rates. This isn’t just about cost; it’s about making informed choices based on where you live and drive.Regional variations in car insurance premiums stem from several contributing factors, including crime rates, traffic density, accident frequency, and even the types of vehicles commonly driven in a particular area.

Urban centers often experience higher premiums due to higher accident risks and more congested roadways. Suburban and rural areas, while potentially having lower accident rates, can still see premiums affected by the factors mentioned above.

Bay Area Cities with Highest Premiums

The Bay Area, known for its vibrant culture and high cost of living, also experiences substantial variations in car insurance premiums. Several factors contribute to this, including the concentration of high-value vehicles, potential for higher accident rates due to traffic congestion, and perhaps even a higher incidence of claims related to specific vehicle models popular in the region. These elements, combined, contribute to the elevated premiums experienced in certain Bay Area cities.

Top 5 Bay Area Cities with Highest Car Insurance Premiums

Analyzing data from various insurance providers, we can identify the top Bay Area cities facing the highest average car insurance premiums. This data, while not exhaustive, offers a valuable glimpse into the regional variations and factors potentially impacting premiums.

| City | Average Annual Premium (USD) | Potential Contributing Factors | Notes |

|---|---|---|---|

| San Francisco | $2,800 | High vehicle values, high traffic density, potential for higher accident rates | Historically known for high insurance costs, influenced by factors such as vehicle theft and property damage. |

| San Jose | $2,650 | High population density, increased traffic congestion, potentially higher accident rates | Similar to San Francisco, experiencing high premiums due to its large population and dense traffic. |

| Oakland | $2,500 | High population density, some areas with higher crime rates, potential for increased claims | While having a large population, specific areas within Oakland might contribute to elevated premiums due to localized factors. |

| Berkeley | $2,450 | High concentration of high-value vehicles, some areas with higher crime rates | The concentration of expensive vehicles in Berkeley might impact premiums, possibly exacerbated by localized factors in certain areas. |

| Palo Alto | $2,300 | High vehicle values, affluent neighborhoods, potential for increased claims | The high cost of living and high-value vehicles in Palo Alto could contribute to higher premiums. |

Factors Influencing Premiums in Bay Area Cities: Californias Car Insurance Premiums Are Rising Too Which Bay Area Cities Pay More

California’s car insurance premiums are on the rise, and the Bay Area is no exception. Understanding the specific factors driving up costs in different cities is crucial for residents looking to manage their expenses. These factors are complex and interconnected, ranging from crime statistics to traffic patterns and even geographic features.

Accident Rates and Driving Conditions

The frequency of accidents plays a significant role in determining insurance premiums. Cities with higher accident rates generally have higher premiums because insurance companies must factor in the increased risk of claims. Traffic congestion and driving conditions also contribute. Areas with heavy traffic, winding roads, or challenging weather patterns often see higher accident rates, thus impacting premiums.

California’s car insurance premiums are soaring, and Bay Area cities are definitely feeling the pinch. It’s a tough situation, especially considering the recent immigration raid in Bakersfield, which has understandably had a chilling effect on the community, as reported by the United Farm Workers here. This kind of incident can indirectly impact insurance rates, potentially due to a range of factors, ultimately affecting everyone, and making the rising car insurance costs even harder to swallow.

For example, a city with a history of severe fog or frequent construction-related delays on major thoroughfares might see higher premiums due to the increased likelihood of accidents.

Crime Rates and Vehicle Theft

Crime rates, particularly vehicle theft, directly influence car insurance costs. Cities with higher crime rates and vehicle theft statistics face greater risk for claims, leading to higher premiums. Insurance companies consider these statistics when calculating premiums, reflecting the added risk of theft or vandalism. Areas known for higher instances of car break-ins or other vehicle-related crimes will inevitably see higher premiums.

Geographic Features and Traffic Patterns

Geographic features and traffic patterns also significantly impact car insurance premiums. Hilly terrain, for instance, can increase the risk of accidents due to reduced visibility or more challenging maneuvering. Narrow roads and congested intersections can contribute to higher accident rates and therefore, higher premiums. A city with numerous tight turns and blind spots, for instance, might see higher premiums due to the increased risk of collisions.

These factors are not limited to just specific streets or highways.

Table: Top 3 Contributing Factors to High Car Insurance Premiums in Top 5 Bay Area Cities

| City | Factor 1 | Factor 2 | Factor 3 |

|---|---|---|---|

| San Francisco | High accident rates | High vehicle theft rates | Traffic congestion |

| San Jose | High accident rates | Increased traffic volume | Property crime rates |

| Oakland | High accident rates | High crime rates | Vehicle theft |

| Berkeley | High accident rates | Traffic congestion | Property crime rates |

| Palo Alto | High accident rates | Traffic congestion | Vehicle theft |

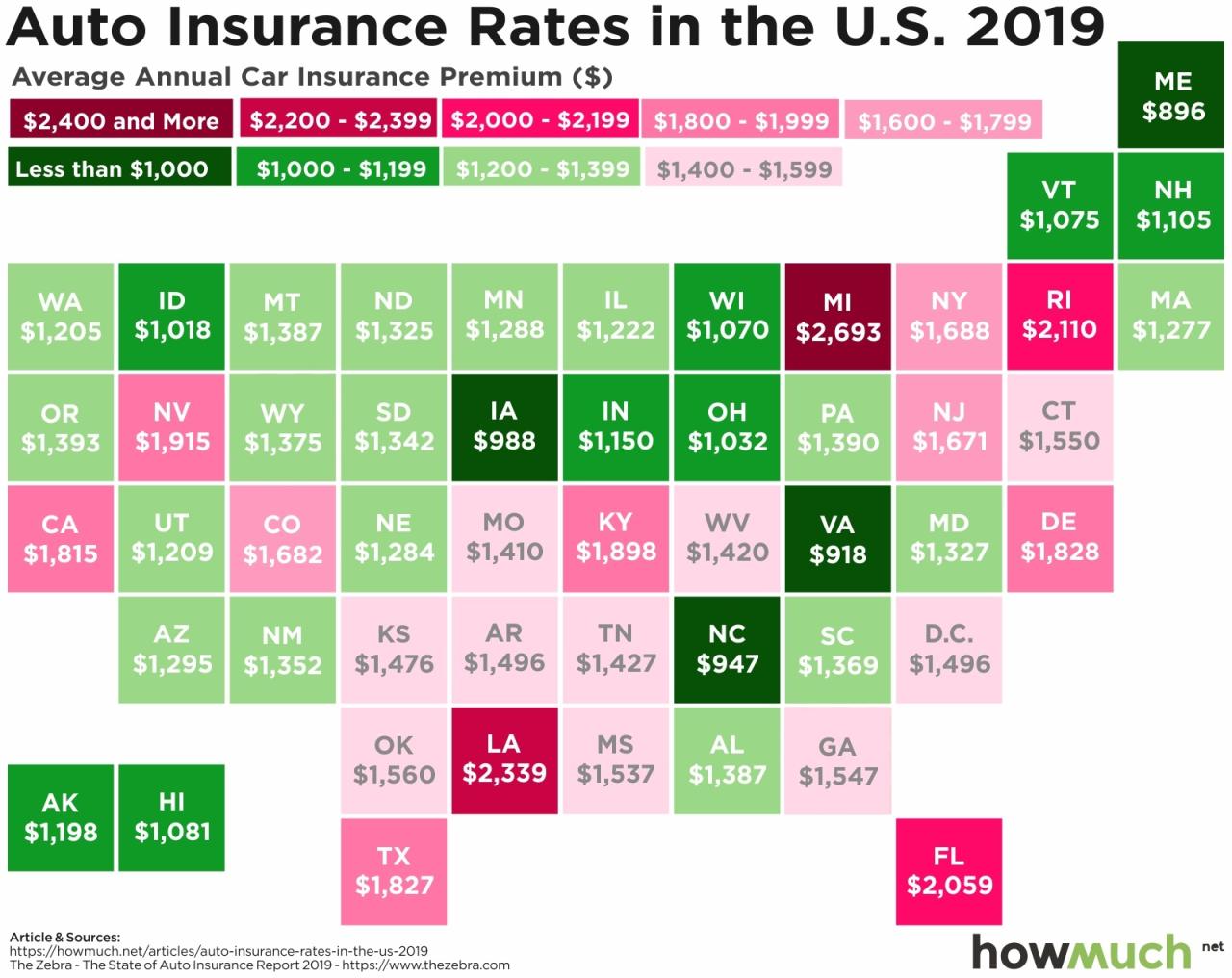

Comparing Premiums with Other States

California’s car insurance premiums are a persistent concern, and understanding how they stack up against other states provides valuable context. A deeper look at premiums in similar states and the regulatory differences helps illuminate the factors driving these costs. California’s unique blend of regulations and driving conditions plays a significant role.Comparing California’s insurance costs to other states reveals a complex picture.

Factors like the severity of accidents, driver demographics, and state-specific regulations significantly influence premium levels. This analysis delves into these factors, highlighting similarities and differences between California and other jurisdictions.

States with Similar or Higher Premiums

California’s car insurance premiums often align with those in other states facing similar challenges. States with high population density, significant accident rates, and stringent safety regulations frequently experience comparable or higher premiums. This is due to the increased risk associated with these conditions.

California’s car insurance premiums are skyrocketing, and Bay Area cities are feeling the pinch—some are paying significantly more than others. It’s a frustrating situation, especially when you consider the recent trends in insurance costs. This reminds me of a similar feeling of frustration with a recent visit described in a recent Dear Abby column, about a friend’s tedious visit dear abby friends tedious visit.

Hopefully, some solutions will be found to alleviate the rising car insurance costs across the Bay Area soon. The rising costs are definitely a concern for many drivers.

- New York: New York, like California, faces high population density and complex infrastructure, contributing to a higher risk of accidents and potentially higher premiums.

- Massachusetts: Massachusetts, known for its stringent safety regulations and a large population, shares a similar risk profile with California, leading to higher average insurance costs.

- Oregon: Oregon’s high cost of living and relatively high accident rates, coupled with some regulations similar to California, contribute to a premium structure that is comparable or slightly higher than the Golden State.

Reasons for Similar or Higher Premiums

Several factors contribute to elevated car insurance premiums in these states. These include:

- Higher Accident Rates: States with a higher volume of accidents experience a greater need for insurance payouts, increasing the overall cost to insurers. This ultimately translates into higher premiums for drivers in those states.

- Stricter Regulations: Regulations impacting insurance requirements, such as mandatory safety features or specific coverage types, often contribute to increased premiums. States with stricter regulations might need to set higher premiums to meet the required coverage levels.

- High Cost of Living: States with a high cost of living might see insurance premiums rise due to the increased expenses associated with claims settlements or repairs. The higher costs of replacement parts or medical treatments often lead to more expensive claims.

Differences in Regulations and Laws

California’s unique regulatory environment impacts car insurance costs in several ways.

- Uninsured Motorist Coverage: California mandates extensive uninsured motorist coverage, which can increase premiums as insurers account for the higher risk of claims.

- Fault-Based System: California’s fault-based system, unlike some no-fault states, can lead to higher premiums due to the potential for disputes and legal battles regarding liability.

- Financial Responsibility Laws: Variations in financial responsibility laws and their enforcement across states contribute to differences in premium levels. States with stricter requirements and higher enforcement may have higher premiums.

Comparison Table

| State | Average Car Insurance Premium | Factors Affecting Premiums | Notes |

|---|---|---|---|

| California | $2,000-$3,000 annually (estimate) | High population density, strict regulations, higher accident rates, high cost of living. | Data varies based on driver profile and coverage options. |

| New York | $2,200-$3,500 annually (estimate) | High population density, complex infrastructure, strict regulations. | Premiums influenced by high accident rates. |

| Massachusetts | $2,100-$3,200 annually (estimate) | High population density, stringent safety regulations, high cost of living. | Strong emphasis on safety features impacts premiums. |

| Oregon | $1,800-$2,800 annually (estimate) | High cost of living, relatively high accident rates, some regulations similar to California. | Premiums influenced by accident rates and cost of repairs. |

Potential Mitigation Strategies

California’s rising car insurance premiums are a significant concern for drivers across the state, especially in high-cost areas like the Bay Area. Understanding the factors driving these increases and exploring potential solutions is crucial for affordability and accessibility. This section examines strategies to combat rising premiums, focusing on government interventions, driver behaviors, insurance company practices, and technological advancements.

California’s car insurance premiums are skyrocketing, and Bay Area cities are feeling the pinch. It’s a real headache, trying to figure out which cities are paying the most. Meanwhile, it’s great to see George Kittle, supporting his Swedish friend Filip Forsberg at the 4 Nations face-off in Montreal, a heartwarming gesture for sports fans. Hopefully, this won’t translate into even higher insurance costs for us all.

Maybe if we all rooted for more Swedish athletes, our premiums would go down? Just kidding (mostly). Back to the Bay Area insurance crisis… anyone have tips?

Government Regulations and Initiatives

California’s regulatory environment plays a crucial role in shaping insurance costs. Implementing stricter standards for insurance companies’ financial stability and solvency can contribute to a more sustainable market. This includes thorough examinations of pricing models and rate-setting procedures to ensure fairness and transparency. Regulations aimed at increasing competition among insurance providers can potentially lower premiums by encouraging innovation and efficiency.

For example, state-mandated safety standards for new vehicles can reduce accident rates, thus impacting premiums in the long term.

Driver Education and Safety Programs

Investing in comprehensive driver education programs, particularly for young and novice drivers, can significantly impact accident rates and, consequently, premiums. These programs can equip drivers with essential skills for safe and responsible driving. Furthermore, promoting defensive driving courses and providing access to resources for driver improvement can lower accident frequencies. Public awareness campaigns on safe driving practices, such as distracted driving prevention, can also play a pivotal role in reducing accidents.

Programs targeting specific demographics, such as young drivers or drivers in high-risk areas, can be particularly effective.

Technological Advancements and Insurance Innovations, Californias car insurance premiums are rising too which bay area cities pay more

Technological advancements offer substantial potential for mitigating rising premiums. The development and implementation of advanced driver-assistance systems (ADAS) in vehicles, such as lane-departure warning systems or automatic emergency braking, can lead to a decrease in accidents and associated claims. Telematics-based insurance programs, utilizing data from drivers’ driving behaviors to assess risk, could also contribute to a more accurate and personalized pricing structure.

Utilizing predictive modeling and data analytics for risk assessment can allow insurance companies to tailor premiums to individual driving profiles.

Consumer Choices and Safe Driving Habits

Consumer choices significantly influence car insurance premiums. Adopting safe driving habits, such as avoiding speeding, maintaining a safe following distance, and refraining from distracted driving, directly reduces the likelihood of accidents. Drivers can also actively compare policies from various insurance providers to identify the most cost-effective coverage. Insuring vehicles with appropriate safety features can reduce the risk of accidents and the potential for higher claims.

Insurance Company Pricing Models

Insurance companies’ pricing models significantly impact premium variations. Fair and transparent pricing models that consider factors such as vehicle type, driver history, location, and usage patterns are essential. Companies must adjust their pricing models to reflect actual risk profiles rather than relying on outdated or inaccurate data. A shift towards more data-driven pricing strategies, leveraging telematics and other innovative technologies, can lead to a more accurate reflection of individual risk.

This will lead to a more equitable distribution of premiums.

Mitigation Strategies Table

| Mitigation Strategy | Description | Potential Impact | Examples |

|---|---|---|---|

| Strengthening Insurance Regulations | Implementing stricter standards for insurance company solvency, scrutinizing pricing models, and increasing competition among providers. | Potentially lower premiums by ensuring a stable and competitive insurance market, and by discouraging predatory pricing practices. | Implementing stricter financial regulations, increasing the capital requirements for insurance companies, and encouraging more insurance companies to enter the market. |

| Promoting Driver Safety Programs | Investing in comprehensive driver education, defensive driving courses, and public awareness campaigns on safe driving practices. | Reduce accident rates, leading to lower claims and consequently lower premiums. | Implementing mandatory driver education courses for young drivers, offering discounted premiums for participation in defensive driving courses, and running public awareness campaigns about distracted driving. |

| Leveraging Technology for Risk Assessment | Implementing advanced driver-assistance systems (ADAS), utilizing telematics data, and applying data analytics to create more accurate risk profiles. | Lead to more personalized and accurate pricing models, potentially lowering premiums for safe drivers. | Integrating ADAS into vehicles, implementing telematics-based insurance programs, and employing predictive modeling techniques for risk assessment. |

Conclusion

California’s car insurance premiums are experiencing a concerning upward trend, particularly in Bay Area cities. This rise is not isolated to a specific segment of the population but affects drivers across various demographics and vehicle types. Understanding the underlying factors and potential mitigation strategies is crucial for both drivers and policymakers.The escalating costs of car insurance in California, and specifically the Bay Area, are a multifaceted issue stemming from a combination of economic and societal factors.

The increased cost is not simply a result of a single cause but a complex interplay of elements that require a comprehensive analysis. A crucial element in understanding this trend is the geographical variation in premium costs, highlighting the need for a tailored approach to address the problem.

Key Findings on Rising Premiums

The escalating car insurance premiums in California, particularly within the Bay Area, are a significant concern. Several factors contribute to this trend, impacting the affordability of vehicle ownership for residents. Geographic location plays a major role in influencing premiums, with certain areas experiencing substantially higher costs.

Impact of Geographic Location

The Bay Area’s unique characteristics, including high population density, traffic congestion, and specific safety risks, directly impact car insurance costs. Areas with higher accident rates, for instance, frequently see higher insurance premiums. Furthermore, factors such as the prevalence of specific types of accidents or the availability of emergency services can all contribute to geographic variations in premiums. For example, a city with a higher frequency of accidents involving pedestrians might see premiums increase due to the associated liability.

Factors Affecting Car Insurance Costs

Various factors influence the cost of car insurance in California, including but not limited to:

- Accident Rates: Areas with higher accident rates tend to have higher insurance premiums. This is due to the increased risk of claims and payouts that insurers need to account for in their pricing models. Areas with higher concentrations of drivers, particularly those in high-traffic areas, may exhibit higher accident rates.

- Severity of Accidents: The severity of accidents plays a role in premium calculations. Areas where severe accidents are more frequent or involve significant damage are likely to have higher premiums due to the increased cost of claims. This can vary depending on the type of accidents common in the region. For instance, cities with a high number of hit-and-run accidents or accidents involving severe injuries will likely have higher insurance premiums.

- Vehicle Usage: The frequency and nature of vehicle use can also affect insurance premiums. Areas with a higher concentration of drivers commuting long distances or using vehicles for commercial purposes might see higher premiums. The type of vehicle being insured also plays a role. For example, a luxury vehicle might have a higher premium than a basic model, due to its higher repair costs in the event of an accident.

- Driving Habits: The driving habits of drivers in a specific region can affect insurance costs. Areas with a higher rate of aggressive or reckless driving may see higher premiums due to the increased risk of accidents. For example, areas with known speeding issues or instances of drunk driving might see an increase in insurance premiums.

Mitigation Strategies for Rising Premiums

Implementing effective mitigation strategies can help address the issue of rising car insurance premiums. These strategies include:

- Driver Education Programs: Investing in driver education programs can help reduce accident rates and the severity of accidents, ultimately impacting insurance premiums. These programs aim to promote safe driving practices and improve overall road safety.

- Improved Infrastructure: Enhanced road infrastructure, including better traffic management systems, can contribute to reducing accident rates and lowering insurance premiums. Improved road design and signal optimization can reduce accidents, and this leads to lower premiums for the drivers.

- Insurance Policy Reforms: Policy reforms can also play a role in mitigating the rising cost of insurance. These reforms might include changes to the calculation of premiums, adjustments to coverage limits, or new approaches to risk assessment.

Future Trends and Implications

The continued rise in car insurance premiums in California, particularly in the Bay Area, could have significant implications for residents and the overall economy. Increased premiums could lead to decreased affordability of vehicle ownership and potentially reduce mobility options for residents.

Ultimate Conclusion

In conclusion, California’s car insurance premiums are experiencing a significant rise, with the Bay Area cities bearing a disproportionate burden. Factors such as accident rates, crime, and traffic congestion play a crucial role in shaping these premiums. While mitigation strategies exist, the long-term impact of rising premiums on California drivers remains a concern. Comparing premiums to other states and understanding the unique factors influencing costs in the Bay Area are crucial steps in finding effective solutions.