Why we choose the view more button instead of pagination? This exploration dives into the design, technical, and user experience considerations that led to our decision. We’ll analyze the pros and cons of each approach, examining user engagement, performance implications, and accessibility concerns.

From user experience to technical implementation, design considerations, and content display, we’ll cover the entire spectrum of factors influencing our choice. We’ll discuss how view more buttons offer a smoother, more dynamic browsing experience, particularly for mobile users. Pagination, while familiar, often presents a less intuitive and less visually appealing alternative, leading to potential user frustration.

User Experience Considerations

The choice between view more buttons and pagination significantly impacts user experience. This section delves into the comparative study of these two methods, examining how design choices affect user engagement, perceived speed, and cognitive load. Understanding user behavior and feedback is crucial in optimizing the interaction with long lists of content.

Comparative Study of User Experience

View more buttons and pagination offer distinct approaches to presenting large datasets. View more buttons typically load more content incrementally when clicked, potentially reducing initial page load time and providing a more dynamic feel. Pagination, on the other hand, presents content in discrete pages, requiring the user to actively navigate through the available content using page numbers.

Impact on User Engagement and Perceived Speed

The design choice significantly influences how users perceive the speed and interactivity of the content. View more buttons can create a more seamless and continuous experience, often perceived as faster, due to the immediate loading of additional content. Users may feel less burdened by page-turning when using a view more button. Pagination, conversely, can sometimes feel more static and require more cognitive effort to navigate, potentially impacting user engagement.

A good example of this difference is observable on social media platforms, where view more buttons are used to display the entire stream of content more quickly.

User Behaviors When Interacting with Each Method

User behaviors vary depending on the presentation method. Users interacting with view more buttons often exhibit a more exploratory and continuous scrolling behavior. They might repeatedly click the view more button to consume more content without needing to actively change pages. Pagination, however, encourages a more structured and deliberate approach. Users might carefully consider the pages they want to visit before clicking, often relying on the page numbers as a guide.

Cognitive Load Involved in Each Approach

The cognitive load associated with each method is noteworthy. View more buttons, by providing a continuous stream of content, can potentially reduce the cognitive load on the user. The user does not need to actively manage multiple pages. Pagination, however, might introduce a higher cognitive load as users need to keep track of their position within the dataset, managing the navigation process.

The cognitive load of pagination can be particularly significant with a large number of pages.

Table Comparing User Feedback on View More Buttons vs. Pagination

| Feature | View More Buttons | Pagination |

|---|---|---|

| Initial Load Time | Often perceived as faster due to incremental loading | Can take longer due to full page load per page |

| User Engagement | Potentially higher due to seamless experience | Can be less engaging due to the need to actively navigate pages |

| Cognitive Load | Potentially lower due to continuous content flow | Potentially higher due to need to manage page numbers |

| User Feedback (Example) | “I like how the content loads smoothly.” | “I prefer pagination for easier referencing of specific content.” |

| User Feedback (Example) | “It’s like reading a magazine, very engaging.” | “Sometimes I lose my place when going through a large number of pages.” |

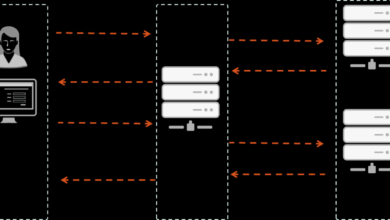

Technical Implementation

Choosing between view more buttons and pagination fundamentally impacts the technical architecture of a web application. The approach selected dictates how data is fetched, displayed, and handled by the server and client-side code. Understanding these technical nuances is crucial for optimizing performance and user experience.Implementing view more buttons introduces a different paradigm compared to pagination. Instead of pre-defining the number of items per page, the user interacts directly with a button to load additional content.

This dynamic loading approach can significantly affect the way data is retrieved and presented. This difference in implementation necessitates a careful consideration of potential performance bottlenecks and how to address them.

API Endpoint Design for View More

Designing an API endpoint for view more requests requires careful consideration of data handling. The endpoint needs to be efficient in handling potentially large result sets. A well-structured API will streamline the data retrieval process. Crucially, the endpoint should include a mechanism for handling pagination parameters, such as the starting index or offset. This approach allows for controlled data loading, avoiding excessive server load.

For instance, the endpoint could accept a `page_token` that is passed back in subsequent requests to indicate the current position in the dataset. An example structure might be:“`GET /api/items?page_token=abc123“`This would allow the server to efficiently fetch the next set of items. Error handling and validation are also critical components to ensure data integrity and maintain a robust API.

Database Query Optimization

Database queries are a critical factor in the performance of view more functionality. Inefficient queries can lead to significant delays, impacting the user experience. To optimize database queries for view more, consider using techniques like limiting the number of records retrieved in each request. Also, employing appropriate indexing strategies can significantly improve query performance. For example, creating indexes on columns used in the `WHERE` clause of your queries can drastically reduce query time.“`SQLSELECT

FROM products WHERE category = ‘electronics’ LIMIT 10 OFFSET 20;

“`This query retrieves 10 products starting from the 21st product in the ‘electronics’ category. Using `LIMIT` and `OFFSET` is essential for efficient data retrieval in large datasets.

Performance Implications

The performance implications of view more buttons and pagination differ. Pagination often has a predictable performance curve, especially for smaller datasets. However, view more functionality might exhibit varying performance depending on the size of the dataset and the implementation details. If the database queries are not optimized, the view more approach can lead to slowdowns, especially for large result sets.

This can result in a poor user experience.

Comparison Table

| Feature | View More | Pagination ||—|—|—|| Data Loading | Dynamic, incremental | Static, fixed page size || API Endpoint | More complex, needs pagination tokens | Relatively simpler || Database Queries | Potentially more complex depending on the data handling and request size | Predictable for smaller datasets || Performance | Can be slower for very large datasets if not optimized; faster for small datasets | More predictable, consistent speed for smaller datasets || User Experience | Potentially smoother, but can be slower for large datasets | Can be less smooth; better for users familiar with pagination |

Design Considerations

Choosing between a “View More” button and pagination significantly impacts user experience. Effective design considers both the visual presentation and the user’s interaction with the content. This section explores various design patterns, visual styles, and crucial UI elements for each approach.A well-designed “View More” button or pagination system should intuitively guide users through the available content, promoting a seamless and enjoyable browsing experience.

Visual consistency with the overall brand aesthetic is paramount, ensuring a cohesive and professional user interface.

View More Button Design Patterns

Different design patterns for “View More” buttons cater to various needs. Understanding these patterns allows for tailoring the design to the specific context and user behavior.

- Progressive Loading: This pattern dynamically loads more content as the user interacts with the button, providing an immediate sense of progression. This style is ideal for displaying extensive lists of data or products, as it avoids the need to reload the entire page. Users appreciate the smooth transition and continuous experience, reducing perceived wait times. For example, a newsfeed loading more posts as the user scrolls down.

- Click-to-Load: This traditional method requires a click on the button to load the next portion of content. While simple, it might not be as engaging as progressive loading for long lists. This is suitable for smaller datasets or when progressive loading isn’t feasible due to technical constraints.

Visual Styles for View More and Pagination

Visual distinctions between “View More” and pagination significantly impact the user’s perception of the interface.

- View More Button Styles: “View More” buttons can be styled with various visual cues. A prominent button with a clear call to action, such as a visually distinct color or shape, helps draw attention. The button should be positioned logically within the layout, and its size and typography should be appropriate for the overall design.

- Pagination Styles: Pagination typically uses numbered or dot-based indicators, or potentially more elaborate visual representations for displaying the current page and available pages. The design should clearly show the user’s current position in the dataset and the total number of pages available.

Good and Bad User Interface Design Choices

Good UI choices are crucial for effective user experience. Bad choices can confuse or frustrate users.

Sometimes, a “view more” button is just easier than endless scrolling through pages of results. It’s a quicker way to consume content, especially when the information is fast-moving, like the recent news out of Mexico City regarding the ban on bullfighting. The city’s decision to ban violent bullfighting, sparking fury and celebration, highlights the need for immediate access to the latest updates.

This makes the “view more” button a preferable choice, especially for those wanting to stay up-to-date on the story. Mexico City bans violent bullfighting sparking fury and celebration is a prime example of content that benefits from this streamlined approach. It streamlines the user experience, avoiding the need for page-by-page navigation, making the whole process a lot smoother.

- Good: A clear visual distinction between “View More” and pagination, with each design element enhancing the user’s understanding of their options. Examples include using a contrasting color for the button or distinct shapes for each page number in pagination. A well-designed button should clearly convey its purpose.

- Bad: Using the same visual style for both “View More” and pagination elements can lead to confusion, making it difficult for users to discern between loading more content and moving to a new page. Hidden or poorly placed elements, as well as inappropriate font sizes or colors, will detract from the user experience.

Visual Consistency and Branding

Visual consistency is essential for creating a recognizable brand identity and user experience. Both “View More” buttons and pagination elements should align with the overall branding guidelines. Consistent use of colors, typography, and imagery builds a strong and memorable user interface.

- Branding Alignment: Using consistent brand colors, fonts, and iconography across the application ensures visual unity. This enhances brand recognition and user trust. It is essential to maintain a uniform design aesthetic, ensuring the interface aligns with the overall brand identity. For example, a corporate website should use the same brand colors and fonts for both the header and the “View More” button.

Table of View More Button Styles and User Experience Impact

This table provides a comparison of various “View More” button styles and their potential impact on user experience.

| Button Style | Description | Potential User Experience Impact |

|---|---|---|

| Prominent, High Contrast | Visually distinct button with a contrasting color. | Improved discoverability and engagement; clear call to action. |

| Subtle, Integrated | Button seamlessly integrated into the design, with minimal visual distinction. | Less noticeable, might be overlooked; potentially less engaging. |

| Animated, Progressive Loading | Button triggers dynamic loading of content. | More engaging; immediate feedback on action; reduced perceived wait time. |

| Disabled State Indication | Button visually indicates when it is disabled or unavailable. | Reduces user frustration; clear feedback on limitations. |

Content Display and Loading

The “View More” button, a popular alternative to traditional pagination, significantly impacts how content is presented and loaded on a webpage. Effective implementation of view more functionality requires careful consideration of display methods, dynamic loading strategies, and the crucial role of loading speed in maintaining a positive user experience. This section explores these elements, focusing on optimizing the user journey while preventing content overload.Displaying content with a “View More” button requires a flexible approach.

One common method is to initially load a portion of the content and then dynamically load additional content as the user interacts with the “View More” button. This approach allows for a controlled flow of information, presenting content in manageable chunks, and preventing overwhelming the user with excessive information at once.

Different Approaches to Displaying Content

Different approaches can be employed to manage the presentation of content with a “View More” button. One common approach is to load a subset of content initially, allowing the user to progressively view more content by clicking the “View More” button. This strategy helps to prevent the user from being overwhelmed by the sheer volume of data displayed on the page at once.Another approach involves using a pre-loading technique, where a portion of the content is loaded in the background while the initial content is being displayed.

This approach provides a more seamless user experience, minimizing perceived loading times and enhancing the overall responsiveness of the page.

Strategies for Dynamic Content Loading, Why we choose the view more button instead of pagination

Dynamic loading strategies are essential for implementing a “View More” button effectively. These strategies are critical to ensuring the smooth presentation of content. Employing techniques such as AJAX (Asynchronous JavaScript and XML) enables efficient and non-blocking data retrieval. This approach allows the page to remain interactive while fetching additional content, preventing a sluggish user experience.Further, implementing a caching mechanism is crucial.

Caching previously loaded content can significantly improve loading times, as it reduces the need to retrieve the data from the server on subsequent requests. This can dramatically enhance the overall performance of the page.

Impact of Loading Speed on User Experience

Loading speed significantly influences the user experience. Slow loading times can lead to frustration and abandonment, ultimately affecting user engagement and conversion rates. The goal is to minimize the time it takes to load additional content, ensuring a quick and responsive user interface. A good rule of thumb is to keep loading times below 2 seconds. User experience studies consistently demonstrate that exceeding this threshold results in a negative impact on user satisfaction.

Managing Infinite Scrolling with View More Buttons

Implementing infinite scrolling with view more buttons requires careful management of data loading. The key is to dynamically load more content as the user scrolls down the page, ensuring a seamless transition between loaded and loading content. A common approach involves detecting when the user is near the end of the visible content and initiating a request for more data.

This approach allows the user to continue scrolling without interruption, enhancing the perceived responsiveness of the page.

Strategies to Prevent Content Overload

Preventing content overload is crucial for maintaining a positive user experience. By strategically managing the amount of content displayed at once, users are less likely to feel overwhelmed. Implementing content filtering mechanisms is vital. Users should be able to filter content based on criteria that are relevant to their needs, thereby ensuring that they only see content they are interested in.

This filtering reduces the potential for information overload. In addition, appropriate content chunking is essential. Breaking down large amounts of content into smaller, more manageable sections can enhance the user experience, allowing for a less overwhelming presentation.

Accessibility and Inclusivity: Why We Choose The View More Button Instead Of Pagination

Ensuring a website is usable by everyone, regardless of their abilities, is paramount. This includes users with visual impairments, motor skill limitations, cognitive differences, and other disabilities. A well-designed view more system needs to be equally accessible for all users, not just those with typical abilities.The accessibility of view more buttons hinges on several key factors, including clear visual cues, proper screen reader compatibility, and a well-structured user experience that anticipates potential challenges.

A thoughtfully implemented view more system allows for a more inclusive experience for all users, regardless of their abilities.

Screen Reader Compatibility

Screen readers are essential tools for users with visual impairments. These programs read web content aloud, allowing users to navigate and understand the information presented. View more buttons, when not implemented properly, can cause significant disruptions in the screen reader experience. For optimal screen reader compatibility, view more buttons should announce their presence and function clearly. The screen reader should inform the user of the total number of items available and the ability to load more content.

It should also be possible for users to navigate the entire content set using the keyboard. A simple but effective approach is to use descriptive ARIA attributes, such as `aria-label` and `aria-describedby`, to explicitly describe the purpose of the button.

Best Practices for Inclusive Design

Creating an inclusive user experience involves more than just technical implementation. It requires a conscious effort to anticipate the needs of all users. This includes providing clear and concise instructions for navigating the view more system. Users should understand instantly what clicking the button will do, and how they can navigate to other content. Using visual cues, such as tooltips or highlighting, can aid in user comprehension.

Scrolling through endless lists can be a pain, right? That’s why we often prefer the “View More” button to clunky pagination. It’s just smoother, especially when you’re checking out a new eatery like the ones serving up delicious Berlin-style döner kebabs with a Californian twist in Oakland, like you can read about in this article berlin style doner kebabs get a californian twist in oakland.

It’s much more user-friendly and keeps the browsing experience nice and streamlined.

An inclusive design also means allowing for diverse interaction methods. For example, consider using keyboard navigation for users who may not be able to use a mouse. Keyboard-only users should be able to interact with the view more button and navigate through the loaded content.

Accessibility Issues and Solutions

- Problem: View more buttons that do not announce their function to screen readers.

- Solution: Use ARIA attributes like `aria-label` to describe the action, e.g., `aria-label=”Load more products”`.

- Problem: Difficulty navigating content loaded with view more buttons using only a keyboard.

- Solution: Implement keyboard navigation that allows users to access all content using tab, arrow keys, and enter. Ensure the view more buttons are part of the tab order and that the loaded content is also navigable.

- Problem: View more buttons that don’t provide visual cues or feedback to indicate loading or completion.

- Solution: Include visual feedback like a loading spinner or a visual state change (e.g., button text change to “Loading…”) during the loading process.

Guidelines for Accessible View More Buttons

| Issue | Solution | Description |

|---|---|---|

| Screen reader compatibility | Use descriptive ARIA attributes | Explicitly tell screen readers what the button does using `aria-label` or `aria-describedby`. |

| Keyboard navigation | Ensure keyboard accessibility | Enable navigation through all content using tab, arrow, and enter keys. |

| Visual feedback | Implement visual cues | Show visual feedback (loading spinner, button state change) during loading. |

| Clear instructions | Use clear language | Provide concise instructions on what clicking the button does. |

Scalability and Maintainability

The choice between pagination and “View More” functionality significantly impacts the long-term maintainability and scalability of a website. Effective design considerations for “View More” are crucial for handling large datasets without sacrificing user experience or technical efficiency. This section details strategies for designing, maintaining, and scaling both approaches.

Designing View More for Large Datasets

Implementing “View More” for large datasets requires careful planning. A key aspect is the use of server-side processing to retrieve data in manageable chunks. Instead of loading all data upfront, the “View More” button triggers a request for a specific subset of items. This is essential for performance as it avoids overloading the client-side and the server.

This approach also allows for dynamic updates to the displayed data without requiring a full page reload. The size of each “View More” chunk should be carefully considered to balance the user experience with efficient data handling. Smaller chunks, while offering faster loading times, can lead to multiple clicks for users to view the full dataset, potentially impacting user satisfaction.

Conversely, excessively large chunks may lead to a slow and unresponsive interface. Therefore, a data chunk size optimized for the average user’s interaction speed and data volume is critical.

Maintaining and Updating View More Buttons

Maintaining “View More” buttons necessitates a robust system for updates and modifications to the underlying data. The approach should allow for easy integration with data updates. Version control for the server-side code handling data retrieval is crucial. This approach helps to identify and resolve potential conflicts and regressions that might arise when modifying data fetching logic. Regular code reviews can also help identify and mitigate issues before they impact the user experience.

Scalability of Pagination and View More

Pagination, while seemingly simpler, can become cumbersome with very large datasets. Each page load requires a separate request, potentially increasing latency and server load. “View More” on the other hand, can handle large datasets more efficiently by retrieving data in smaller, manageable chunks. The server-side logic needs to be optimized for performance, especially when handling queries that need to fetch many records.

Scalability considerations for “View More” depend heavily on how well the database and the server-side application are optimized.

We often prefer view-more buttons over pagination, especially for news feeds. It’s a cleaner presentation, making the content feel less segmented. Think about a story like the comeback of Mitty star McKenna Woliczko, who’s undergoing knee surgery and setting goals for her return to court here. A view-more button keeps the flow of the story uninterrupted, which is crucial for engaging readers and keeping them interested, making the reading experience more cohesive.

Long-Term Maintenance Strategies

Long-term maintenance for both methods requires clear documentation and a well-defined code structure. This ensures that developers can easily understand and modify the code as needed. Regular performance testing and monitoring are critical to identify potential bottlenecks and ensure optimal performance as the dataset grows. Using well-established design patterns and adhering to coding standards helps maintain consistency and readability.

Furthermore, employing automated testing can detect errors or regressions more quickly, making maintenance significantly more efficient.

Factors Influencing View More Functionality Scalability

| Factor | Description | Impact on Scalability |

|---|---|---|

| Database Optimization | Database query efficiency, indexing, and data structure | Improved performance and reduced load on the server. |

| Server-Side Code Efficiency | Algorithm design, data fetching strategies, and handling large data chunks | Determines how efficiently data is retrieved and presented. |

| Data Volume and Structure | Amount and organization of data | Impacts the required server resources and query complexity. |

| User Interaction Patterns | Frequency and size of “View More” clicks | Affects the number of data requests and overall performance. |

| API Design | Structure and efficiency of API endpoints | Impacts the communication between the client and server. |

Mobile Considerations

Mobile devices are increasingly the primary way users interact with websites. Understanding how different display sizes and mobile browser behaviors impact the user experience is crucial for a successful design. Choosing between view more buttons and pagination directly affects how smoothly users navigate and consume content on mobile.A key consideration for mobile design is the dynamic nature of screen sizes.

Different mobile devices, from compact smartphones to larger tablets, necessitate adaptable layouts. The optimal choice between view more buttons and pagination often depends on factors like content density, user expectations, and the overall design aesthetic. A poorly implemented pagination system can lead to excessive scrolling and a less engaging user experience, especially on smaller screens.

Mobile Behavior of View More Buttons and Pagination

View more buttons, which load additional content as the user interacts, generally offer a smoother experience on mobile. They streamline the display of information by loading data incrementally. Pagination, with its discrete pages, often requires the user to navigate between multiple screens, which can be cumbersome on smaller devices.

Impact of Screen Size on User Experience

The screen size significantly influences user experience. Smaller screens make pagination more challenging, as users need to click through multiple pages to access the entire content. This can be frustrating and time-consuming. View more buttons, on the other hand, offer a continuous flow of information, making content more accessible on smaller screens. For example, a news website with a long list of articles would benefit from view more buttons to avoid overwhelming users on phones.

Optimization Strategies for Mobile Use

Several strategies can optimize the user experience on mobile:

- Responsive Design: Implementing responsive design principles ensures that the layout adapts seamlessly to various screen sizes, making the website navigable on different mobile devices.

- Efficient Loading: Employing techniques like lazy loading, which only loads content when it comes into view, can dramatically improve page load times, particularly on slower mobile networks.

- Intuitive Navigation: Using a view more button that’s visually prominent and easily accessible ensures a positive user interaction. Clear visual cues help users understand how to proceed without confusion.

- Content Density: Adjusting the amount of content displayed per load to maintain a comfortable reading experience is crucial on mobile. Overloading the screen with too much text can be detrimental to usability.

Usability Comparison Across Mobile Browsers

Mobile browser compatibility is essential. While many modern browsers handle responsive design effectively, inconsistencies can still exist. Testing across various browsers, including popular options like Chrome, Safari, and Firefox, is vital to ensure a consistent experience. For example, certain browsers might render elements differently, impacting the layout and functionality of view more buttons or pagination systems.

Responsive Table Demonstrating Implementation Differences

The following table illustrates the differences in implementing view more buttons and pagination across various mobile devices. It showcases how the design adapts to different screen widths, mimicking the behavior of a website’s content display.

| Device | Screen Width | View More Button Implementation | Pagination Implementation |

|---|---|---|---|

| Smartphone (small screen) | 360px | Displays a concise list, with a prominent “View More” button beneath. | Displays a limited number of items, with pagination controls below. Excessive scrolling. |

| Tablet (medium screen) | 768px | Displays a more substantial list, with a “View More” button at the bottom. | Displays a moderate number of items, with clear pagination controls. |

| Desktop (large screen) | 1200px+ | Displays the complete list of items. “View More” button might not be visible. | Displays the complete list of items, pagination not required. |

Conclusive Thoughts

Ultimately, our choice to implement view more buttons prioritized a more streamlined user experience. The benefits in terms of perceived speed, engagement, and accessibility, particularly on mobile, significantly outweigh the technical complexities. While pagination remains a valid approach, the tailored design choices in favor of view more buttons reflect a commitment to delivering a more dynamic and engaging browsing experience for our users.

The detailed analysis in this article underscores the critical importance of understanding user behavior and preferences when making such decisions.